Building approvals commence their downhill run

Building approvals are set to decline sharply during 2015 following elevated activity over the past year. Nevertheless, residential construction will continue to rise, supporting real GDP growth, but unless the household and non-mining sector picks up, it may be for naught.

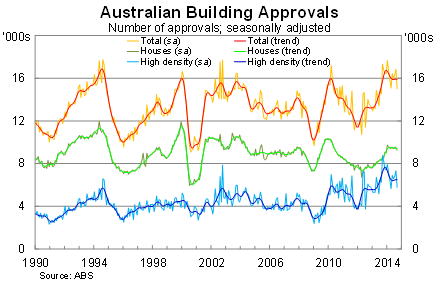

Building approvals fell by 11 per cent in September, missing market expectations, to be 13.4 per cent lower over the year. After a brief second wind -- during which trend approvals stabilised -- it appears as though building approvals will commence their steady decline over the remainder of the year.

Approvals in September were at their lowest level since August last year and have moderated considerably from their elevated level earlier this year. Nevertheless, new residential construction should remain strong for some time -- due to the lag between approvals and activity -- and will support real GDP growth over the next year.

Approvals for housing -- which have historically been less volatile -- continue to ease at a modest pace. The recent volatility has reflected activity within higher-density apartment living, which fell by 21.5 per cent in September and is 34 per cent off its peak late last year.

Due to the volatility, trend measures can be often provide a more reasonable assessment of events. Approvals for apartments are actually rising modestly on a trend basis, though based on the monthly developments that upswing will almost certainly be short-lived.

Approvals for apartments also provide a good indicator of investor activity -- on the rare occasions that investors purchase new rather than existing properties -- so there are growing signs that investor optimism is subsiding. This is understandable given the unsustainable nature of recent activity and comments made by the Reserve Bank of Australia regarding investor demand (Another sign the RBA will act on housing, October 22).

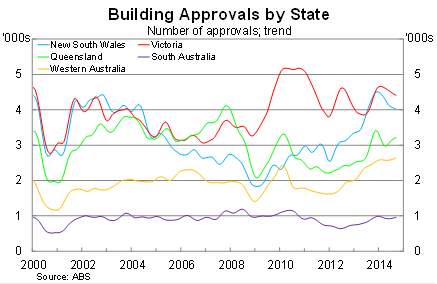

At the state level, approvals are clearly easing in both New South Wales and Victoria, but increasing modestly in Queensland and Western Australia. The construction boom will be concentrated in New South Wales, but the other three states should benefit to some degree.

But, we should also remember that this data relates to approvals rather than completions or construction and some projects may not go ahead. Construction in Western Australia and Queensland might be most at risk, given the perilous state of the resource sector in both these states.

The collapse in mining investment is ongoing but prices have deteriorated more quickly than commonly expected. Don't be surprised if some of these projects -- particularly of the higher-density variety -- fail to get off the ground.

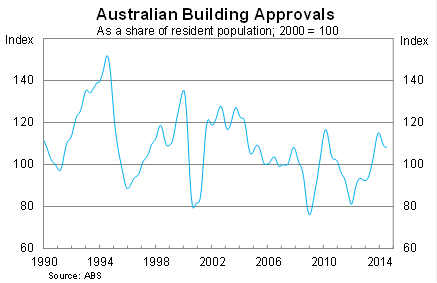

Finally, it is also worth putting the current construction boom in some context. While approvals have been and remain elevated, the upswing has not been as significant as during past construction booms.

The 2010-11 ‘boom' -- during which approvals tracked awfully similar to current trends -- saw residential investment rise only modestly as a share of GDP. This episode should last longer -- mostly due to the high number of apartment projects -- but the boom is unlikely to be as pronounced as earlier upswings during the mid-1990s and early 2000s.

Low interest rates should continue to support housing activity for the foreseeable future but building approvals are now on a clear descent and that will continue to play out over the next year. Residential investment remains one of the few bright spots for the Australian economy and has increased significantly over the past few quarters.

But new residential investment remains only a small share of real GDP and the ongoing health of the Australian economy will depend far more on our export and household sectors than on our ability to construct new houses. Both of those sectors remain hampered at present -- exports by low prices and a high exchange rate; consumption by declining real wages -- and as a result the Australian economy will continue to grow at a sub-trend pace for the foreseeable future.