Australia's renewables wipe-out; Russia's solar steps

The long-awaited review of Australia’s Renewable Energy Target, or RET, dealt a blow to its renewables industry, when the government-appointed panel gave Prime Minister Tony Abbott two options to cut emissions more cheaply: either scrap or weaken its main clean energy program.

However, such a drastic change – i.e., scrapping the RET – is unlikely to be legislated due to the Palmer United Party’s promise to block changes to the proposal in the Senate.

The Abbott government was required to assess the program this year as part of a bi-annual process. The study was led by Dick Warburton, a former Reserve Bank of Australia board member much known for his sceptical views on climate change. Implementing either of the two options would only serve to imperil $20bn of existing projects and close the door to new investment.

“Essentially, this says Australia is closed for business for renewable energy,” Kobad Bhavnagri, an analyst for Bloomberg New Energy Finance in Sydney, said after the government released the panel’s recommendations at the end of August.

Closing the Large-scale Renewable Energy Target to new investment is likely to cause certificate prices to collapse and the value of the Large-scale Generation Certificate to be destroyed. LGCs are likely to have a fundamental value of zero because the units will cease to be a scarce commodity.

Renewable energy projects exposed to market prices will only receive revenue from the wholesale electricity market, with prices at between $30 and $44/MWh. But for projects that have been built under the RET, they require revenue of around $100-120/MWh in order to be able to meet costs, pay debtors and deliver some kind of return to equity holders. The massive gap between expected and required revenue means that equity investors will be quickly wiped out and projects could default on debt payments. Not unexpectedly, bankruptcies of renewable developers may then be imminent, and exposed energy assets will probably be stranded.

All this and more on the impact of this policy change can be found in a Bloomberg New Energy Finance Analyst Reaction published prior to the outcome of the study, and titled: Stranded assets: the consequence of cutting Australia’s RET.

So while the renewable industry is battling to stay alive in the world’s smallest continent, the biggest country in the world – Russia – is doing much to spur development in solar and wind.

Six solar power generators are slated to be built in southern Russia by 2016, with Moscow-based VC/PE investor Bright Capital and Solar Management having agreed to invest RUB 10bn ($US277m). The plants are to have a total capacity of at least 90MW, according to a statement from a signing ceremony with Bright Capital managing partner Mikhail Chuchkevich, Solar Management’s Pavel Shevchenko and Astrakhan governor Alexander Zhilkin on the regional government’s website. At capex over $US3/W, the project should be able to meet the Russian local content requirement.

Wind power, which is not, so far, much of an energy source in the country, is getting a boost with Chinese Xi’an Electric and Hong Kong’s Goldwind International Holdings mulling building a factory in partnership. The plant will manufacture wind power equipment, according to engineering firm E4 Group. Electronic equipment for the plant would be supplied by Xi’an Electric Engineering, which is part of the China XD Group, according to the statement.

Goldwind is not the only Chinese manufacturer to express an interest in Russia. Similar plans have been announced by other Chinese companies such as Dongfang Electric. Several European manufacturers including Siemens and Vestas are also believed to be looking at Russia. However, the country's stringent local sourcing rules and disappointing interest in past tender rounds for wind have had a negative effect on investors. Still, for Goldwind, a final decision may be close: on August 26, it suspended trading of its shares on the Hong Kong Stock Exchange and the Shenzhen Stock Exchange, pending the announcement of a “major event”.

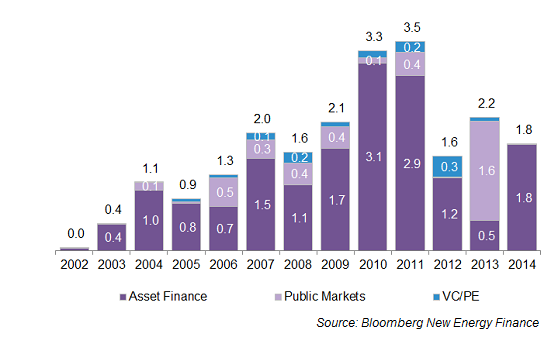

Graph of the week: Global new build asset finance for geothermal is already up 260% this year, due to deal for world's biggest project

Originally published by Bloomberg New Energy Finance. Reproduced with permission.