Climate summit holds sway; Abengoa, Barclays stir up green bond market

Today, US President Barack Obama joins more than 100 world leaders in New York for the United Nations summit on climate change.

The brainchild of UN Secretary-General Ban Ki-moon, the summit is meant to help propel the negotiations on a draft global agreement, which has been in a state of limbo up until now. The day-long summit is significant in that an agreement needs to be reached in time for another round of talks to be held in Lima later this year, followed by a formal accord in Paris in 2015.

Such is the sheer number of representatives estimated to speak at the summit – 125 – that each of them has been limited to just four minutes. Conspicuous by their absence will be India’s Prime Minister Narendra Modi and Chinese premier Li Keqiang – both representatives of fast-growing countries with a burgeoning population and energy issues. China is currently the world’s largest greenhouse gas emitter, with India not far behind.

Rather than seeking a legally binding pact like the 1997 Kyoto Treaty, which the US never ratified, the UN this time wants countries to offer promises of specific action to curb the release of carbon dioxide and other such polluting gases. All this action is aimed at stopping average global temperatures from rising more than 2 degrees Celsius from pre-industrial levels, according to the scientific consensus put forth by the Intergovernmental Panel on Climate Change.

All that you need to know and more about the climate talks to be held today can be found in a white paper released by Bloomberg New Energy Finance, and titled “The data behind the UN deadlock: a need-to-know guide”.

While world leaders will, hopefully, pledge action, some companies and institutions are already doing their bit to help prevent global warming by way of issuing climate bonds. Climate bonds, or green bonds, are issued in order to raise finance for clean energy projects, and this last week saw plenty of activity on that front.

Spanish energy and environment company Abengoa is to issue its first green bond, to raise €500 million ($US642 million) to finance projects. The bond, maturing in 2019, will be offered in dollars and euros to institutional investors, Abengoa said on Monday.

Abengoa’s issue will also be Europe’s first high-yield green bond, the company said on its website, adding that the proceeds will be used for projects comprising renewable energy, water, power transmission, energy efficiency, bioenergy and waste-to-energy plants.

Barclays also said it plans to invest at least £1 billion ($US1.6 billion) in green bonds by November next year. The bank will buy debt that is designed to raise money for low-carbon projects from issuers including the World Bank, it said on Monday in an e-mailed statement. Its current green-bond portfolio is worth about £430 million.

“The participation of strategic investors such as Barclays in the green bond market will continue to bring scale and diversity to the market and help mobilise more capital for climate-friendly projects,” Madelyn Antoncic, vice president and treasurer at the World Bank, said in the statement.

Bloomberg New Energy Finance estimates that the market for green bonds may triple in size this year to more than $US40 billion.

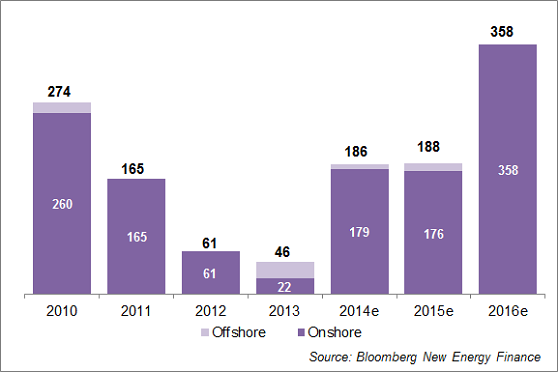

Graph of the week: After latest feed-in tariff statistics, Japan wind installations will likely reach 186MW by year-end: BNEF

Originally published by Bloomberg New Energy Finance. Reproduced with permission.