Business is preparing for a capital strike

The mining investment cliff will arrive in the 2014-2015 financial year; it is also the year that the Australian manufacturing industry unofficially dies. Data on capital expenditure intentions for the next two financial years paints a bleak picture for the Australian economy, with both mining and manufacturing investment set to decline sharply in the 2014-2015 financial year.

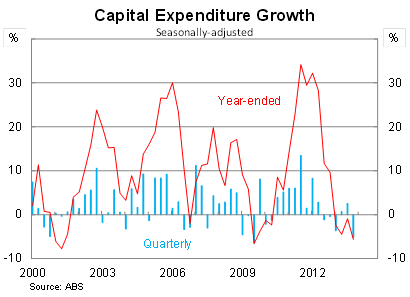

New capital expenditures fell by 5.2 per cent in the December quarter, weaker than market expectations of a more modest decline, to be 5.7 per cent lower over the year. This followed surprisingly strong expenditure in the September quarter.

The fall in capital expenditure was broadbased across sectors, with mining investment down 5.5 per cent and manufacturing investment down 7 per cent. The September quarter provided only a brief reprieve for the manufacturing sector where capital expenditure has declined by 35 per cent over the past two years.

Capital expenditure predictably got smashed in the states reliant on manufacturing, with Victoria and South Australia down 10 per cent and 12.5 per cent respectively. But expenditure in Western Australia was also particularly weak, highlighting the rapid slowdown in mining investment.

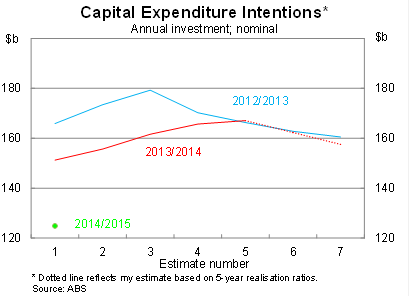

Each quarter the Australian Bureau of Statistics asks businesses their investment intentions for the future; this is the fifth quarter where businesses have been asked about the 2013-2014 financial year and the first where they were asked about the 2014-2015 financial year. There are seven quarterly estimates for each financial year.

Nominal capital expenditure intentions for 2013-2014 rose slightly compared with three months ago, but based on historical realisation ratios it is likely that capital expenditure over 2013-2014 will fall moderately compared with the previous financial year.

But the danger signs are in the initial estimate of capital expenditure for 2014-2015. Investment intentions are down sharply on the current year and based on realisation ratios over the past five years, we could be looking at a decline in capital expenditure of around 10 per cent. But the result is extremely sensitive to the realisation ratio used – it will likely be a much larger decline.

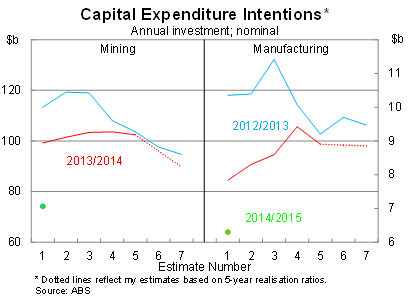

I have been talking about the impending mining investment cliff for some time and the graph below shows exactly what I mean. Mining investment is set to tank in 2014-2015, probably in the range of 15 to 20 cent – but given the mining sector can often be a little optimistic about its intentions the decline could be much greater.

Manufacturing investment is also set to fall sharply, with nominal investment likely to fall to its lowest level since 1992 – in real terms it would be much weaker. Despite the rebalancing narrative that the Reserve Bank is spinning, the manufacturing sector appears unlikely to take part. With investment set to be so low, the manufacturing industry will not be expanding capacity anytime soon and realistically the sector will continue its slow march towards extinction.

I mentioned yesterday that today’s Capex survey could be a game changer and a game changer it proved to be (The loose screws in Australia’s economy; February 26). The mining investment cliff is coming and it will punch a sizable hole in the economy. The unfortunate reality is that it will be extremely difficult for other sectors of the economy to fill the gap.

Can the housing sector do it? Not likely. What about manufacturing? You’ve got to be kidding. Exports will pull their weight but consumption must be considered a little shaky given the state of the labour market. It is difficult to see where the growth will come from, particularly if the government goes through with its desire to cut spending.

Does this report suggest that the Reserve Bank will lower rates further? The report certainly makes it clear that the rebalancing the Reserve is relying on is not progressing as cleanly as it would like. At the very least the central bank will resume its easing bias and the next rate move should be down rather than up. After a quiet few months, a nice holiday and the G20 meetings, it is time that the RBA began making more noise.