Collected Wisdom

Summary: Spotless Group's December trading update has highlighted flat earnings growth and caused analysts to adjust their expectations, while Collins Foods' half-year results beat expectations, as new KFC stores are rolled out. Analysts appear optimistic about newly listed medical imaging provider Integral Diagnostic Services, given its margins and ability to growth through acquisition, while Spanish multinational Ferrovial launches a cash takeover bid for Broadspectrum Limited (formerly Transfield Services). |

Key take out: Analysts have adjusted expectations on Spotless Group Holdings given the company's December 2 trading update outlined an expected NPAT 10 per cent below FY15. This was not long after the October AGM forecast Spotless's FY16 performance would exceed FY15's results. |

Key beneficiaries: General investors. Category: Shares. |

This is an edited summary of the Australian investment press: It includes investment newsletters, major daily newspapers and broker reports. The recommendations offered represent the views published in the other publications and may not represent those of Eureka Report. This article is general advice only which has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.

Spotless Group Holdings Limited (SPO)

Only a few weeks ago, on October 22, Spotless chairwoman Margaret Jackson stood in front of investors at the AGM and reaffirmed expectations of FY16 to “materially exceed FY15 results.” Fast forward to December 2 and it is a materially different story. So different in fact the share price has halved since the trading update announcement.

On December 2, SPO came out with a very disappointing trading update. Earnings have gone from looking to be materially higher to flat and NPAT is now expected to be 10 per cent below FY15. A number of one-off charges that will impact FY16 were also in the update, including bid costs written off on tenders as more decisions are being delayed or deferred. Management were of the view these would not impact the business as they would be offset by recent acquisitions, however it looks like these acquisitions will take longer to integrate and synergies are realised.

The update saw analysts adjusting their expectations accordingly. It has also left them wondering how this was all an unknown when management reaffirmed guidance on October 22. The pullback in share price has brought the outsourced services company well below the average 12 month price target which currently sits at $1.86. At the time of writing the share price was $1.065.

Despite this representing a considerable upside to the analyst's price targets, only one has SPO as a buy with the majority calling the group a hold. Perhaps analysts are waiting to see earnings growth return and also some consistency in management's guidance before being enticed back in.

• Investors are generally advised to hold Spotless Group Holdings Limited at current levels.

Collins Foods Limited (CKF)

To the delight of Collins Foods shareholders, Western Australia is getting fatter. Well, maybe not fatter, but they have been thoroughly enjoying their KFC. The half-year results announced last week (December 2) beat consensus expectations and the CKF share price marched on. NPAT was up by 33.6 per cent on the prior corresponding period.

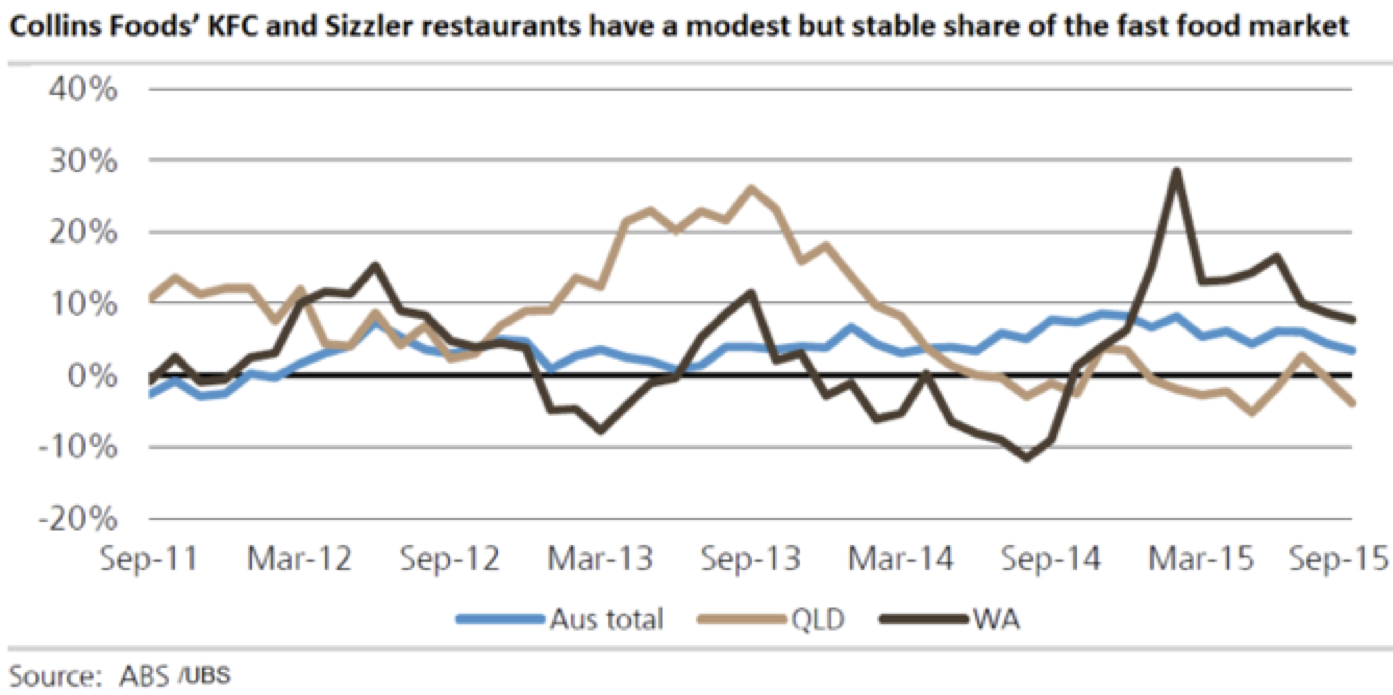

KFC was the main contributor to Collins Foods performance, increasing same store sales by 5.2 per cent. CKF opened a further three KFC outlets, with two of those located in WA. There are also four to five more set to open in the second half FY16. I took the below chart from The Australian newspaper's Business Review Twitter feed. With the mining downturn in WA it looks like some have been drowning their sorrows with family bucket of Original Recipe.

Despite the lack of guidance by the fast food company, analysts remain bullish. All but one of the five who cover CKF rate it as a buy. Growth is still expected from further store roll-outs. The current average 12 month price target is $5.00 with the most bullish case set at $5.44 and the bearish at $4.38. Imagine the material increase in valuation if the Double Down Dog ever made it to Australian stores!

• Investors are generally advised to buy Collins Foods Limited at current levels.

Integral Diagnostics Limited (IDX)

Integral Diagnostics Limited listed mid October. Analysts have just initiated cover on the imaging diagnostics specialists who cover Western Australia, Queensland and Victoria and are a direct competitor to Capitol Health Limited (CAJ).

IDX is the fourth largest player in the medical imaging space with 44 sites around Australia. Analysts are optimistic due to the group's margins on their higher-end service model. The company's ability to grow by acquisition will aid growth in an industry where those with scale will be at a significant advantage.

The industry has historically been growing at a rate of 7.2 per cent pa, however this has slowed in the past few months. Despite the recent slowdown in the industry, two out of the three analysts initiating coverage on IDX have it as a buy. The average price target is $2.13 with $2.30 the highest and $1.95 the lowest. Current share price for IDX is $1.85.

• Investors are generally advised to buy Integral Diagnostics Ltd at current levels.

Broadspectrum Limited (BRS)

The facilities and asset management company formerly known as Transfield Services - in the press recently for its Manus Island and Nauru operations - is in the press again. Broadspectrum has received an all cash takeover offer from Spanish multinational Ferrovial S.A's Ferrovial Services Australia Pty Ltd of $1.35 per share. The offer comes with the condition of a minimum 50.01 per cent acceptance by shareholders. This is the third takeover offer made by Ferrovial.

Analysts do not anticipate the offer to get up, given the BRS board had previously rejected an offer at $2 just 12 months ago. A large hurdle for Ferrovial to overcome is the fact 40 per cent of BRS shares are held by four shareholders.

The consensus price target for BRS is $1.26 with the majority of analysts having the company as a hold. The one outlier who has listed BRS as a sell has their price target set at $0.98.

• Investors are generally advised to hold Broadspectrum Ltd at current levels.