Bank hybrids get better

Summary: Regulatory changes will introduce pressure on bank equity returns, but improve the credit quality of debt and hybrid securities up the capital structure. |

Key take-out: Investors looking for income have choices other than risking capital in bank ordinary securities. |

Key beneficiaries: General investors. Category: Hybrid securities. |

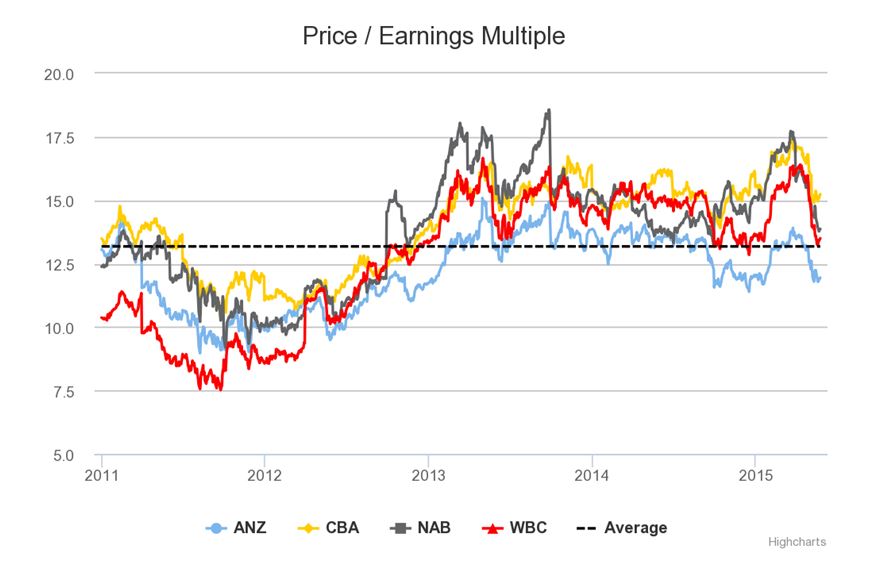

The chase for yield by self-managed super funds has been well documented but despite the warnings by regulators, commentators and analysts about further changes to regulations, bank share prices continued to trade well above their long term average (on a price to earnings multiple basis).

Figure 1: Historical P/E multiples

In a low interest rate environment this demand for yield is completely understandable, but dividends are purely a function of capital management. The key is understanding how new regulations affect different parts of a bank's capital structure and in turn how investors are being compensated for the risk they are taking. I would argue that there should be a shift in focus away from equities while the economic landscape and regulatory environment re-balances.

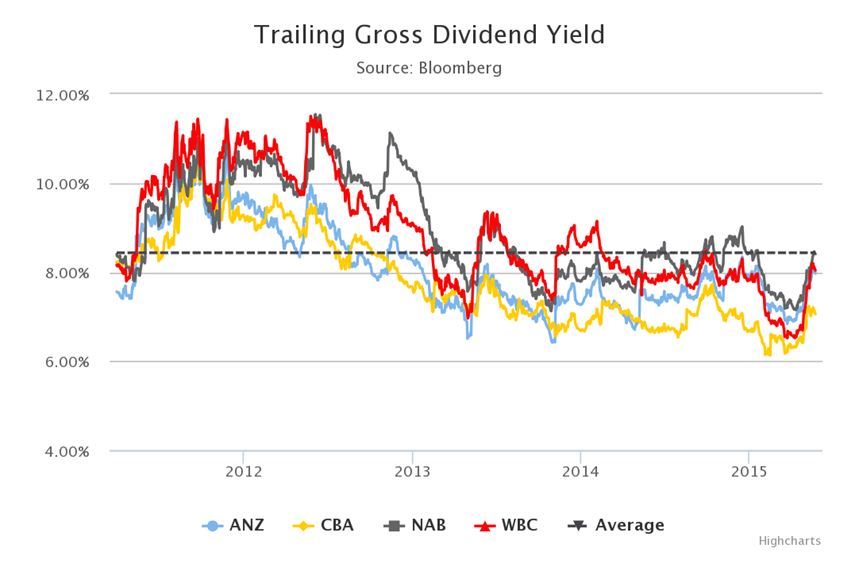

Figure 2: Historical bank dividend yield

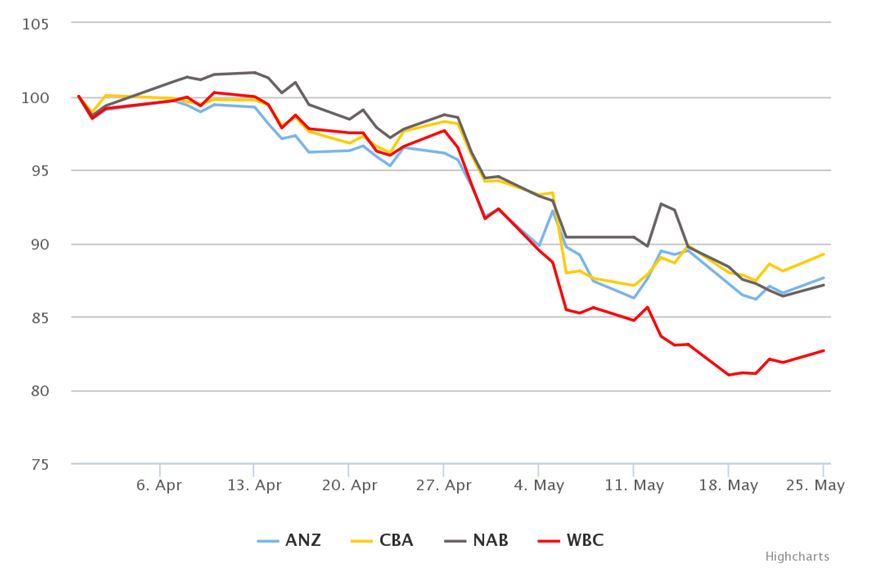

In the past month APRA took the market by surprise in suggesting it will implement a number of new measures to change the way the major banks "measure" the risk of residential mortgages held on balance sheet. This change ultimately means the banks will end up holding more common equity capital against mortgages to offset the new risk weightings. To most investors this means nothing but in technical terms it will make it significantly harder for banks to achieve the same sort of return on equity they have over the past few years. This is the primary reason for the sell-off in bank shares over the past few weeks.

Figure 3: Rebased equity chart

But from the perspective of debt and hybrid investors, this increase in nominal capital just creates a greater capital cushion to absorb any unexpected losses. The point of introducing these rules is to reduce systemic risk in the banking sector and remove concerns around the transparency and comparability of the risk models used by banks.

So although APRA has been publicly criticised for jumping the gun (nothing has been confirmed yet) on the timetable for what is known as "Basel IV" they stand firmly on their position causing an early shift in the capital management plans of the banks.

Strangely, the selloff in bank shares has resulted in a similar sell-off in listed hybrid securities for no particular reason.

This increase in common equity capital is a credit positive for anyone investing up the capital structure and hence trading margins on hybrid securities should in theory tighten. Sure, some of the recently issued capital securities were issued with no real premium to the secondary market, but margins are now at a point where cash and gross yields are comparable to dividend yields on common equity (but without the earnings leverage).

To complement this argument the risk-free yield curves across the globe have been moving sharply higher over the past month as an unwind in some of the quantitative easing yield plays has caused a normalisation in the domestic swap curve. This convergence of yields doesn't come along often and should cause bank equity investors to rethink their strategy for investing in bank equity for income. We recognise the depth of liquidity in the secondary market for bank capital securities is less than the shares of the same bank, but what is the trade-off value between risk and liquidity? A prime example of this yield convergence is the Commonwealth Banks' PERLS VII (ASX Code: CBAPD) capital security issued last year and its common equity (ASX Code: CBA).

Figure 4: Historical yields of CBA common equity over PERLS VII

Bank capital securities (also known as bank hybrids) have received plenty of negative publicity due to the complexity of their structures, behavioural biases in sales pitches and uncertainty surrounding the conversion premium. Although a lot of the market publicity spelling out the risks of these securities is warranted, the key feature is whether management at the bank can adequately maintain measures of capital, liquidity and funding (among others) above APRA's thresholds. Broadly speaking they have always managed this and there is no reason why this should change.

Negative sentiment has impacted securities such as the CBA PERLS VII which are now priced at $94.90, a significant discount to their issue price ($100). They now offer a significant yield above returns on term deposits and other bank debt securities. So if you're happy owning the shares of a bank for income why wouldn't you consider buying the hybrid of the same bank? By doing so you are taking a less risky security in the capital structure of the bank and maintaining your portfolio yield.

In the world of bank investing there are alternatives to equity and investors should educate themselves on the securities available in the different ‘risk buckets' of a banks' capital structure and inquire what yields can be obtained from securities in each basket.

Nicholas Yaxley is a director at www.bondadviser.com.au.