Clearing skies over England's economy

While their mates across the English Channel continue to struggle, the Bank of England is becoming more optimistic about the United Kingdom’s economic recovery, declaring that the ‘recovery has finally taken hold’.

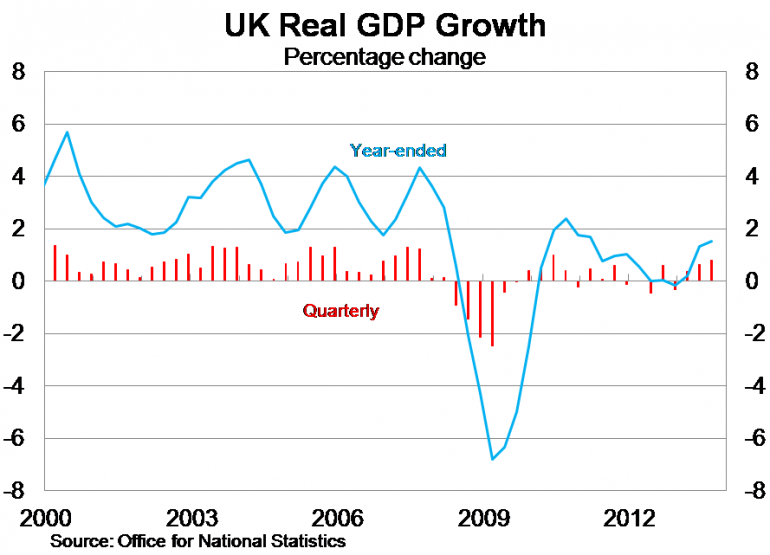

In its quarterly Inflation Report, the Bank of England revised up its outlook for the UK economy. Real GDP growth is estimated to be 1.6 per cent in 2013 (up from an estimate of 1.4 per cent in its August Inflation Report), while growth in 2014 has been revised to 2.8 per cent (up from 2.5 per cent).

These upward revisions come after data in late-October showed that the UK economy rose by 0.8 per cent in the September quarter, to be 1.6 per cent higher over the year. The recovery began in March this year after the economy contracted during 2012.

Weakness in the eurozone remains the greater threat to the UK recovery, with the Bank of England acknowledging that the adjustments to indebtedness and competitiveness within that area may prove to be a much greater drag on growth. That process has been far from smooth so far, and has become more difficult recently with both inflation and inflation expectations on the decline, prompting the European Central Bank to cut its cash rate (The ECB cuts but will have to cut again, November 8).

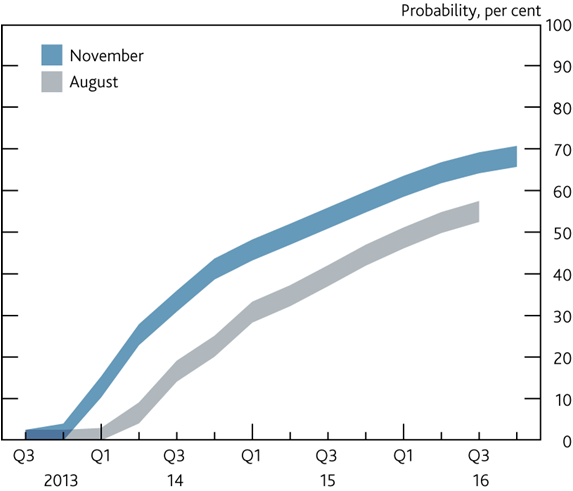

In August, the Bank of England unveiled its forward guidance policy, where it said it intends not to raise its bank rate from its current level of 0.5 per cent at least until the unemployment rate fell below a 7 per cent threshold. The faster than expected recovery has prompted the Bank of England to improve its outlook for the UK labour market. They believe that there is a 40 per cent chance that the 7 per cent threshold is hit in 2014, a 60 per cent chance in 2015 and a 66 per cent chance by the end of 2016. The graph below shows the cumulative probability of the unemployment rate hitting the 7 per cent threshold, compared with its outlook in August.

Figure: Cumulative probability of hitting 7 per cent unemployment probability.

However, the Bank of England reiterated that reaching the unemployment threshold would not necessarily trigger an immediate policy response. Although it is prudent to remain flexible and responsive on monetary policy, its forward guidance policy seems to lack credibility, or at least fails to provide any certainty, given the strings attached. The Bank of England have said that any decision to wind back monetary stimulus will depend on expectations for inflation and whether the UK recovery looks sustainable around the time that the UK economy reaches that 7 per cent unemployment rate target.

Data, released last night, shows that the UK unemployment rate ticked down to a four year low of 7.6 per cent in the three months to September. The Bank of England believes that with significant spare capacity left in the economy, inflation should remain contained and drift towards its medium-term target of 2 per cent. Its outlook for both inflation and growth depend crucially on a recovery in labour productivity, which has experienced ‘unprecedented weakness’ in recent years. Measuring, let alone forecasting, productivity is an incredibly difficult task and this strikes me as a strong assumption and a potential driver of uncertainty.

Obviously for Australia, an upward revision of growth for a major trading partner is always a positive development. The UK is currently Australia’s seventh largest export and import market, and our third largest services export market. The pound pushed higher on the back on the inflation report and unemployment data and, if sustained, this provides some positive news for Australian exporters.