Bank stocks a hold strategy

| Summary: The decline in bank share prices from their peak levels over the past month is not reflective of an about-turn by investors, heading from yield to growth, but rather a response to broader economic conditions and political unrest. |

| Key take-out: The major banks have benefitted from improving profits and lower provisioning since the GFC, and have maintained their returns on shareholders’ equity over a long period. |

| Key beneficiaries: General investors. Category: Income. |

The recent pullback in the prices of bank shares and other high-yielding listed shares does not represent a desperate fleeing from yield to growth.

Rather, it is better described as a correction in the prices of shares that had lifted above short-term valuations. This is because there isn’t much growth to flee into, and earnings expectations across the market are being dramatically cut. To my eye, the market is pulling back for the whole host of reasons that I have expressed in recent weeks. In brief, these are:

- A misplaced focus on ‘change’ in the growth rate of Chinese GDP, rather than ‘absolute’ growth (8% growth on China’s 2012 GDP of approximately $8 trillion, will deliver a 50% greater increase in GDP than the record 14% growth in 2007 on a GDP base of only about $3 trillion), which has translated to a heavy sell-off in mining stocks and a broadly pessimistic outlook for Australia as a leveraged partner to this growth;

- The rising risk of inflation as the $A slide affects our ‘tradable’ inflation (tradable goods have held inflation at reasonable levels in recent years, despite inflation of approximately 4-5% in ‘non-tradable’ goods and services); and

- The significant and persistent political noise, with no chance of that abating until September.

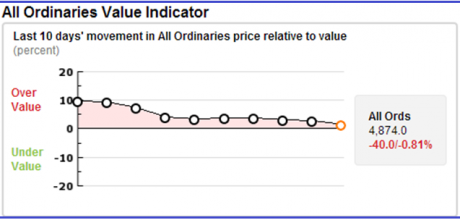

Where the market ultimately settles is unknown. StocksinValue’s assessment of the market has it at fair value at around 4,800 points. Certainly, as the chart below shows, the market has been approaching our estimate in the past 10 trading days. Our current internal forecast for FY14 is for middle single-digit growth in value. However, investors should be cautious – if reported and forecast earnings slide further than expectations and Australia faces a real prospect of recession, this will clearly see a further revision in the intrinsic value of All Ordinaries stocks.

Figure 1: Last 10 days, comparison of All Ordinaries Index Price to its calculated intrinsic value

Source: StocksInValue.com.au

As for yield discussions, I am continuously amazed by brokers who recommend tactical shifts or rotations in equity portfolios. Obviously some brokers have their clients’ best interests at heart. But the larger brokers associated with investment banks have a history of having little regard for anyone other than their preferred larger clients and hedge funds. The rotation of portfolios, from growth to income and back again, is a truly senseless practice designed to maximise volatility, trading activity and therefore brokerage.

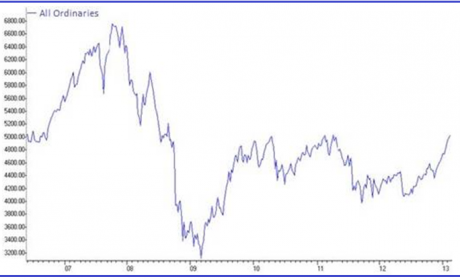

As for volatility, you can check out the following chart of the Australian sharemarket index from January 2006. It shows an immensely volatile market that has gone nowhere over seven and a half years. From a starting point of 4,900 in January 2006, the market has transcended up and down and finished where it had started. I am not sure of the relevance of an index that periodically dumps poor or insolvent stocks and replaces them with short-term winners, but that is what is promoted as an investment proxy by many experts. These same experts also claim that an equity portfolio has more risk if it deviates away from the index. On reflection, that seems a strange view given that the equity index has struggled to achieve a cash-like return over seven years.

Figure 2: All Ordinaries Index: January 2006 to May 2013

The recent volatility in the market has actually been caused by excessive quantitative easing and a sickening realisation that the Australian economy is undergoing a slowdown. A sweep across market estimates for profits shows that earnings of Australian companies will decline in 2012-13 over 2011-12.

Given the disruption of a federal election in September and a sharp decline in the capital investment cycle, without any new government projects, we will likely see flat earnings over 2013-14. The weakening $A may be a godsend to exporting businesses, but it has come late due to the incessant behaviour of the Federal Reserve and European central banks.

More recently we have seen the Japanese central bank up the QE ante on its bigger peers, and the markets are left pondering as to where this is taking us. The answer is nowhere in a hurry. Therefore, investors who are spooked into dismissing the equity market as a place to generate returns that substantially includes income should calm down.

In particular, Australian banks are fair value with a reasonable yield. They will generate low underlying earnings growth, but most of the top 100 companies will also struggle with this objective. The outperformers will clearly be those companies that report higher $A earnings from overseas earnings, but there is no franking benefits from these companies.

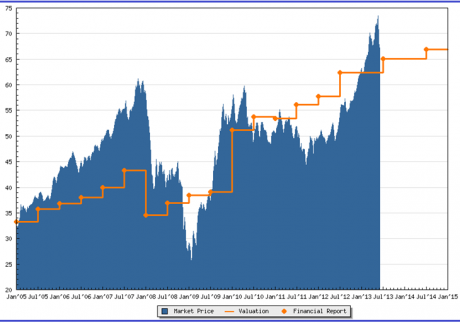

More specifically, following the recent falls in bank share prices, I am inclined to retain the bank shares in the income portfolio. The fall in price has brought these companies back towards value – as the chart for Commonwealth Bank illustrates below, it’s current price of $67 is equal to our FY14 valuation.

Figure 3: Comparison of CBA market price and intrinsic valuation (current and forecast)

Source: StocksInValue.com.au

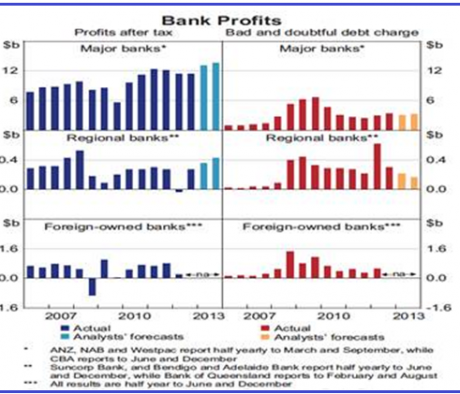

Further, as I acquired the shares at much lower levels, I am happy to tolerate the short-term volatility at current levels. The following chart shows that our major banks have benefitted from improving profits and lower provisioning since the GFC. Indeed, the major banks continue to trade much better than both their smaller peers and foreign-owned competitors.

Figure 4: Bank Profits

Sources: APRA; Credit Suisse; Deutsche Bank; Nomura Equity Research; RBA; UBS Securities Australia; banks’ annual and interim reports

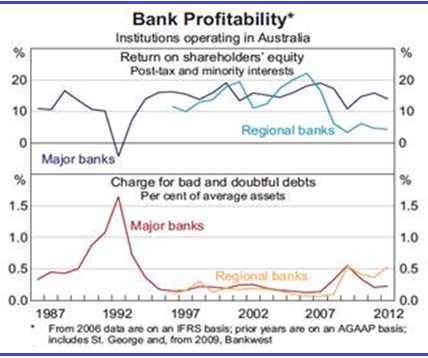

Profits are one thing but it is profitability, or the return on shareholders’ equity, that encourages me to hold the banks in my portfolio. The following table shows that the larger banks have maintained their returns over a long period, and once again the majors are a standout.

Figure 5: Bank Profitability*

Sources: RBA; banks’ annual and interim reports

John Abernethy is the chief investment officer for Clime Asset Management. The insights and valuations made by John and his funds management team power an online stock valuation platform: StocksInValue (www.stocksinvalue.com.au).

Eureka members can access a 14-day free trial (click here) and are entitled to special discounts if they choose to subscribe.

Clime Income Portfolio Statistics

Return since June 30, 2012: 26.39%

Returns since Inception (April 24, 2012): 25.12%

Average Yield: 7.57%

Start Value: $118,757.19

Current Value: $150,102.77

Dividends accrued since December 31, 2012: $4,425.12

Clime Income Portfolio - Prices as at close on 4th June 2013 | ||||

| Hybrids/Pseudo Debt Securities | ||||

| Company | Current Price | Margin over BBSW | Running Yield | Franking |

| MXUPA | $84.13 | 3.90% | 7.98% | 0.00% |

| AAZPB | $96.50 | 4.80% | 7.89% | 0.00% |

| MBLHB | $73.80 | 1.70% | 6.11% | 0.00% |

| NABHA | $73.00 | 1.25% | 5.56% | 0.00% |

| SVWPA | $86.15 | 4.75% | 8.76% | 100.00% |

| WOWHC | $105.00 | 3.25% | 5.77% | 0.00% |

| RHCPA | $105.60 | 4.85% | 7.24% | 100.00% |

| High Yielding Equities | ||||

| Company | Current Price | Dividend | GUDY | Franking |

| TLS | $4.67 | $0.28 | 8.57% | 100.00% |

| AAD | $1.68 | $0.12 | 7.16% | 0.00% |

| CBA | $67.15 | $3.62 | 7.70% | 100.00% |

| WBC | $28.95 | $1.84 | 9.08% | 100.00% |

| NAB | $29.61 | $1.88 | 9.07% | 100.00% |