Breaking the big four's bad habits

Australia’s major banks are getting desperate. The Murray Inquiry threatens to corral their dodgy lending practices and misleading accounting, prompting a last ditch effort by senior management to convince members of the inquiry that additional regulation is not required.

We shouldn’t sugar-coat the situation: the Murray Inquiry poses a serious threat to the business model of Australia’s big four banks. That might sound dire, but don’t be fooled, this is a business model that should be threatened.

The inquiry itself -- the first into the financial sector in 17 years -- will be released in November. At the centre of the inquiry are two fundamental issues: the major bank’s low capital ratios and the government’s implicit guarantee of Australia’s financial system.

Those two factors go some way to explaining why three Australian banks -- almost entirely irrelevant outside our shores -- are currently among the biggest 20 banks in the world in terms of market capitalisation. The big four also sit in the top 50 global banks as measured by total assets.

Australia’s obsession with mortgage lending isn’t merely an accident. It’s an entirely rational (albeit short-sighted) and inevitable consequence of a financial system that perceives mortgage lending as less risky than business or personal lending.

Under the current regulatory regime, favouring mortgage lending allows the banks to effectively lend more, leverage themselves higher and generate greater profits. Christopher Joye at the Financial Review provides an excellent recap on how the system works. As long as house prices keep rising the banks can’t lose.

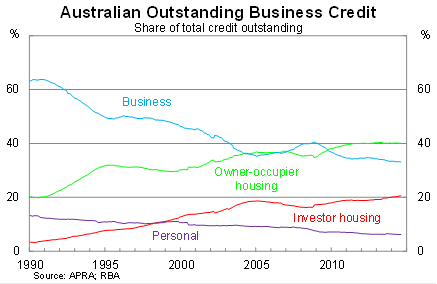

It’s a model that has been embraced by the banking community. Mortgage lending now accounts for almost 61 per cent of total outstanding domestic credit (compared with 45 per cent in 2000 and 24 per cent in 1990). Mortgage lending has accounted for almost 100 per cent of credit growth since the beginning of the global financial crisis.

But higher mortgage lending isn’t without its costs. An obvious implication has been higher house prices, while elevated land prices have created a significant cost -- and in some cases a barrier to entry -- for Australian businesses.

It’s also a business model that is built on unsustainable foundations. How long can the banking community starve the business sector – particularly small and medium-size enterprises – to feed the housing beast?

We should remember -- and the banks should bear in mind -- that it is the business community that underwrites the Australian housing market. They pay the incomes that become the mortgage repayments that enable the banks to post record profits year-after-year.

By starving the business community, our major banks are compromising productivity and income growth. Eventually that will put their mortgage holdings and business model at risk.

It’s rational in the short-term due to higher profitability and a stronger share price but it’s easy to see that it isn’t in the long-term interest of Australian shareholders or the business community.

The Murray Inquiry determined that “housing is also a potential source of systemic risk for the financial system and the economy.” The inquiry noted that “a large enough disruption to the housing market could have significant implications for household balance sheets, financial stability, economic growth, and the speed of recovery in housing spending and broader economy activity following a shock.”

Where the story becomes more concerning is that the taxpayer will be on the hook if it all goes belly up. The federal government’s implicit guarantee of the Australian financial system creates a situation where it’s heads they win and tails you lose.

The guarantee -- which has effectively lowered the cost of bank funding -- has come with no strings attached. It didn’t come with a government equity position, nor was it received with an expectation that banks would reduce their risk exposure.

According to a report by The Australian, “one source close to the inquiry suggested it was mulling more than doubling the big four’s charge for being ‘systemically important’ from an additional 1 percentage point of common-equity tier-one capital to 2.5 percentage points”. If that is realised, it will be a big victory for Australian taxpayers and the stability of the Australian financial system.

The major banks won’t accept this lying down and even once the inquiry is released they will direct their considerable influence towards the federal government. But make no mistake, the bank’s concerns warrant little attention and are entirely short-sighted and self-serving.

The Australian economy will benefit from a more diversified financial system -- one that not only finances housing speculation but also small- and medium-sized businesses. The system will also be improved by forcing the banks to bear a greater degree of the financial risk they create. Hopefully the Murray Inquiry will deliver on both fronts.