China is the danger

Summary: Large share market falls, such as the current moves in China, affect consumer and business confidence for many years. The Chinese government is trying to reverse the fall, but is not acting decisively enough. Commodity markets are falling, which puts pressure on Australian budgetary forecasts. |

Key take-out: The Chinese slowdown could be greater than most economists forecast. While there are exceptions, share market falls of 30 per cent plus normally cause a steep economic decline. |

Key beneficiaries: General investors Category: Economics and Investment strategy. |

I don't know how many of our Eureka Report readers have been through a 30 to 50 per cent fall in the stock market. It is a very scary experience and that sense of petrification is multiplied many times when the market is based on margin lending and other forms of borrowed funds.

My first experience of a big market collapse was in November 1960 when I was taking the quotes on the floor of the stock exchange under the old ‘call' system, and I watched stock brokers absolutely turn ashen as share prices disintegrated.

That huge fall came after the then treasurer, the late Harold Holt, had announced that interest would not be tax deductible among a series of other draconian moves.

He was later to discover the stupidity of that interest rate decision but the damage was done as the market had been highly inflated. Then of course there was the end of the Poseidon boom and the daddy of all crashes – the 1987 share crash which brought down high flying entrepreneurs like Allan Bond, John Spalvins, Christopher Skase and Robert Holmes à Court although Robert Holmes à Court survived the experience by facing the reality and selling.

I recall those experiences this week because I know what the Chinese must be experiencing as a result of their plus 30 per cent fall in the stock market.

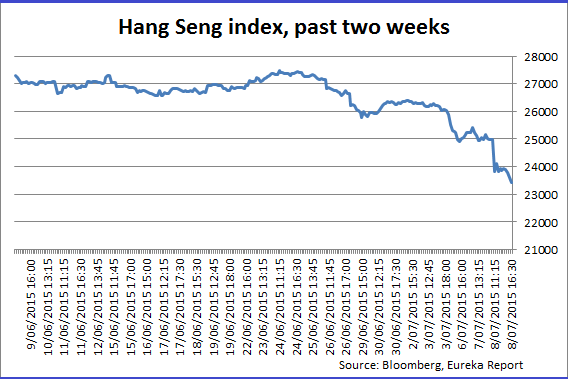

The Shanghai market closed down a sickening 6.8 per cent today.

Very large numbers of Chinese punted on the stock market using borrowed funds and that has decimated their savings. And if it is the male in the family who has been punting the market he faces the terrible ordeal of telling his wife he has lost their money. And those that have come through it have had their confidence shattered by what has happened to their friends.

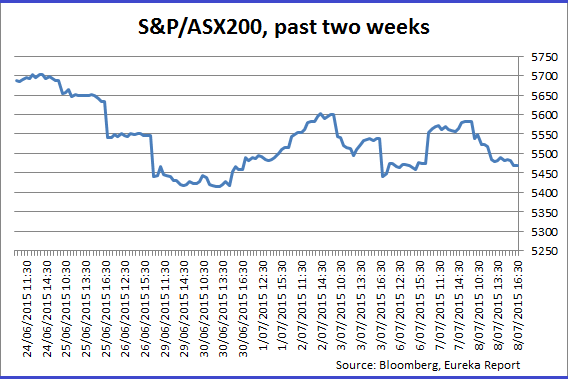

Such a fall in the stock market affects consumer confidence and business confidence and it takes many years to repair it. While there are exceptions, 30 per cent plus falls normally cause a steep economic decline. That's now likely to happen to China, which will be a disaster for Australia.

Governments can reduce the damage if they act strongly and decisively. That certainly happened in Australia after the global financial crisis but in 2015 in China the government was fostering share buying on the stock market by turning a blind eye to huge lending. Now it's trying to reverse the fall but that is no easy task and at the moment China is not acting nearly decisively enough.

The actions of Chinese market regulators last week and early this week did not work so they have been compounding the problem and causing this morning's Shanghai index to fall almost 7 per cent. Unfortunate margin investors were sold out at the bottom of the day's trade. The market recovered ground but the damage was done in the first 15 minutes. China desperately needs a Donald Tsang!

Tsang, of course, was the Treasurer of Hong Kong around 2001 when global market traders launched a bear raid on the Hong Kong share market. Tsang watched aghast as traders slashed the value of Hong Kong's Hang Seng index.

Rarely seen without his bow tie, Tsang decided to take on the world institutions. Tsang had two advantages – Hong Kong shares were cheap and he had a pot of cash. Tsang knew he had to be decisive so he moved into the market to buy on day one and stock started to respond. He was back on day two and day three taking the shares even higher.

There were substantial short positions in the market and once the institutions shorting stock knew he was serious they began to cover and the stock and market then developed its own momentum. The damage was curtailed by decisive government action and the government went on and made large sums when they eventually sold.

For the most part governments are very reluctant to get involved with the market and usually they are very wise to stay out but if they are tempted to interfere then the lesson from Donald Tsang is to avoid half measures like suspending stocks (China's strategy).

Unless China really moves in behind their stock market or there is some major event then I think the Chinese slow-down is going to be greater than most economists are forecasting. The commodity markets have a real whiff of this and we are seeing metals prices over a wide range of decline (although many rose last night) and of course as we have an oversupply in iron ore and oil making the falls in these commodities more severe. That means that Australian budgetary forecasts are going to be put under pressure. At the moment our currency is being held up because our interest rates are higher than most other developed countries.

If the US lifts its interest rates in September that will help our currency fall. The gyrations in Europe (see John Kimelman's piece today: Greece: The view from Wall Street) are currently sending money to the ‘safe haven' of the American dollar and that is pushing our currency down without Australia lowering rates.

I think there is a real chance our currency at US74 cents could fall below US70 cents well before the year is out. Forecasting currencies is a high risk, high error business and I don't have a terribly good record in this area although in recent times it was easy to predict the dollar was going to fall. Make sure your investment strategies take into account the likely further fall in the Australian dollar.

In these circumstances we are not going to see a lot of investment from the corporate area except that which is directed at modernising systems and lifting productivity. And we are seeing clear signs that consumer confidence is falling in the light of our share market gyrations and events in Europe and China. What is holding the Australian economy together is the massive inflow of funds from Asia into residential apartments.

I know many people don't like apartments but this is what is supporting the economy at present. There is no sign to date that the fall in the China stock market is affecting this investment. We need to hope that continues. We are helped by the fact that a lot of investment is coming out of Malaysia because they are very frightened by the increased Islamisation of the Malaysian society. The Australian government has severely curtailed the amount of money people can allocate to residential real estate in their visa applications.

The new rules started July 1 and a lot of apartment development set sail just before the deadline. While it is easy to be pessimistic given what is happening in China we should not forget there are good yields in the Australian market and as interest rates look like falling in Australia those yields will become even more attractive.

At the same time we have seen a number of 2014-15 profit warnings from corporations but outside the stocks that have raised the profit alert I don't think we are going see too many surprises on the down side for the 2014-15 year. It may be tougher in the current year but most companies have trimmed their costs to cover any revenue problems they may encounter.

You will notice I haven't mentioned Greece (you can read Adam Carr's summary of the Greek situation post referendum: Greece…bargain hunters get ready, July 6), except its effect on Australian confidence and on the flow of global funds. So much has been written and it is an incredibly fluid situation at this moment so given that Australian direct involvement is quite small I will save it for another day.