Carr's Call: Swallow the food story

PORTFOLIO POINT: The bearish IMF has a bullish outlook on agricultural commodities, and that sends a buy signal to investors on listed agricultural stocks and ETFs.

The International Monetary Fund has been quick to talk down global growth prospects and, in my opinion, it is a little bit over the top with the doom and gloom.

That said, it’s not renowned for its optimism. So within that I was struck by one very important piece of analysis provided by the fund. And that is its view on food prices. For mine, it’s one of the stand-out features of its report, that despite its more bearish global perspective, it appears quite bullish on the prices of soft commodities.

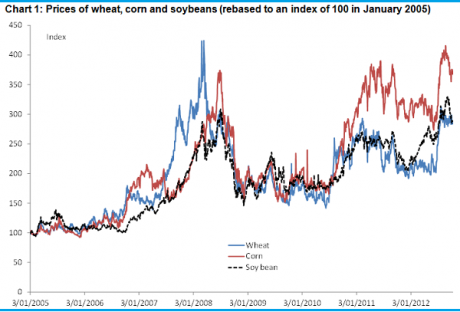

The above chart shows that after a brief global financial crisis lull, food prices have continued their rapid spike higher, the latest leg up (around June/July for corn and wheat) taking corn and soybean prices above their previous 2008 peak – wheat not too far below.

We know that weather played a big role in lifting prices in 2012 – well, more precisely, the magnitude of those rises – and specifically, both North and South America experienced drought, with similar adverse weather conditions seen in Russia and the Ukraine. So it’s reasonable to expect that as weather conditions improve, and assuming no further weather-related events, that prices may ease off a little. Indeed, the IMF notes this is exactly what is expected by the futures markets. I should note at this point that, as far as forecasting commodities, the IMF appears content to defer to the futures market.

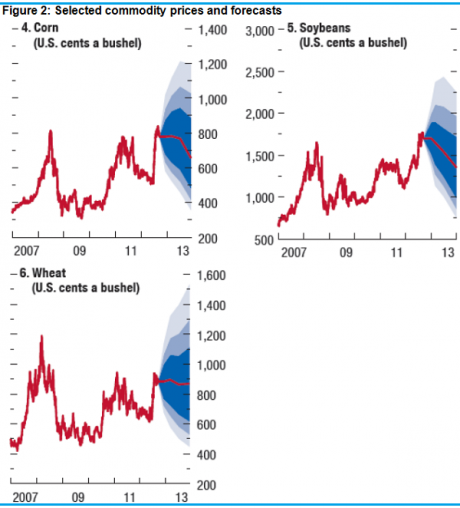

However, have a look at the charts below. What I’d like to draw your attention to is the fact that prices aren’t really expected to moderate considerably over the course of the next year – even if weather conditions improve. Wheat, for instance, is forecast to decline 5-10%, corn by maybe 20% and soybeans by roughly 30%. These don’t sound like insignificant price falls, but you have to see them in the context of the prior price rise. The fact is, and as the charts show, even with such falls, prices will remain elevated and not too far off the ‘crisis’ levels we saw in 2008 and again now.

Now here’s the thing. These price declines are expected to occur against a backdrop of severe pessimism, a European recession and sluggish advanced economic growth. That is, an environment where there is a lot of negativity – almost as bad as it’s going to get. Recall that the IMF reckons there is only a 17% chance of a severe global recession, and that probability was apparently 10% in 2010 – which was a strong growth year.

Which brings me to my next point. What if the IMF is wrong again and growth surprises on the upside? Certainly that is my expectation, as regular readers will know. If the bearish IMF is bullish on food during sluggish growth, extreme pessimism and through the US fiscal cliff, then how bullish will it be if some of these things don’t turn out to be as bad as expected? Which, let’s be frank about it, has been the case consistently over these last few years. What are we left with?

- Robust global growth.

- Rising inflation.

- Excessive monetary stimulus and a strong hunt for yield.

- Growth of the middle class in Asia and rising food consumption or rather strong demand, which appears to be impervious to the IMF’s view that there is a slowdown in economic growth.

All of these factors are supporting the rapid rise in food prices, and that’s not going to change it seems. I mean, if even the bears are bullish on food, it’s a strong buy.

Now, in addition to the factors I’ve listed above, and weather-related events, the IMF suggests there is one other supporting factor for food prices – and that is declining stocks, in an environment where stocks are lower relative to history anyway. This carries with it a greater risk of trade restrictions as countries hoard food to feed their populace, further boosting prices. This is what we saw in previous years and while it hasn’t happened much this time around. It’s the more likely outcome given the civil unrest high food prices seem to spark.

Thought of another way, the IMF is telling us that even if the worst-case scenario eventuates the prices of soft commodities will flat line – or maybe will fall a bit. There is just too much ongoing support, even with lacklustre growth and improving weather conditions.

If you are already in that trade then so far you’re laughing – for the rest, all is not lost. The only difficulty for everyone is in determining what to do about the fiscal cliff. Now in my article of September 24, Don’t Fall Over the Fiscal Cliff I demonstrated why, in reality, the cliff isn’t all that serious. It will be equivalent to a very minor lift in the Federal Funds Rate (the official cash rate) from its current rate around zero to something not too far above. Having said that, the market reaction to the inevitable theatrics could be extreme. It’s one of the great unknowns – how the market will react.

So with that in mind I’d certainly look to book some profits now, lock some of those gains in, if not all. For those out of the market, it’s all about the entry point. On this I think there is one thing we can be reasonably sure about – there will be a better entry point than now, when prices are pushing higher and coming up to key resistance. Perhaps that better point will be provided by the fiscal cliff or an easing of US drought conditions. I would, howeve,r keep soft prices on your radar – actively look for that entry point.

Applying this to the local Australian investor there are a number of ways to play it.

- Domestic-listed stocks such as GrainCorp or Primeag.

- Globally listed stocks.

- Domestic or globally listed ETF’s. One domestically listed agriculture ETF is BetaShare’s agriculture ETF (ASX code QAG).

- Directly trade derivatives – futures and options (for the sophisticated investor only).

My favoured option is the ETFs, although they are often synthetic (i.e. based on futures rather than the underlying commodity). This which isn’t ideal, but it does have the advantage of simplicity over directly trading derivatives yourself.

Similarly, I’ve become very nervous of management risk in Australia. This is very high in my opinion given the poor performance of executives and boards across a number of listed companies. Avoid it where you can.