Back in my day: How cost of living pressures have changed over 20 years

It's a result that’s become somewhat predictable, two major Australian cities have again made it into The Economist’s most expensive cities list.

What is interesting is the reason we’re in the top ten. The Economist didn’t attribute the outcome to Australia’s escalating house prices or the increased cost of a loaf of white bread. Instead it boiled down to the strength of the dollar.

We’re fond of OECD comparisons at Business Spectator, but in the context of cost of living expenses it’s also enlightening to look back in time, as well as abroad. So today we’ve gone back 20 years to 1994.

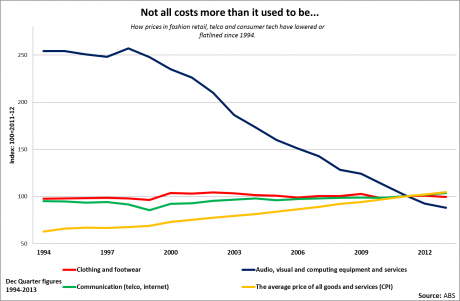

First, some good news. We tend to assume that over time the prices of goods and services will go up as a result of inflation. But as the graph below shows, this isn't always the case. It’s noteworthy, for example, that even though companies generally charge Australians more consumer electronics than other developed nations, the overall price of these goods has plummeted over the years.

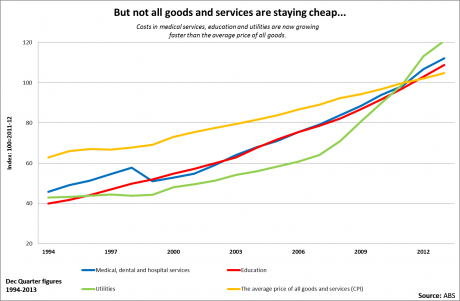

On the other side of the coin, some costs that were cheap in the past are rising at a faster pace than inflation. This is the case for education services (including child-care), health care and utility costs.

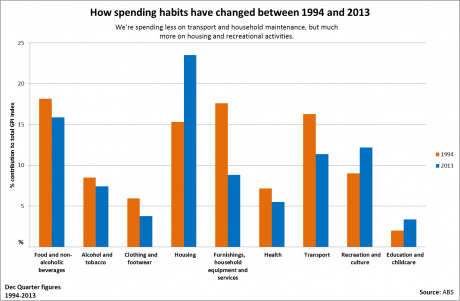

But perhaps the most surprising discovery lies in how household expenditure has changed over time. By looking at the breakdown of Australia’s total consumer price index we can get an indication on what proportion of household funds the Australian Bureau of Statistics concludes are being funnelled into various goods and services.

Of course, the make-up of these categories have also changed over time. Notably, entertainment expenditure has jumped over the two decades largely because of the addition of consumer electronics spending into that category.

Other than that, the data reinforces much of what we already knew: housing affordability has become a key issue in the cost of living debate. Back in 1994, the ABS found that the average Australian was spending more on furnishing and improving their home than on paying for it. Now that trend has flipped largely as a result of rising utility bills, rent costs and housing prices. It’s enough to make young potential home owners long for the good old days.

Got a question? Ask the reporter @HarrisonPolites on Twitter.