Beloved bank shares are no bargain

On a valuation basis, the Big Four banks are looking expensive compared with historical averages as growth potential remains muted in the absence of booming credit growth. A Deutsche Bank report estimates the forward price-earnings ratio to be 14.1 against a 25 year average of 10.8. That's a 30 per cent premium.

Reporting season saw balance sheets of the Big Four bolstered to be one of the more noteworthy positive outcomes. But core earnings were relatively flat once bad and doubtful debt (BDD) and tax rates were accounted for.

Despite record profits, the final bottom line number wasn’t generated by activity that can be easily repeated or expanded upon year after year. Basically it wasn’t revenue growth from operations driving the final numbers.

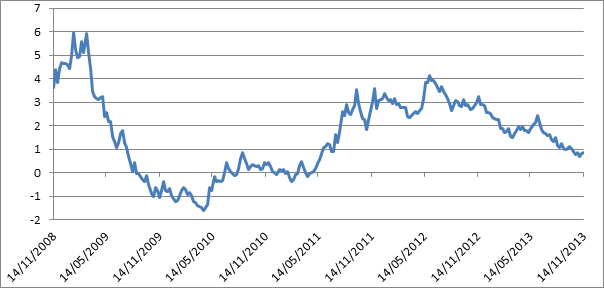

As investors have pushed banking share prices up in the quest for a juicy dividend yield, the dividend-yield premium from the banks over the yield on the 10-year government bond has slipped to below 1 per cent. A premium gap this small hasn’t been seen since early in 2011 when interest rates were considerably higher and the banking sector as a whole, including dividends, was only just recovering.

The graph below details the premium for investing in financials (un-franked), once accounting for the yield on a 10 year Australian government bond.

Australians have long had a love affair with the Big Four – it is reckoned over 70 per cent of the registers are taken up by retail investors or institutions managing money for Australians. The question for domestic investors should now be around valuation and dividend yields moving forward.

Part of the reason the price-earnings ratio is looking stretched at current levels is the expectation of lower earnings-per-share growth over coming years. At the moment, earnings growth for the coming three years falls between 4 and 6 per cent. In comparison, average growth from 2000 through to 2008 was 9 per cent. Not surprisingly, credit growth during this time was significantly higher than future expectations.

Also on the valuation front, each of the Big Four banks is trading over a price-to-book ratio of 2, with Commonwealth Bank pushing 3. Essentially, this means the market is willing to pay a significant premium for each of the Big Four at present, which has been encouraged by the attractive dividend yield on offer.