Barron's Top 10 for 2016

Summary: Barron's 2016 Top 10 stock picks include the entertainment company behind shows like The Walking Dead, AMC Networks, videogame maker Electronic Arts and airline Delta. Analysts are keen on Foot Locker given the rise in popularity of athletic fashion, and flooring seller Mohawk looks set to grow with a recovery in US housing. |

Key take out: The US stock market is expected to fare better in 2016 than 2015, and Barron's new picks include adding growing credit card lender Discover Financial Services (DFS) and removing Bank of America (BAC), while they swap Gilead Sciences (GILD) for cancer drug producer Celgene. |

Key beneficiaries: General Investors. Category: Shares. |

In the year of the FANG stocks, we got bitten. Dot-com heavyweights Facebook (ticker: FB), Amazon.com (AMZN), Netflix (NFLX), and Google, which changed its name to Alphabet (GOOGL) in August, delivered blowout gains in 2015 of 34 per cent, 115 per cent, 160 per cent, and 45 per cent, respectively. Among these, we at Barron's picked only Alphabet a year ago as one of our best bets. Mostly, we passed up momentum stocks in favour of humbly priced ones. It has been a bad year for penny-pinchers: U.S. growth stocks have outperformed value ones by nearly 10 percentage points year to date, according to data from Standard & Poor's.

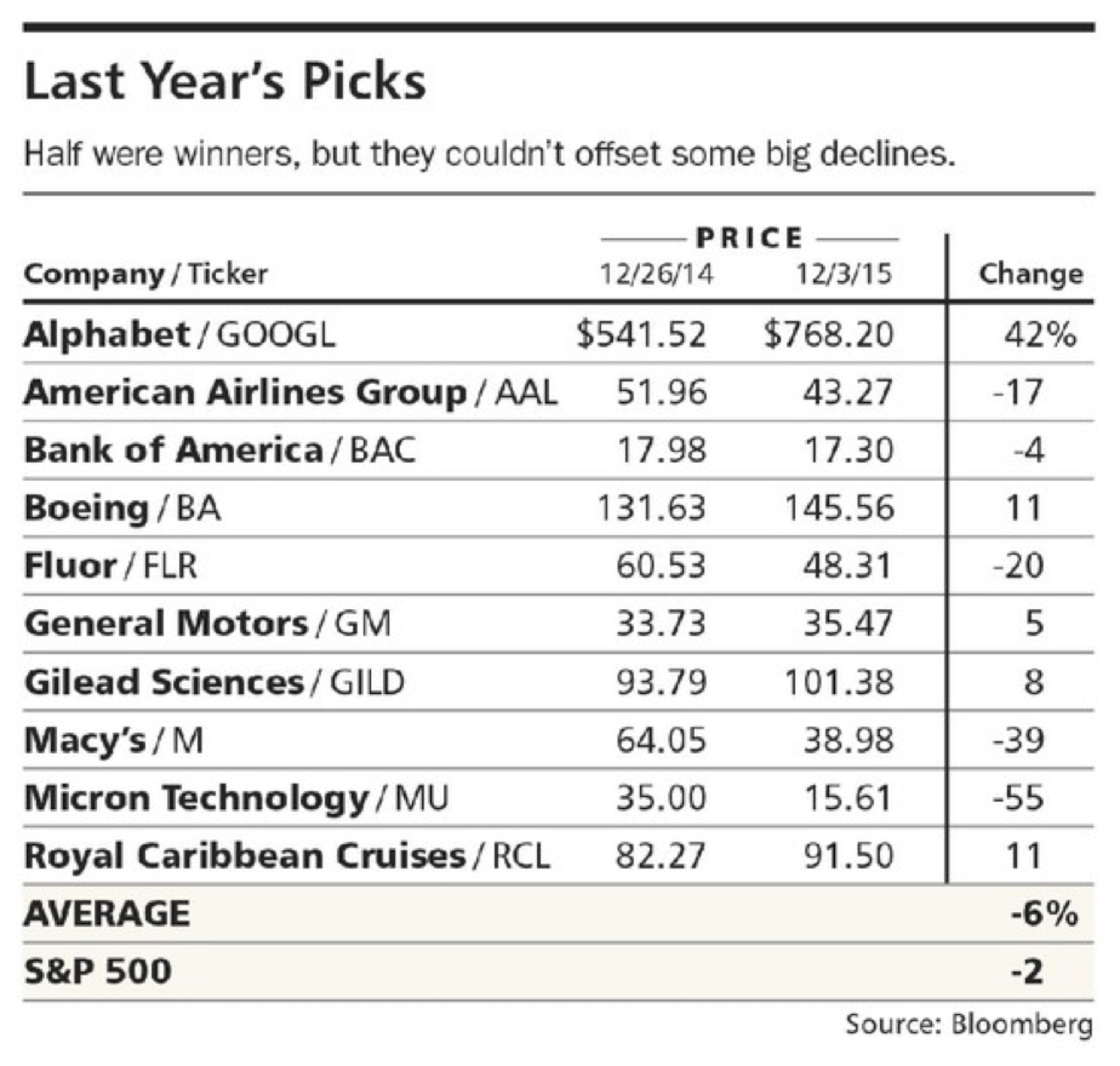

Barron's 2015 picks have lost an average of 6 per cent since publication, versus a 2 per cent loss for the Standard & Poor's 500 index.

Half of our stocks outperformed, including Gilead Sciences (GILD), Royal Caribbean Cruises (RCL), and Boeing (BA). But our stinkers stunk more than our stars shined (see table below). Engineer Fluor (FLR) slipped on falling oil investment. Macy's (M) led a wrong-way parade by department stores. And Micron Technology (MU), a memory-chip maker we'd rather forget, proved that even oligopolies can look crowded when end markets turn weak.

In 2016, we expect that the broad US stock market will fare better, if not shine. The S&P 500 looks fully priced at 17.5 times projected 2015 earnings, and, during the past two quarters, earnings declined slightly versus a year earlier. But that is due to a crash in oil profits. Excluding energy, earnings are rising at a 5 per cent clip. Assuming similar growth next year, with a steady price/earnings ratio and 2 per cent in dividends, stock investors could end up with a total return in the high-single digits.

For our 2016 picks, tempted as we are by Micron, Barron's is not waiting for a comeback. Patience, wrote Ambrose Bierce, is a minor form of despair disguised as a virtue. Our sole holdover, General Motors (GM), modestly outperformed on a late-year rally. We're upgrading our airline to Delta Air Lines (DAL) from American Airlines Group (AAL) and swapping Alphabet, which we still like a great deal, for Apple (AAPL). Videogames and zombie shows are in. Anything oily is out. We're trading Gilead—whose best-selling drug is so effective that treatments could peak in a year or two as more patients are cured—for Celgene (CELG), which is also highly dependent on a single drug but has much better growth potential. There are no department stores, only a druggist and a sneaker merchant. Sprawling Bank of America (BAC) is gone, replaced by steady grower Discover Financial Services (DFS). And we're adding some housing exposure in the form of flooring specialist Mohawk Industries (MHK).

AMC Networks

AMC Networks (AMCX) sells for 16 times projected 2015 earnings, a discount to the broad market and to other stand-alone cable-network firms, like Discovery Communications (DISCA) at 17 times earnings. One reason is that AMC's fortunes are closely tied to its zombie thriller, The Walking Dead, which is halfway through its sixth season. If the undead fall out of favour, shares would surely suffer. In the short term, that exposure is a nice problem to have. Recent ratings for the series have been among the best in its history. Earnings per share are expected to soar nearly 40 per cent this year on the debut of a companion series, Fear the Walking Dead, which also had blowout numbers. The two Dead shows, along with Better Call Saul, a Breaking Bad spinoff that aired earlier this year, are the three best series season debuts ever among adults 18 to 49, on broadcast or cable. Next year, Fear gets 15 episodes, up from just six this year. Wall Street is predicting another 13 per cent earnings gain, and estimates have been rising.

One way for AMC to solve its problem of revenue dependence is to sell to a bigger media player. The buyer would get hot shows with plenty of young viewers that advertisers like to reach, and shareholders would get a premium price. Last February, the company named investment banker Gregg Seibert as vice chairman, perhaps signalling a rising interest in deal making.

The old-fashioned fix for hit-dependence is, of course, more hits. That takes longer, but there are promising signs. Into the Badlands, a dystopian martial-arts series, debuted in November to solid ratings. Preacher, a highly anticipated shoot-'em-up based on a cult comic book, comes out in mid-2016. Even without a deal, shares could return 20 per cent over the next year if earnings estimates continue to rise and AMC continues its recent habit of beating them by double-digit percentages.

Apple

The outlook for Alphabet remains bright. It's hoovering up ad dollars as they shift to online and mobile, and its YouTube streaming business is quietly becoming bigger than Netflix. Earnings could double by the end of the decade, making 27 times this year's projected earnings a square deal for shares. But Apple sells for just 12 times earnings for its fiscal year ended in September. It sits on cash and securities worth more than all but a dozen or so big US companies. Subtract the cash and securities per share from the stock price, even with a haircut for repatriation tax on the overseas portion, and the P/E falls to single digits.

Apple will have a difficult time dreaming up a more lucrative gadget than the iPhone, and growth there looks sure to slow. The smartphone market in general is becoming saturated, and while the iPhone 6 and now 6s have offered an obvious reason to upgrade — a long-awaited shift to larger screens — it's unclear, as always, what will make the next model a must-have. Earnings for Apple are projected to rise at only a high single-digit pace over each of the next two years. But consider two things. First, that's the kind of growth investors get from General Mills (GIS), which goes for 20 times earnings and carries net debt, not a cash surplus. And consumers can switch from Cheerios to Raisin Bran without having to migrate their family photos to a new platform.

Second, investors shouldn't count out Apple exceeding growth expectations. It has beaten earnings estimates for 12 quarters running. The consensus for its fiscal year through September 2017 has been rising — understandable, considering the success of the iPhone 6s. But estimates for the following year have been rising, too. The valuation sets the bar low; we think that Apple will hop over. Look for a 20 per cent gain over the next year, along with a rising dividend.

Celgene (CELG)

Celgene's main risk is a little like AMC's zombies. It will generate more than 60 per cent of its revenue this year from a single medicine called Revlimid, used primarily to treat a type of cancer called multiple myeloma. But Revlimid is gaining regulatory approval for an expanding number of uses. It has plenty of growth potential overseas, and shows promise in combination therapies. And it has more than a decade of remaining patent protection. Analysts predict double-digit yearly revenue growth for Revlimid through the end of the decade.

By then, Celgene is expected to have four drugs with yearly sales in the billions of dollars, versus just Revlimid today. And a robust pipeline of medicines in development provides ample opportunity for new successes. Management has set a goal of $US21 billion in yearly revenue by 2020, up from a projected $9.2b this year. If it's successful, two things are likely to happen. First, Revlimid's contribution is likely to drop below half of revenue by then. Second, earnings per share could more than double, as Celgene's growing size offers better leverage on its research and marketing expenses. Shares sell for 22 times this year's earnings consensus—inexpensive considering the growth outlook. Bristol-Myers Squibb (BMY) is expected to increase earnings at a similar pace, and it goes for over 35 times earnings. Eli Lilly (LLY), a slower grower, goes for 25 times.

CVS Health

CVS Health (CVS) is a long-term winner, returning more than 14 per cent a year over the past decade, double the yearly return of the S&P 500. It has sold off from over $US110 this past summer to a recent US$93, presenting a buying opportunity. The decline stems in part from management last quarter issuing 2016 earnings guidance below Wall Street expectations. Even so, it implies earnings per share growth of 10 per cent to 14 per cent next year. Shares now sell for 16 times projected earnings for the next four quarters, down from close to 20 times earlier this year.

The company remains at the center of trends that could keep earnings growing at a double-digit pace through the end of the decade. Increased medical-plan coverage is driving more prescriptions. So is the aging of the baby boomers. Medical plans are looking to save on drugs, and some are turning over more business to drug-plan managers like CVS' Caremark. Patients looking for savings, including those who remain uninsured, can take care of basic health-care needs through walk-in clinics, like CVS' Minute Clinic chain. The stock's dividend yield is unremarkable at 1.5 per cent, but payments are expected to grow more than 60 per cent cumulatively over the next three years.

Delta Air Lines

Delta has been outperforming other legacy carriers on operational metrics like its on-time flight percentage and its scarcity of cancellations. Those things don't show up on an income statement — at least, not right away. Over time, good performance on those measures tends to lure business fliers who are highly averse to wasting time, and are also fairly indifferent to paying premium prices. In a recent survey of corporate travel managers, Delta beat its rivals for a second consecutive year. That sets up the company to gain share in a lucrative part of the market.

There are other things to like about Delta. It has shown restraint on capacity growth, announcing overseas cuts that could boost margins in weak markets. And its fuel-hedging program has delayed some of the benefits of a plunge in fuel prices, giving investors something to look forward to. In 2016, earnings per share are expected to climb 24 per cent. Estimates have been rising. Shares sell for less than 11 times this year's projected earnings. They could return 20 per cent in a year even if the valuation slips. Over the long term, airline valuations look likely to rise, as the much-consolidated industry becomes a source of more-stable profits.

Discover Financial Services

Like CVS, Discover has trounced the broad market over the long term but sold off recently. It's down more than 15 per cent this year. Costs rose early in the year in part due to one-time expenses related to anti-money-laundering efforts and other regulatory concerns. Analysts predict an offsetting decline in expenses next year. Don't confuse Discover with a company that's primarily in the business of running a credit-card network, like Visa (V) and MasterCard (MA). It's basically a credit-card lender, like Capital One Financial (COF), that runs its own network to gain a competitive advantage.

By saving on network fees, Discover can offer attractive card rewards, including a popular cash-back program. Any card lender can offer cash back, of course, but being too aggressive risks hurting margins. Discover has grown its portfolio of credit-card loans much faster than big banks have in recent years. And it has done so with industry-leading returns on capital. Rising growth could be on the way. Early this year, Discover went on a marketing spree. Last quarter, it reported its best card growth since 2007. Historically, new-card growth and loan growth have been closely correlated. In a November note to investors, Morgan Stanley analyst Cheryl Pate predicted accelerating loan growth within six months. Meanwhile, defaults remain low. Shares sell for less than 10 times projected earnings for the next four quarters, down from 12 times at the end of last year. They could rise 20 per cent on a combination of earnings growth and a valuation rebound. The dividend yield is 2 per cent.

Electronic Arts

Videogame maker Electronic Arts (EA) is the priciest stock on our list at close to 23 times projected earnings for its fiscal year ending in March. We like that it has been demolishing earnings estimates of late, and that remaining estimates have been rising. Earnings have a shot at doubling by the end of the decade.

Electronic Arts is best known for annual sports hits like Madden NFL and shooters like Battlefield. It's also doing well at the moment with Star Wars Battlefront, just days ahead of a new release in the beloved film franchise. In coming years, the company stands to benefit not just from what gamers buy but how they buy it. Digital revenue topped store-shelf revenue for the first time, in the company's fiscal year ended March. That includes full-game downloads, in-game purchases, and advertising. Rising digital delivery has done wonders for operating margin, which has more than doubled in three years, to 25 per cent last fiscal year. That is unlocking more free cash flow to be spent on share buybacks and game development.

EA says it has more than 300 million registered users in over 200 countries. Overseas, it stands to benefit from a gradual rise in leisure spending. Its revenues are diversified among gaming platforms, including consoles, personal computers, and mobile devices. Next year, it should benefit from falling prices for the Xbox One and PlayStation 4, and corresponding growth in the user base.

Foot Locker

Barron's has recommended Foot Locker (FL) shares several times in recent years, going back to 2009, when the shares traded for about $US10. They recently fetched $US64, up 12 per cent since our most recent story (“Foot Locker: Still Running Fast,” March 9). They hit US$75 in September, and could regain lost ground and then some over the next year.

Foot Locker is benefitting from a long shift toward casual and athletic fashion. It also has a close relationship with Nike (NKE) and secures plenty of exclusive shoes, which helps protect the business from being undercut by Amazon. Nike shares have jumped 26 per cent over the past six months on stellar earnings reports. That stock goes for over 30 times earnings, reflecting investor expectations of rapid growth for years to come. Foot Locker shares, at less than 16 times earnings, offer inexpensive exposure to Nike's success. The retailer is also helping itself with store remodelings and a turnaround of its Lady Foot Locker chain. It has invested in recent years in Europe, where footwear sales are highly fragmented. That could pay off when Europe's economy rebounds. For now, Wall Street predicts low-double-digit earnings growth over the next two years, and Foot Locker has made a habit of hurdling estimates.

General Motors

Earnings for GM are expected to jump more than 50 per cent this year, to US$4.76, as the company moves past one-time costs related to faulty ignition switches. In two years, earnings could approach $US6 a share. That makes the stock look underpriced at a recent $US35. Perhaps more impressive than the upside potential for earnings, however, is the potential bottom for profits during the next downturn in car sales. GM has slashed its debt through bankruptcy restructuring and cut its US break-even point from 16 million yearly vehicles to fewer than 11 million. The recent pace of sales is over 18 million. During the next downturn, assuming a sales decline of ordinary size, earnings are likely to remain solidly positive, say $US3 to $US4 a share.

As investors gain confidence in GM's improved earnings stability, they could award the stock a valuation more befitting an healthy cyclical business. A rise to 10 times earnings would put shares at $US48 based on this year's estimate, for a gain of over 30 per cent. That doesn't include next year's estimated earnings growth, pegged at 13 per cent. GM says that it will break even in Europe by then, and expects to continue to generate solid profits in China. Shares yield 4 per cent.

Mohawk Industries

Mohawk Industries is a leading flooring seller with a hand in carpet, wood, tiles, laminate, and so on. Over the next year, the company stands to gain from a fall in raw-materials prices, an earnings boost from acquisitions, and rising market share. It's also a bet on a continued recovery for US housing. Housing starts look healthy, and permits are rising. The Federal Reserve has signalled its intention to begin raising its benchmark fed-funds interest rate as soon as this month. The impact on mortgage rates, which are tied more to longer-term yields, could be minimal. And a slight rise in mortgage rates could help motivate potential buyers who've been dawdling. Mohawk trades for 19 times earnings. Profits are expected to grow 17 per cent next year.

This piece has been reproduced with permission from Barron's.

* The report here is from Barron's, these stocks do not constitute formal recommendations from Eureka Report. To see Clay Carter's recent assessment of Eureka Report's formal recommendations on US and international stocks, click here.