Business caution comes at a cost

Commercial lending continues to push upwards, providing some tentative evidence that businesses are looking to invest. But with many firms continuing to refinance existing loans or pay down debt, the net effect of business lending may not be a great as many expect.

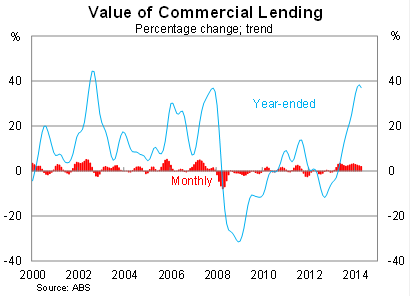

On a seasonally-adjusted basis, commercial lending rose by 5.8 per cent in April, to be 42 per cent higher over the year. This follows strong growth in March. The graph below shows lending on a trend basis -- to remove the monthly volatility -- and highlights how strong business lending activity has been over the past year.

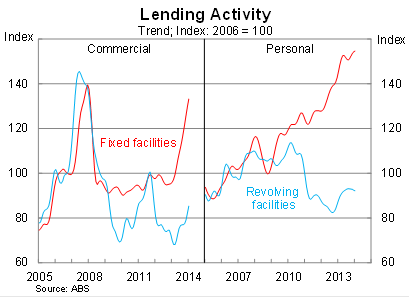

Growth in April was fairly broad-based across fixed and revolving facilities. Lending through revolving facilities such as overdrafts and business credit cards has improved significantly over the past six months, albeit off a low base. However, revolving facilities still have a long way to go before they reach their peak.

By comparison, fixed facilities – such as longer-term loans – are still 11 per cent below their 2008 peak, but the non-mining sector is certainly far more active than during the global financial crisis.

Personal lending declined by a further 2.2 per cent in April and is down 6.2 per cent over the year. The weakness in personal lending stands in stark contrast with the ongoing (albeit moderating) optimism in the housing market.

While households are reluctant to take on growing credit card risks or take out loans to purchase new vehicles, they are more than happy to leverage up to buy a home or an investment property.

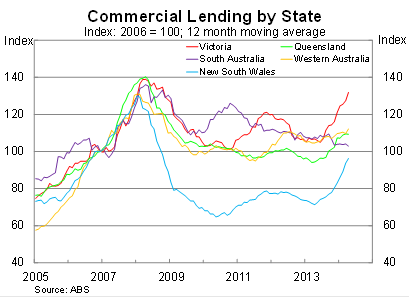

At the state level, lending conditions differ significantly between states. Lending continues to be led by growth in Victoria and New South Wales, providing some evidence that the economy is rebalancing, while growth has been relatively subdued in both Western Australia and South Australia.

Although growth in New South Wales has picked up recently, there remains a fair divergence between the behaviour of households and businesses. Are households too optimistic or are businesses too pessimistic? I’m inclined to believe the former.

The lending data provides further evidence that low interest rates are helping to support the non-mining economy. But so far this has yet to translate into credit growth, which reflects an ongoing willingness of businesses to refinance existing loan commitments or wind down their loan balances.

Rather than seek out new purchases or investment opportunities, they are instead happy to simply improve the quality of their balance sheets. That’s smart thinking, particularly during uncertain times, and may help boost growth in the medium-term even if it does little to rebalance growth right now.

Certainly, many businesses continue to face barriers to receiving credit. Small businesses are particularly affected, which is unfortunate since small businesses are often where fresh thinking and innovation originates from.

I noted last week that the major banks' obsession with household lending is starving some Australian businesses, particularly those who don’t have ready access to international finance or the corporate bond market (How the housing obsession is short-changing business, June 2). This is something that we need to address if we want to create a vibrant, innovative and dynamic business environment.

The lending data provides tentative evidence that the economy continues to rebalance but the Reserve Bank of Australia would want to see some of this activity translate into credit growth. That would provide not only an indication that businesses are investing but that there is growing optimism throughout the business sector.