Business is nibbling at the RBA's carrot

Low interest rates are encouraging businesses to borrow but many are cautiously paying debts rather than expanding. Unfortunately for the RBA, that’s of little benefit to the broader economy.

Business lending picked up further in December but remains well below its previous peak. Meanwhile, credit balances outstanding continue to grow at only a modest pace, indicating many firms are taking advantage of record-low interest rates to deleverage and refinance existing loans.

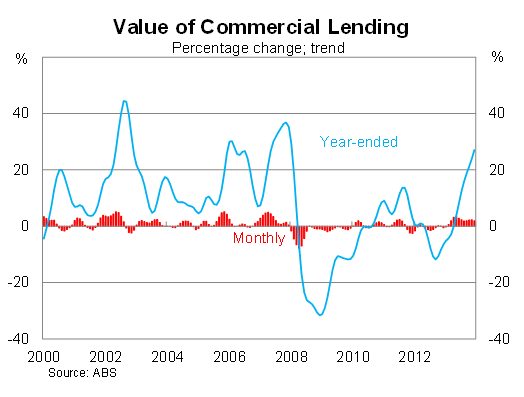

Commercial lending rose by 4.7 per cent in December, following growth of 8.5 per cent in November, and is now almost 30 per cent higher over the year. Low interest rates have created an environment conducive to lending activity and, much like housing loans, we have seen a sharp rise in bank lending. Nevertheless commercial lending remains 27 per cent below its previous peak.

But many businesses are using low lending rates to pay down existing loan balances or alternatively to refinance their loans to reduce their interest burden. That is not particularly surprising given the non-mining economy is still fairly subdued and the outlook for that sector is reasonably uncertain.

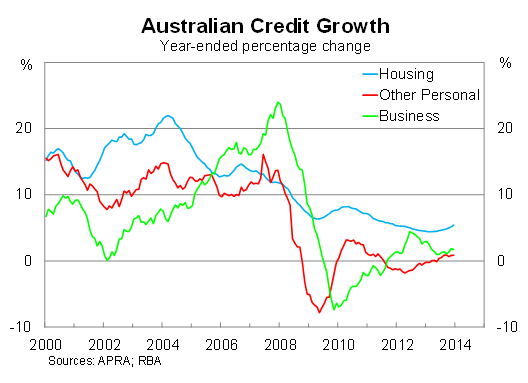

As a result, growth in business credit outstanding remains incredibly weak by historical standards and has yet to really pick up following the onset of the global financial crisis. While expansion opportunities likely exist, improving the business balance sheets is important to weather a slow economy or subdued recovery for the non-mining sector. It is not particularly great for the economy as a whole, but for individual businesses it’s a prudent strategy.

Business credit outstanding rose by 0.4 per cent in December, to be just 1.7 per cent higher over the year. It’s a long way from the dizzying heights prior to the global financial crisis.

Commercial lending activity – as opposed to loans outstanding – was driven by fixed facilities in December, which have been driving growth over the past year. The same can be said for personal loans.

Revolving facilities – such as credit cards – remain incredibly weak for both businesses and individuals. These facilities are generally riskier propositions with higher interest rates and the fact that lending activity for these facilities remains so weak is an indication that lending activity itself is perhaps not as strong as the headline data suggests.

On balance, though, the rise in lending activity is exactly what the Reserve Bank would be expecting given the current state of interest rates. But they would also have expected low interest rates to encourage businesses to expand and to seek out new opportunities, rather than paying down debts and refinancing. However, with daily news articles focusing on job losses at major Australian companies, it’s hard to blame businesses for taking a conservative stance in regards to debt.

With the economy expected to grow at a below-trend pace over the next two years, it’s likely this two-tier type of lending activity will persist. Some businesses will be more than happy to leverage up and take risks, while for others the benefit of low interest rates may simply be the difference between surviving or closing shop.