Black coal supply falls sharply amid downward demand

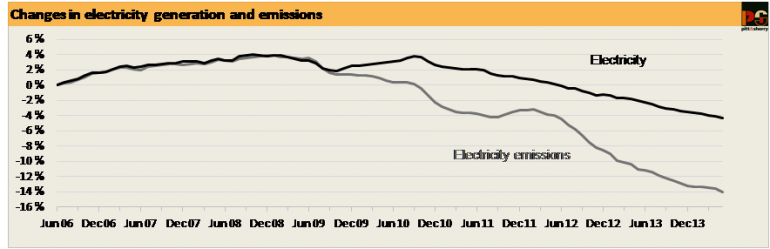

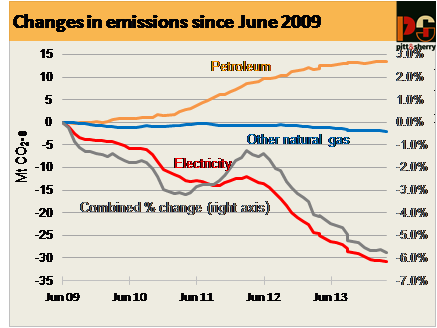

The decreasing trend in annual electricity supply and demand in the National Electricity Market, and associated emissions, continued in the year ending May (Figure 1). The fall in annualised emissions from April to May was 0.7 Mt CO2-e and the fall in total annual demand for electricity was 0.4 TWh.

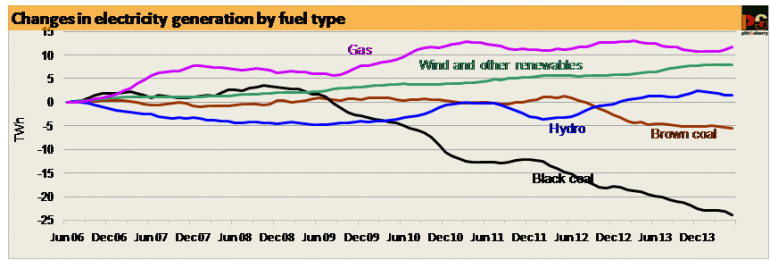

Supply from both black and brown coal fuelled generators fell, the former quite sharply. Hydro generation continued to fall, while wind generation also fell slightly and gas generation increased more significantly (Figure 2).

Compared with the year ending May 2013, the fall in demand was 4.8 TWh, equivalent to 2.6 per cent, and the fall in emissions was 5.3 Mt CO2-e, equivalent to 3.2 per cent. The total fall in annual emissions from generation in the NEM since the historical peak, in the year to December 2008, has been 32.4 Mt CO2-e, equivalent to almost 17 per cent. The total fall in demand over those five years has been 14.6 TWh, equivalent 9.2 per cent.

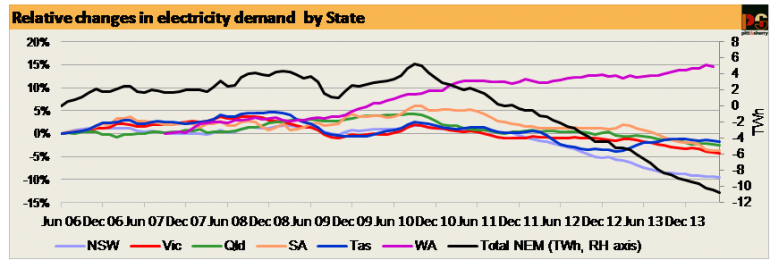

In the year to May 2014 total demand fell slightly in all five NEM states, and demand also fell in the year to April 2014 in Western Australia (the first month on month fall for nearly a year). It is probable that the exceptionally mild seasonal weather across most of Australia during May contributed to the fall in demand, by reducing consumption of electricity for residential space heating (Figure 3).

Figure 1

Figure 2

These numbers are interesting in the context of the recent announcement by President Obama of the intention to reduce electricity generation emissions in the US by 30 per cent below 2005 levels over a period of 15 years from next year.

Australia’s electricity generation emissions (in the NEM) are now 13 per cent below the 2005 level (and 17 per cent below the higher 2008 level), a reduction achieved in a little over five years from 2008. Note, though, that US generation is currently less emissions-intensive than in Australia – with coal being less dominant in the US than Australia.

In the year to May 2014, output from both black and brown coal fell quite sharply, compared with the year to April 2014.

Hydro and wind also fell, though only slightly. Gas rose markedly in all states except SA. The biggest output increases were in the relatively new combined cycle power stations, including Braemar 2, Darling Downs, and Swanbank in Queensland, Tallawarra in NSW and Mortlake in Victoria, all of which operated in combined cycle mode for more of the time than they did in either April 2014 or May 2013 (hence the increased output both month on month and year on year).

When generating in combined cycle mode, these plants use between 7 and 8 GJ of gas per MWh of electricity sent out. This means that they currently pay about $10 per MWh in carbon price. With the wholesale spot price averaging (median) around $49 per MWh in both NSW and Queensland during April and May, and just one 30-minute high price event in each state during these two months, a back of the envelope calculation suggests that the operators of these power stations break even on their fuel costs alone at a gas price of around $5 per GJ, with no revenue to cover other operating costs. (This is of course a greatly over-simplified calculation which makes no allowance for revenue from other services or any revenue gain from hedging contracts.)

It is not hard to see why, as discussed in the last Carbon Emissions Index, CEDEX, Electricity Update, several of these power stations are expected to be closed indefinitely once wholesale gas prices rise to levels set by the new LNG export plants at Gladstone. When that happens, Australia’s electricity generation is likely to move towards coal – precisely the opposite direction from that planned for its US counterpart. Any move to lower the LRET target will exacerbate such effects.

Figure 3

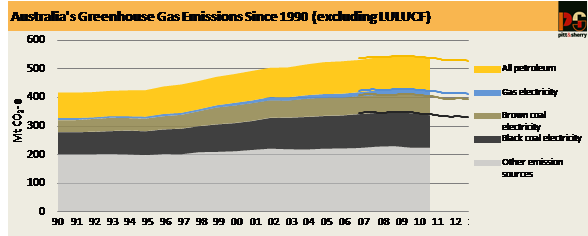

Natural gas

The year to March 2014 showed a continuation of the now well established trend of gradually falling consumption of natural gas in eastern Australia (figure below). It is hard to see how, why or when this trend might be reversed. Big increases in wholesale gas prices are only just starting to appear in large consumer contract prices and in retail tariffs for small consumers. Network costs for retail consumers have increased almost as much as electricity network costs, but have received much less public scrutiny.

In the residential sector, the major use of gas, for winter space heating, is gradually being replaced by electricity using reverse cycle air conditioners, the efficiency of which has increased substantially in recent years.

Figure 4

Figure 5

This is the latest report on Australia's energy emissions from pitt&sherry.