Benefits stalemate weighs on the US economy

Household spending is holding up reasonably well given the recent poor weather, but it will receive a considerable boost if the US Congress can stop penny pinching, get their priorities straight and extend unemployment benefits to the millions of long-term unemployed.

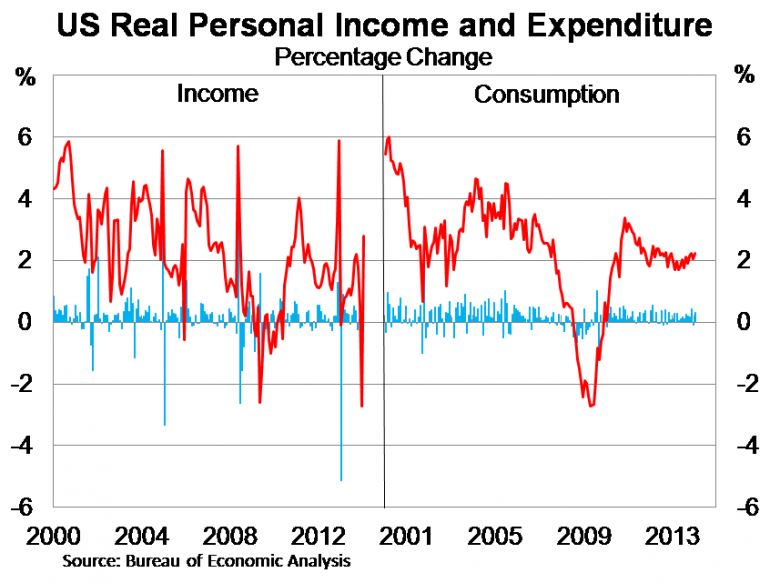

Real household spending rose by 0.3 per cent in January, slightly exceeding market expectations to be 2.2 per cent higher over the year. The pace of annual growth has trended upwards at a modest rate over the past year.

Growth was led by services, which rose by a robust 0.8 per cent, but spending on durable goods fell for the second consecutive month. Unseasonally poor weather is likely to have pushed down spending a little bit, particularly for larger durable goods purchases.

Real personal income rose by 0.3 per cent as well to be 2.8 per cent higher over the year. As a result, the household savings rate has trended upwards over the past year.

Income growth is often extremely volatile, mostly due to special factors that affect growth at various times during the year. Boosting income in January were several provisions of the Affordable Care Act, as well as cost-of-living adjustments to several federal transfers programs and pay rises for civilian and military personal.

On the downside, the expiration of unemployment benefits and lump-sum social security payments pushed growth in January down. Excluding these special factors, personal income rose by a modest 0.2 per cent in January.

Congress has yet to pass a compromise on extending unemployment insurance for the long-term unemployed. 1.3 million Americans had their benefits cut off on 28 December, an estimated 850,000 have been cut off by March and potentially 2 million more by the middle of this year. The US Senate is expected to have another crack at it this week but Senate Republicans appear unlikely to support the move.

Although income and consumption growth held up reasonably well in January, data from the Bureau of Economic Analysis suggest that it may have shaved between 0.1 and 0.2 percentage points from income growth in January. The Congressional Budget Office suggests that as many as 200,000 jobs could be lost this year if the emergency unemployment benefits are not extended for the almost 4 million long-term unemployed.

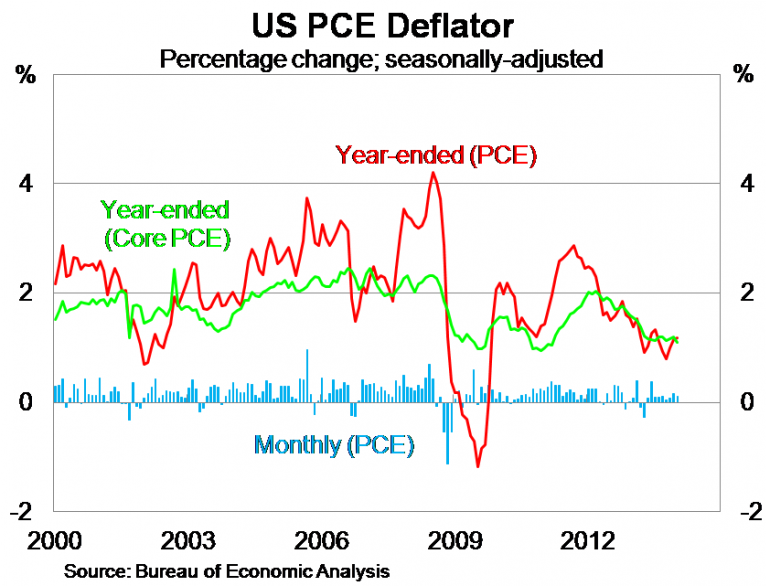

Inflation data suggests that the economy could do with more support from Congress – particularly support, which has such a direct impact on income and jobs. The Personal Consumption Expenditure Deflator, the Federal Reserve’s preferred measure of inflation, rose by 0.1 per cent in January, to be 1.2 per cent higher over the year. The core measure – which excludes volatile items – has climbed by just 1.1 per cent since January 2013.

Household spending appears to have held up reasonably well in January, following the failure to extend unemployment benefits, the poor weather and the Federal Reserve’s decision to begin tapering its asset purchasing program. However, it is clear that consumption growth could be much stronger right now, providing more support for the economy and creating more jobs.

By arguing over pennies, the Republican Party is achieving little more than potentially destabilising the economic recovery. There will be a time when extended unemployment benefits should expire, but how anyone could argue that time is now – when there remains millions of long-term unemployed – is quite frankly beyond me.