Changes to the InvestSMART Property Portfolio

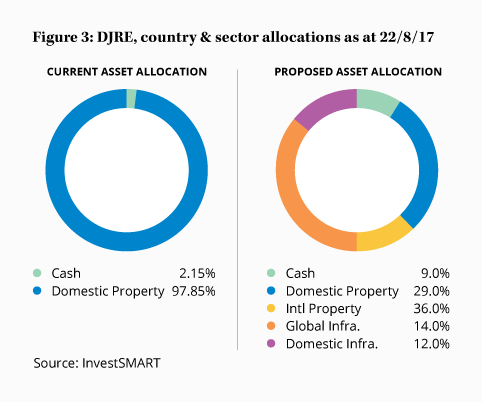

In the interests of providing a more diversified property solution to investors, we have expanded the mandate of our Portfolio to include global property and infrastructure exposures.

How

We are achieving this objective by investing in a number of Australian A-REITS (ASX-listed real estate investment trusts) as well as global property and infrastructure exchange-traded funds (ETFs).

Initiating the change, we have identified two ETFs that have been designed to deliver diversified property and infrastructure exposures and these have been added to the Portfolio.

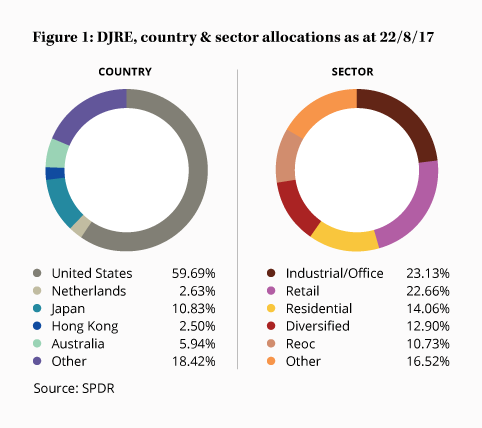

DJRE - SPDR Dow Jones Global Real Estate Fund

The SPDR Dow Jones Global Real Estate Fund seeks to provide investment returns, before fees, that closely correspond to the performance of the Dow Jones Global Select Real Estate Securities Index.

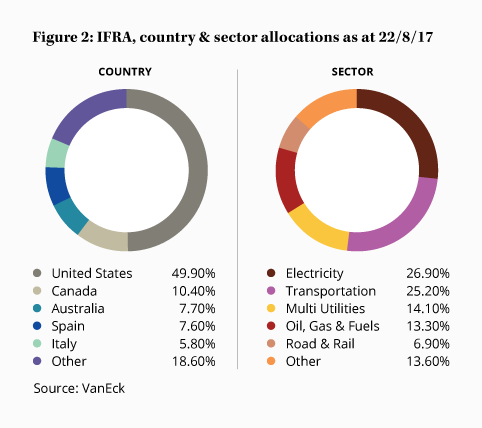

IFRA - VanEck Vectors FTSE Global Infrastructure ETF

The VanEck Vectors FTSE Global Infrastructure ETF invests in a diversified portfolio of infrastructure securities listed on exchanges in developed markets, with the aim of providing investment returns, before fees, that track the return of the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index.

In order to fairly judge the performance of our Portfolio, we will also need to change the benchmark. Currently the InvestSMART Property Portfolio is benchmarked against the S&P/ASX 200 A-REIT Accumulation Index.

The newly named InvestSMART Diversified Property & Infrastructure Portfolio will be benchmarked against a composite index made up of 25% S&P/ASX 200 A-REIT Index, 25% S&P/ASX Infrastructure Index, 25% S&P Developed Property Index and 25% S&P Global Infrastructure Index.

Benefits

The main purpose for making these changes, is to improve the diversification profile within this Portfolio.

You will begin to see these changes within your portfolio from Friday the 25th August.

Frequently Asked Questions about this Article…

The InvestSMART Property Portfolio has been expanded to include global property and infrastructure exposures. This involves investing in Australian A-REITs and global property and infrastructure ETFs.

The inclusion of global property and infrastructure aims to provide a more diversified property solution for investors, enhancing the portfolio's diversification profile.

Two ETFs have been added: the SPDR Dow Jones Global Real Estate Fund (DJRE) and the VanEck Vectors FTSE Global Infrastructure ETF (IFRA).

The DJRE seeks to provide investment returns that closely correspond to the performance of the Dow Jones Global Select Real Estate Securities Index, before fees.

The IFRA invests in a diversified portfolio of infrastructure securities in developed markets, aiming to track the return of the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index, before fees.

The portfolio will now be benchmarked against a composite index consisting of 25% S&P/ASX 200 A-REIT Index, 25% S&P/ASX Infrastructure Index, 25% S&P Developed Property Index, and 25% S&P Global Infrastructure Index.

The changes will begin to be reflected in your portfolio from Friday, 25th August.

The main benefit is improved diversification within the portfolio, offering a broader range of property and infrastructure investments.