Carbon price gone but Alcoa smelter to shut anyway

UPDATED 11AM February 19

Alcoa announced today that it will permanently close the Point Henry Aluminium Smelter located in Geelong, Victoria in August this year. According to the company, “a comprehensive review found that the 50-year-old smelter has no prospect of becoming financially viable”.

August? Isn’t that after Hunt and Abbott have abolished the job destroying, economy wrecking carbon tax?

Now of course the current Greens-Labor dominated Senate is refusing to pass the carbon tax repeal bill but if Environment Minister Greg Hunt is to be believed the carbon tax is dead from 1 July no matter what, as he told Lateline late last year:

EMMA ALBERICI: … The point is your document specifically says that the government won't extend the carbon tax beyond July 1 – or June 30, as it may be – even if the Parliament doesn't pass the carbon tax repeal bills. What I'm interested to know is what the message there is to business about what they should do?

GREG HUNT: Well the message is very clear: that we will abolish the carbon tax, lock, stock and barrel.

EMMA ALBERICI: But you can't do it on your own. You know you need the support of other parties, other members of the Parliament on both – in both houses. You are not likely to get that support before July 1 next year.

GREG HUNT: Well I think that's not necessarily correct.

Of course Hunt is talking complete rubbish that he can bypass the Senate. Nonetheless, the current numbers for Senate from July 1 suggest repeal of the carbon price is highly likely.

So if you were in charge of Alcoa and the carbon tax was a huge cost impact that spelt the end of the smelter's viability, wouldn’t you at least wait until July to see how the new Senate might vote rather than deciding to pull out now?

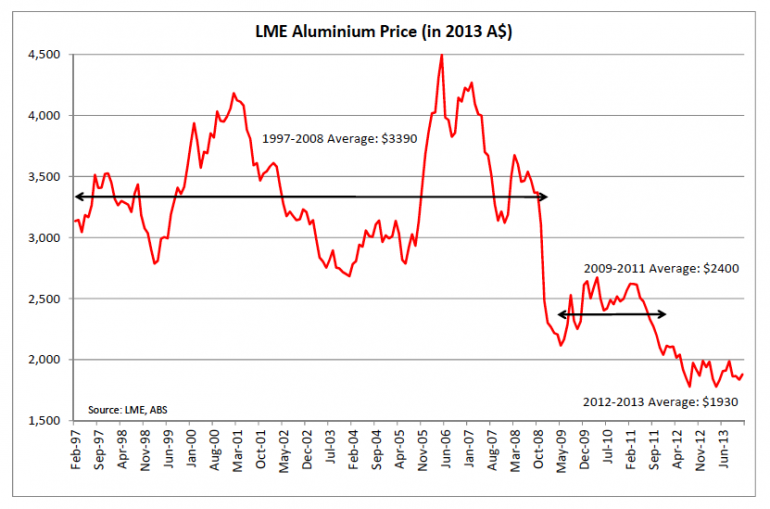

The graph below suggests that other factors, such as a falling aluminium price on the back of increased Chinese production, are probably playing a bigger part given the carbon price impact after the 90% free permits is less than $20 per tonne of aluminium (assuming the EU ETS market price sets Australian permit prices).

Thinking beyond the nonsense that is the Australian politics on this matter, the reverberations of this decision in Australia’s electricity market are considerable.

Point Henry alone represents almost 7 per cent of Victoria’s annual electricity consumption, so its closure will leave a serious hole in demand. At the same time Alcoa also said it doesn't intend to close the associated Anglesea power station that supplies 40% of the smelters power needs and instead is seeking to sell it. Given the already heavily oversupplied state of the electricity market, the smelter closure without the withdrawal of Anglesea will likely further depress wholesale prices to the lowest levels seen since the beginning of the National Electricity Market (with Queensland excepted thanks to that state's government acting to reduce competition there).

On the other hand, this could represent very good news for the viability of Alcoa’s other smelter in Portland, Victoria, and also possibly Tomago in NSW – while meaning bad news for existing power generators in the NEM.

Alcoa’s statement today merely said Portland will “continue normal operations”, adding nothing else about its likely long-term future. Key to this future will be obtaining power supply at very low prices. Alcoa's power supply for Portland and Point Henry had been covered by a long-term contract with AGL's Loy Yang A. But on 20 December last year it was announced that this contract had been cancelled by mutual agreement to head off litigation Alcoa was threatening to commence against AGL. It is understood that AGL was trying to hold Alcoa to the power contract even if Alcoa closed a facility, but with the contract now cancelled Alcoa finds itself in a very strong negotiating position with power suppliers.

With the Point Henry closure coming on top of the earlier closure of the Kurri Kurri aluminium smelter, power generators are likely to be terrified about the the demand and price collapse that would accompany the closure of Portland and very anxious to avoid it. Given this situation Alcoa may be able to be negotiate a power price vastly better than what it had previously with AGL.

Tomago Smelter’s contract with MacGen (to be acquired by AGL subject to ACCC approval) is understood to expire in 2017 and Tomago, too, would appear to have a strengthened hand in negotiations.

This will further up the pressure on the generators to mothball or close some of their power plant capacity. It will also increase the stakes for incumbent generators to see the Renewable Energy Target cut down in size.

CORRECTION: An earlier version of this article stated that Alcoa's still had an electricity supply contract with AGL when in fact it had been cancelled late last year.