Can big solar take on wind? Look to the banks

A few months ago in an interview Tom Werner, chief executive of major global solar PV manufacturer and power developer Sunpower, and his Australian head Chris O’Brien, told me that he believed large-scale, 50 megawatt solar power projects in Australia could be viable at close to $100 per megawatt-hour in locations with solar resource equivalent or better than Broken Hill.

Such a cost structure represents a major development, placing solar squarely competitive with the two other bankable power options in Australia – wind and gas (you’d struggle to obtain bank finance for coal because carbon regulatory risk is too high).

I was rather incredulous of his claim but he could point at a real world project they had built in California to back-up his claim. And they had another project under construction in Chile achieving similar economics.

Still, the available historical data on megawatt-scale projects in Australia suggests costs much higher that $100 per megawatt-hour. The winning project bids under the ACT Government solar auction were between $178/MWh and $186/MWh. Now these were 20MW or less, while Sunpower’s Californian project was 250MW so economies of scale might go someway to explaining the difference. Also, ACT’s solar resource is not particularly ideal, with Australia having vast areas with better solar irradiance.

Still, if we look at AGL’s Broken Hill and Nyngan projects they are 50MW and 100MW in scale, and they are located in areas with reasonably good solar resources. Based on Sunpower’s claims these projects should be close to the $100MWh benchmark, yet the costs reported for those projects are miles off anything close to $100.

What gives?

Australian Renewable Energy Agency chief executive Ivor Frischknecht provided a chart at Clean Energy Week which was worthy of our chart of the week and goes a very long way to explaining the difference. It turns out much of the difference comes simply down to the fact that the US has built lots of large-scale solar PV farms and Australia has built barely any.

As the chief executive of ARENA, with hundreds of millions of dollars to give out to worthy renewable energy projects, Frischknecht gets bombarded with a lot of proposals. This means he is in an extraordinarily privileged position of getting to see the underlying financials for an awful lot of solar power projects in a range of circumstances across Australia. This includes AGL’s Nyngan and Broken Hill projects, but he’s also seen more recent bids from Infigen and Pacific Hydro, as well as a range of smaller megawatt-scale off-grid and fringe-of-grid solar PV projects. Consequently, he and his team now have a pretty good appreciation of what drives their costs.

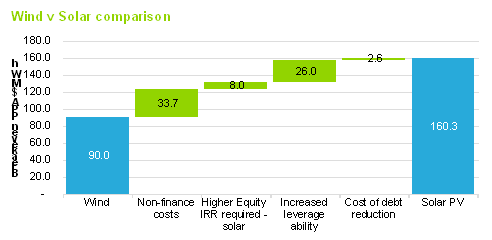

In the chart he breaks down the underlying differences in the required power purchase price a wind project needs versus solar PV. The way he pegs it, a large-scale solar project in Australia needs around $160/MWh, leaving it completely uncompetitive relative to wind at $90. However, more than half the cost gap is explained by financiers unfamiliarity with solar PV and perceptions of higher risk. If you take that away, then solar’s cost per megawatt-hour is close to $124, within the ballpark of Tom Werner’s claim.

It shows $26, or a more than a third of the cost difference, is because banks are unprepared to finance as large a proportion of a solar project’s cost relative to wind power. This adds a lot of cost because bankers charge a much lower interest rate (very roughly 7 per cent) on their finance than equity financiers (very roughly 14 per cent).

Banks chose to lend a lower proportion of the overall project cost to cover for the risk that the project may not generate as much free cashflow as originally planned. By, say, lending only half the cost of the overall project, cashflows have to be much lower than originally planned before there’s insufficient money to repay the bank loans, with the drop-away borne instead by the equity financiers (who only get paid after the banks get their share).

Then on top of this, both the equity and the bank financier want an extra premium return on the money they provide to a solar project, presumably to account for the extra risk they perceive a solar project represents.

Yet from a technical perspective, there seems to be little reason to believe a solar project should represent a greater risk than a wind project. Solar PV panels have well understood and reasonably reliable electricity generation performance characteristics based on several decades of experience. There are solar panels installed more than 20 years ago that are still reliably producing power out in the field. Also, data on levels of solar irradiance stretch back a very long time and indeed are probably more reliable than wind speed data. Also, both wind and solar are exposed to the same power and renewable energy certificate market dynamics -- so on face value this shouldn’t represent a major difference in risk either.

Instead, the difference may be a function not so much of the technology as the financiers themselves. The Australian finance sector just hasn’t financed many solar PV projects. Understandably they’re nervous about handing over hundreds of millions of dollars to a project using a technology they don’t yet understand and aren’t completely confident about. However, one expects that just like in the US, as they gain more experience and become more familiar with the technology, they’ll become more confident about financing such projects and costs will come down to something closer to wind.