Competition reform must address the elephant in the room

Has a report been more overdue than the Harper Review on competition? Coming over 20 years after the excellent Hilmer Review, which ushered in the introduction of National Competition Policy, it has been far too long since we actively pursued a broad agenda of structural reform to boost productivity and competition within Australia.

It won’t come as news to Australian business leaders that their businesses are often uncompetitive by international standards. It would be easy to lay the blame entirely at their feet -- and I’m sure they deserve some share of the blame -- but that would be far too simplistic.

During the 1990s and early 2000s, competition reform proved highly beneficial for the Australian economy and the broader community. Sure, there were winners and losers -- industries thrived and failed -- but on a whole we became a wealthier and more productive nation.

But at some point, progress on the competition front slowed and structural reform fell into the too-hard basket. Reform had always been characterised by rigorous and healthy debate but more recently, reform has taken a backseat to nasty debates and a lack of political courage from both the left and right.

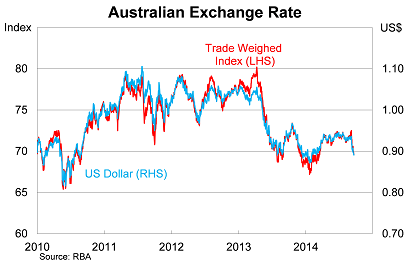

At the same time, the rapid industrialisation of the Chinese economy prompted an unprecedented rise in our terms of trade, boosting Australian wages but also pushing the real exchange rate to an unsustainable level.

What quickly became evident was that Australia’s non-mining and trade-exposed sectors were hopelessly uncompetitive against international competition, due to high wages, insufficient productivity but also elevated land and property prices.

Solving these three problems is naturally difficult. Who wants to take a pay cut? And how many Australians want to see land and property prices decline?

A depreciation of the Australian dollar will certainly help to some extent. The dollar is down almost 16 per cent against the US dollar since its peak in April 2013. But we’d be naïve if we left all the heavy lifting to the currency. In the long run, productivity growth will determine our standards of living.

In that regard, the Harper Review, as with the Hilmer Review before it, is fundamentally about increasing competition and market forces and thereby encouraging innovation and productivity growth.

“Competition policy … is aimed at securing the welfare of Australians,” the review says. “Broadly speaking, it covers government policies, laws and regulatory institutions whose purpose is to make the market economy service the long-term interests of Australian consumers”.

It’s about making markets work properly, which is not always easy in a relatively small economy prone to creating monopolies and oligopolies. To foster innovation and productivity, the Australian economy often requires strong regulation or monitoring to ensure that businesses don’t abuse their market power.

The draft report comes in at 313 pages, so I feel as though I am only scratching the surface. But at this stage the report contains sensible ideas to improve road usage and increase competitiveness in the taxi and pharmaceutical sectors (Pharmacy protection should be lifted: Harper review, September 22).

The review could also prove a boon for those of you who want to shop outside traditional business hours, while energy and utilities and telecommunications will receive additional attention.

If the government pursues a strong competition reform agenda, it will leave Australia better placed to meet the new challenges that we face, including an ageing population, the decline of the terms of trade and widespread technological disruption.

But the elephant in the room remains land prices. High property prices are, for whatever reason, celebrated in Australia, but they go a long way to explaining our lack of competitiveness.

High house prices equal high land prices, which equal elevated business costs. The higher our property prices go, the less competitive Australian businesses become. Our obsession with housing has effectively undermined the very business sector that pays our bills (How the housing obsession is short-changing business, June 2).

High land prices also create a considerable barrier to entry for new businesses and ensure that Australia isn’t even on the radar for most start-ups. Can anyone imagine a Google, Facebook or WhatsApp being created in Australia? If you wanted to create a business and physical location was not important, why would you invest in Australia?

The Harper review addresses land usage and it is clear that there was deep dissatisfaction among a number of submissions to the report. Until we sort this out, Australian businesses are playing at a considerable disadvantage.

Time will tell whether the Harper review proves as influential as the Hilmer review but we should be under no illusions: greater competition and higher productivity growth will determine Australia’s economic success over the next generation. Australian businesses will either become more competitive or they’ll start cutting wages and firing employees. The choice should be simple for our federal and state politicians.