Business investment: The missing link

Summary: Low corporate earnings has put a pause on business investment in the last couple of years, which in turn has stalled expansion and job growth across the country. |

Key take-out: Until Australian companies return to a more elevated level of business investment, it's unlikely equities will be in a position to chase their post GFC highs. |

Key beneficiaries: General investors. Category: Economy |

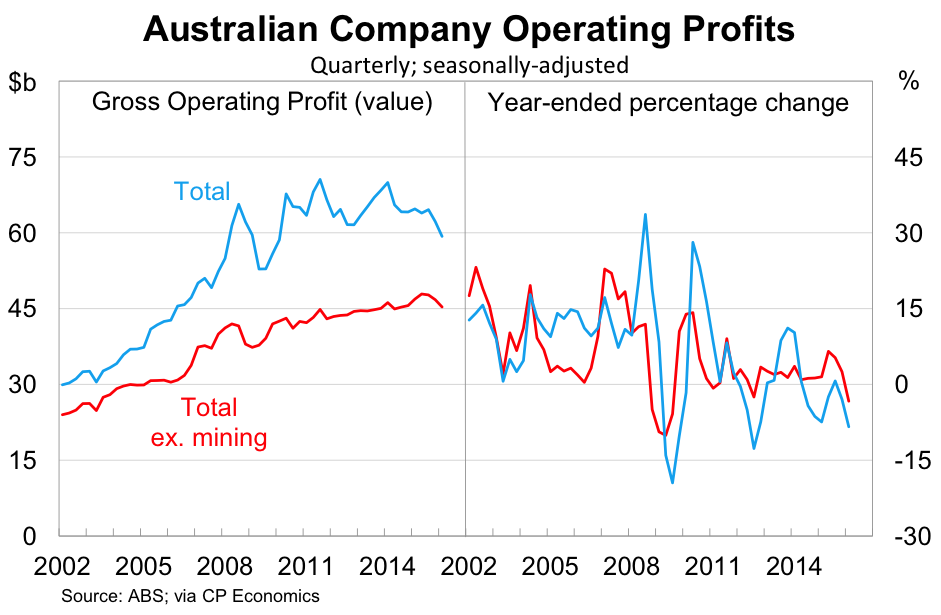

The Australian Bureau of Statistics (ABS) released a sobering assessment of Australia's corporate sector earlier this week. According to the ABS, company profits fell for the second consecutive quarter, to be at their lowest level in six years.

Gross operating profit across Australian companies fell by 4.7 per cent in the March quarter, to be 8.4 per cent lower over the year. The lacklustre result was largely concentrated in three sectors: mining (down 9.6 per cent in the quarter), manufacturing (down 14.5 per cent) and financial & insurance services (down 69 per cent).

The best of an ordinary bunch were transport, postal & warehousing (up 5.3 per cent in the quarter), wholesale trade (up 1.8 per cent), as well as “other” services (up 19.2 per cent). “Other” services excludes real estate and financial services and generally only covers smaller operations.

A weaker profits and earning environment reflects the growing divergence between the “real” and “nominal” economy. The “real” economy continues to expand at a solid, if unspectacular, pace whereas the “nominal” economy is stuck in a rut that has now persisted for the past three years.

Nowhere is this more apparent than for the mining sector. Each quarter iron ore producers export higher volumes of iron ore and yet the income they receive tumbles. Real GDP declares this a success but mining firms and investors are only too aware of the reality facing these operations.

The outlook for company earnings and profit is obviously complex and depends on a variety of different and related factors. Australian corporate profitability will depend, to a large degree, on factors outside our influence. Australia is a small open economy and the health of it fluctuates largely based on conditions in the United States, Europe and especially China.

We see this most clearly through our terms of trade, which effectively compares the price of our exports to the price of our imports. A high terms of trade means that we can purchase more goods and services for every dollar of export income. A lower terms of trade is the main reason that Australia has experienced an “income recession” and is a leading cause for lacklustre corporate profitability.

Low corporate earnings and profitability, combined with strong dividend policies, has put a squeeze on business investment. Corporate valuations and dividend policies are focused primarily on the near-term success of corporates rather than on expansion and new opportunities.

As many investors will know, equities haven't, on average, offered much in the way of capital gains over the past decade. Dividend policies have starved Australian corporates of cash and an uncertain economic and financial environment has encouraged corporates to delay investment decisions. The non-mining sector has also suffered, until recently, under the twin burdens of an elevated Australian dollar and high interest rates.

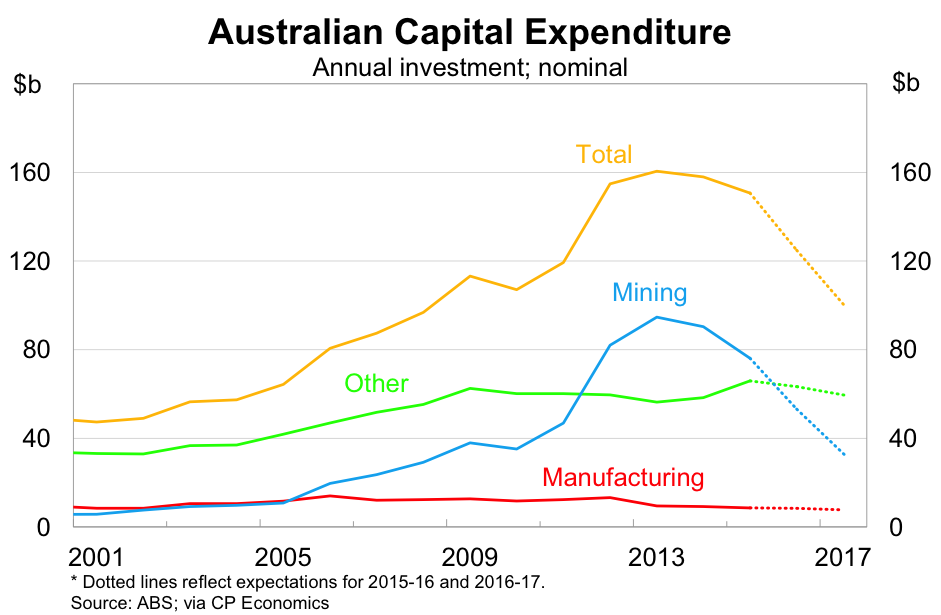

Last week the ABS released new forecasts for capital expenditure for the 2015-16 and 2016-17 financial year. According to the ABS, capital expenditure will fall by around 17 per cent in 2015-16 and a further 20 per cent in 2016-17.

The weakness will be concentrated in the mining sector, where capital expenditure is set to fall by 38 per cent in 2016-17, but lower investment is observed across the non-mining sector as well. Capital expenditure among manufacturing firms is expected to decline by 7.7 per cent in 2016-17; “other” sectors are anticipating a fall in investment of 5.8 per cent over the same period.

Business investment is in many ways a precursor to expansion and job growth. It's the path towards greater output and productivity. In other words, profitable investment is the one sustainable path towards higher corporate valuations.

The Australian share market is currently enjoying a seven week bull-run based primarily on lower interest rates and the expectation that the Reserve Bank will cut rates further over the next 12 months. Low interest rates provide a temporary boost to valuations but the real indicator to keep an eye on is business investment; the moment that begins to turn is the moment that Australian equities can make a genuine run at their post-GFC high. This doesn't appear likely in the next one-to-two years and any sustainable shift in non-mining investment may require a rethink of existing dividend policies.