Balancing Australia's borrowing mismatch

|

Summary: On the residential and commercial property scene, investors are going in as hard as ever. But business lending is continuing to decline, and we need them to borrow to fuel economic growth. |

|

Key take-out: Investors need businesses to borrow to ensure all parts of the economy are ticking along. Encouraging capital expenditure is a core challenge for all levels of governments. |

|

Key beneficiaries: General investors. Category: Economy. |

Sure you've heard it all before: investors in the residential property market are borrowing too much and activity needs to be curtailed for the good of the economy and the financial system as a whole.

Some readers will agree with this sentiment and others will disagree. As I discussed last week, it is clear where Australia's financial regulators sit on this issue (Investors should look out the housing window; April 6).

But the problem isn't so much that property investors are borrowing too much – though I tend to believe they are – but rather that other sectors of the economy are not borrowing enough.

Earlier this week the Australian Bureau of Statistics (ABS) released new data on mortgage and commercial lending. These data provide insight into the flow of new lending that supports the housing market, drives business investment and underpins household spending.

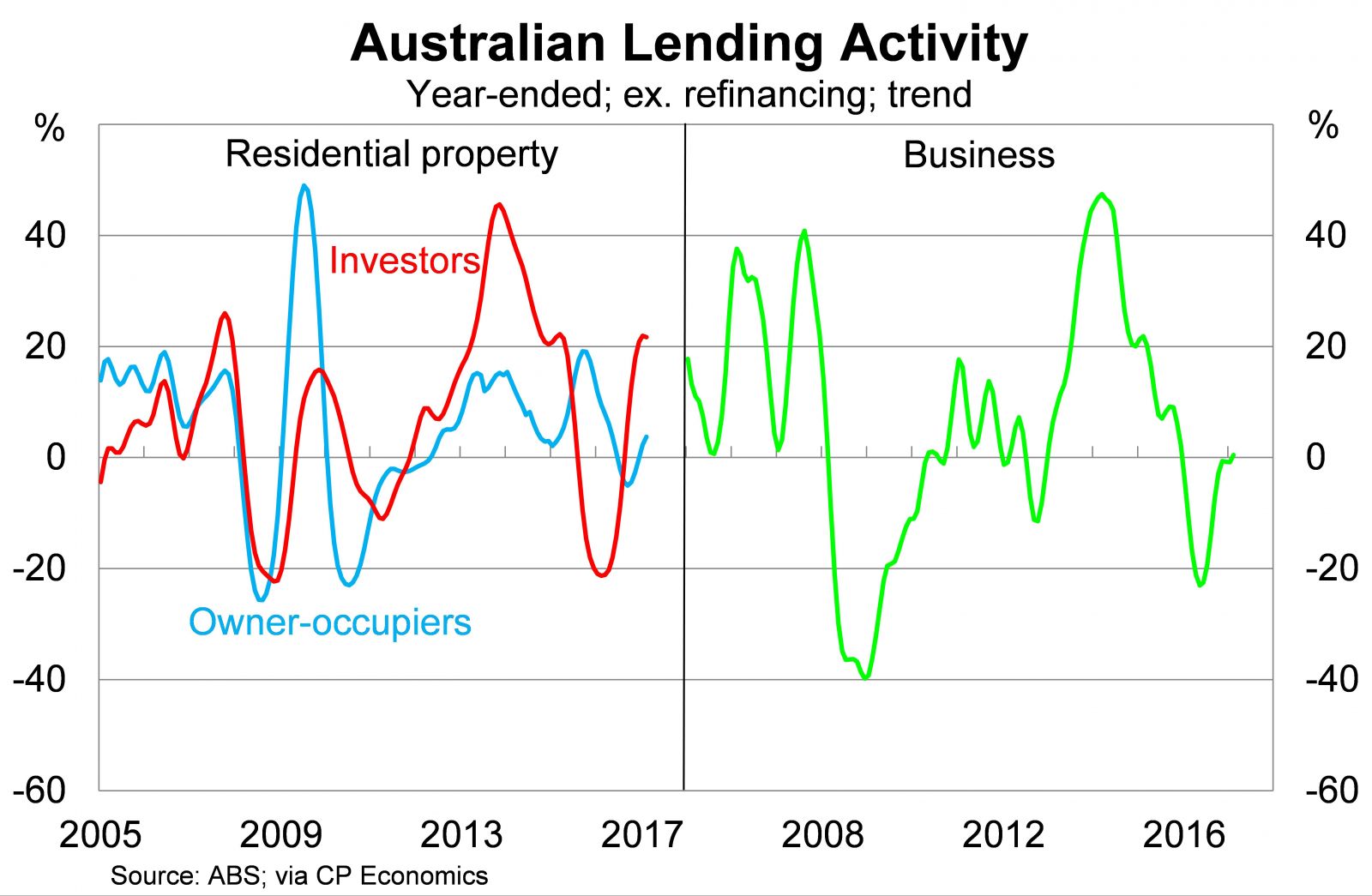

The data in the graph below focuses on trend movements in lending activity since there can be considerable month-to-month volatility in the lending estimates.

Lending to property investors has increased by almost 22 per cent over the past 12 months, rebounding strongly following some weakness over the second half of 2015.

The dip during 2015 was a product of the first round of macroprudential policies introduced by the Australian Prudential Regulation Authority (APRA). The weakness was short-lived, however, since the Reserve Bank of Australia (RBA) cut interest rates in February and May last year.

Recent tightening of macroprudential policies, combined with out-of-cycle rate hikes by the major banks, suggest that growth in investor lending activity will moderate over the remainder of 2017. (Watch this video, The Economic View: Are rates set to rise or fall). If that doesn't eventuate then naturally you'd expect further tightening in lending standards from APRA.

Lending activity by owner-occupiers remains at a high level by historical standards but growth has eased significantly since 2015. Part of the reason is that there is a limited supply of people looking to upsize or downsize and first-home-buyers are poorly placed to keep demand elevated.

The big problem, however, is commercial lending to non-financial corporations. New lending to the business sector is largely unchanged over the past year but the monthly trend has once again turned negative.

Business lending fell by 2.3 per cent in February, the third consecutive monthly decline, which arguably underestimates the persistent weakness in lending towards Australia's non-mining sector. Business lending fell for 13 consecutive months from May 2015 until June 2016 before experiencing a brief and underwhelming rebound.

What this means is that there remains a reluctance by the non-mining sector to invest in new technologies and capacity. Despite record profits in the December quarter, as well as improvement in business confidence measures, it appears as though corporates remain cautious when it comes time to borrow and invest.

This is compounded further by a decline in capital inflows from abroad. I discussed this issue recently and any reduction in capital inflows from abroad must be offset by more aggressive borrowing by domestic corporates (Foreign investors: Why we really need them; April 11). If that doesn't happen then the reality is that economic growth will begin to ease and returns on equity will also dip as company performance suffers.

The federal government hopes that company tax cuts will help to steady the ship. However, these cuts are only for small-to-medium sized corporates, with earnings up to $50 million a year, and the link between company tax rate and investment is tenuous at best.

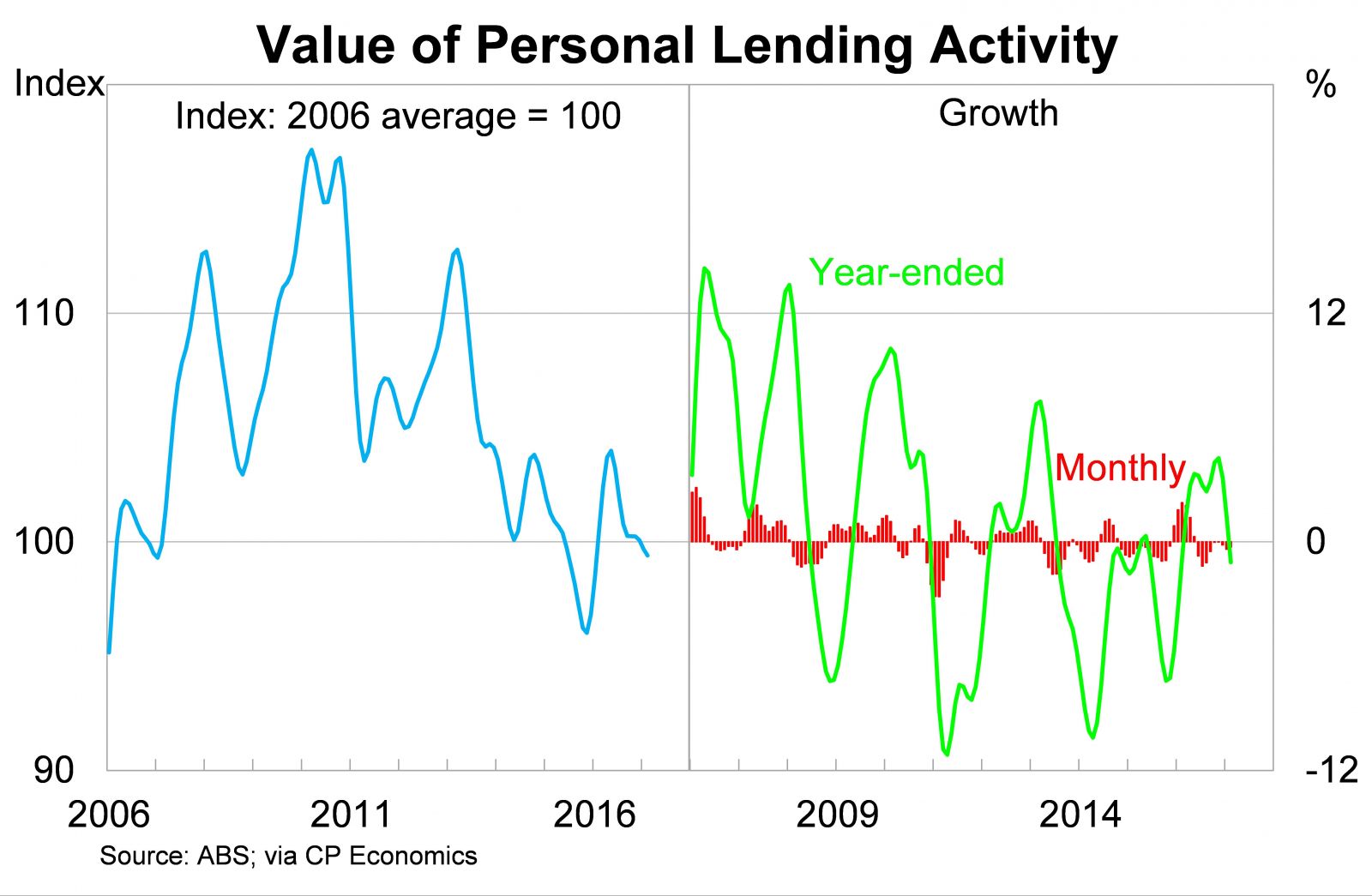

It is also worth noting that it isn't just the corporate sector where lending activity remains weak. Personal lending activity continues to disappoint.

Personal lending activity is currently lower than it was on average during 2006. Ten years have passed and households remain cautious. It is understandable in a way given the presence of low wage growth and heightened unemployment but it still creates a challenging environment for the retail sector.

These are ongoing issues for the Australian economy. Capital expenditure typically requires businesses to borrow from banks, since other forms of financing are limited, which means that subdued lending directly affects investment and expansion.

As investors we obviously don't want businesses to take on unnecessary risks but we also don't want businesses to stagnate. Finding a way to encourage capital expenditure is a core concern for the federal and state governments, as well as the RBA, as so far any genuine improvement to non-mining investment has proved elusive. If these lending figures are any indication that is unlikely to change; at least not in the short term.