Australia's export potential is all in the supply chain

A new research discussion paper from the Reserve Bank of Australia, International Trade Costs, Global Supply Chains and Value-added Trade in Australia, provides fresh insight into global supply chains and Australia’s export sector, suggesting that Australia is more reliant on the US and Europe than commonly believed.

According to a recent paper, new "value-added trade" estimates "suggest that the US and Europe are more important for export demand than implied by conventional trade statistics, as some Australian content is indirectly exported there via east Asia".

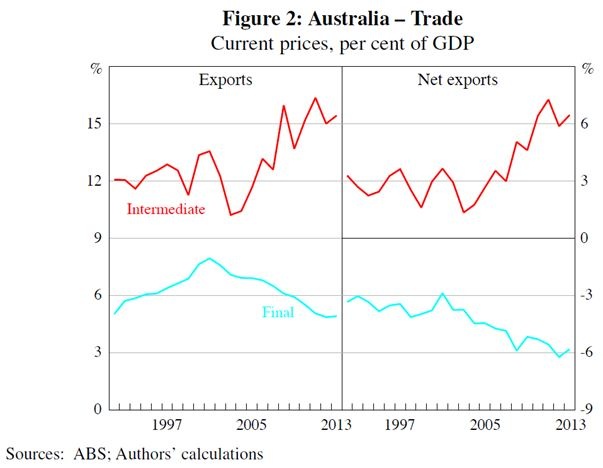

International trade has increased significantly over the past two decades, from less than 20 per cent of output in the mid-1990s to more than 25 per cent more recently. Growth has been driven increasingly by intermediate goods -- that is, goods that form part of a supply chain -- highlighting the rise of production which spans across multiple countries.

The theory of specialisation, made famous by Adam Smith’s pin factories, has pushed beyond borders and individual goods and into particular phases or components of production. Advances in transportation and communication technologies, the removal of trade barriers and capital market liberalisation have facilitated such a move.

Australia has benefited greatly from the uptick in international trade. For example, iron ore and coal are intermediate goods for residential and non-residential construction. Our focus on these, combined with the economic ascendancy of China, paved the way for an once-in-a-lifetime terms-of-trade and resources boom.

By comparison, Australia exports relatively few final goods and runs a considerable trade deficit in that area.

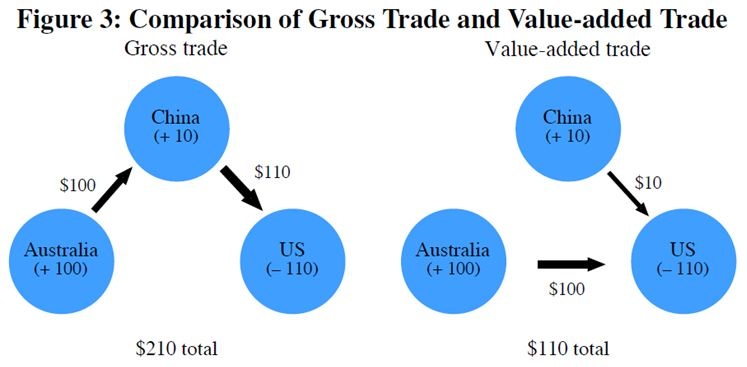

Conventional measures of international trade typically focus on the gross flow of exports and imports but do not consider where the exports and imports eventually end up. Essentially these measures neglect the impact of global supply chains.

To rectify this issue, the researchers constructed an estimate of value-added trade, which identifies the "contributions of each country and each industry to the final value of an exported good or service". Gross measures of trade typically overstate actual trade flows since goods that cross international borders on a number of occasions -- as part of a broader supply chain -- are counted multiple times. The figure below helps to explain the difference between the two measures.

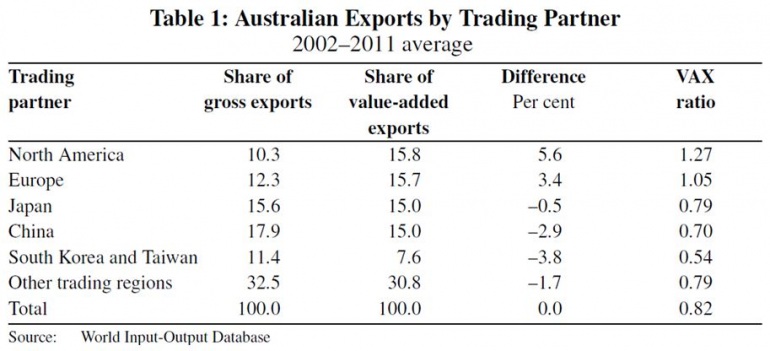

According to the valued-added trade measure, the US and Europe are more important for Australian trade than is commonly believed. A range of Australian intermediate exports eventually find their way to the US and countries within Europe.

The VAX ratio, in the table below, is a ratio of value-added exports to gross exports for each bilateral trading pair. That measure, combined with the data in the second column, provides an insight into which regions are contributing the most to Australian output.

By industry, manufacturing accounted for around 38 per cent of gross exports between 2002 and 2011. But these exports contained a high share of either imported materials or inputs purchased from other sectors; as a result, manufacturing accounted for just 19 per cent of valued-added trade over that period.

Services on the other hand accounted for 22 per cent of gross exports but around 40 per cent of value-added exports. Most services are non-tradable in the traditional sense but they are used extensively as inputs into other goods in the manufacturing and resource sectors.

There are two important points that warrant further discussion.

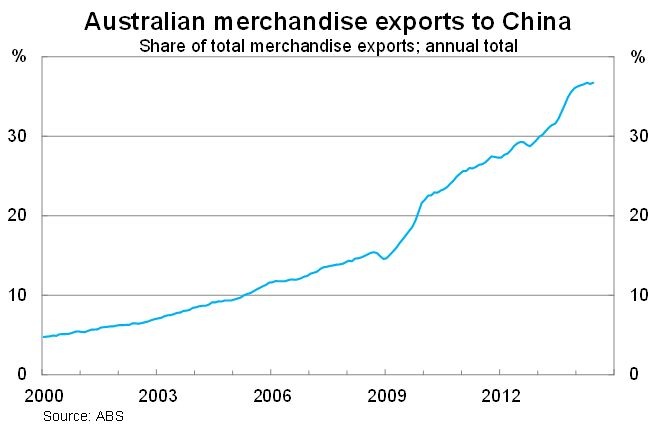

First, the data contained in the table above is over the past decade, which can paint a misleading picture of trade flows for Australia. While Chinese exports only accounted 18 per cent of gross exports between 2002 and 2011, there is a distinct upward trend. For example, China accounts for almost 37 per cent of merchandise exports over the past year -- up from just 7 per cent in 2002.

Second, the data also shouldn’t be interpreted as saying that the US and Europe are more important than China for Australian trade. Instead, the data should be viewed as an acknowledgement that trade linkages are deep and complex.

A shock to any part of the global supply chain can ripple through to the Australian economy. If Chinese demand slows then Australia’s valued-added trade to the US and Europe will deteriorate. Furthermore, if final demand from the North Atlantic declines then Australia will also take a hit -- as we did during 2008 before China went on a spending spree.

The final location of our exports is interesting, and value-added trade is certainly a more accurate measure of aggregate trade flows, but we shouldn’t ignore the steps along the way. The more steps there are in supply chains, the greater the opportunity for disruption for Australian producers.

In the absence of elevated Chinese demand over the past few decades, the composition of Australian exports would be significantly different and the resources boom would never have happened, resulting in vastly lower income and wealth growth.

Furthermore, a slowdown in China remains the worst-case scenario for the Australian economy given the direct implications it has for our mining sector and the indirect effect it would have on real estate and banking. The same cannot be said for our exposure to the US or Europe.