Australian CleanTech Index - March

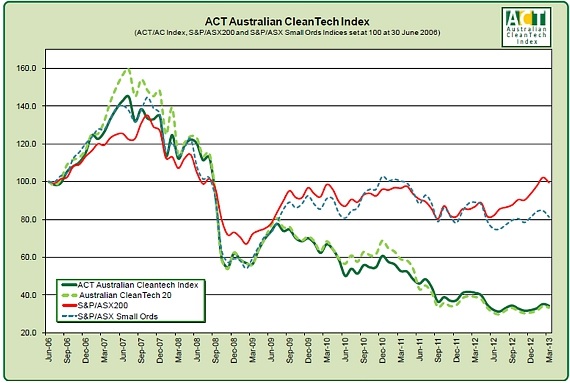

The ACT Australian CleanTech Index just outperformed both the S&P ASX200 and the S&P ASX Small Ordinaries for the month of March 2013, although still lost ground for the month.

The ACT Australian CleanTech Index fell from 35.1 to 34.2 over the month of March, a 2.5 per cent loss. This compared to the S&P ASX200 decline of 2.7 per cent and the S&P ASX Small Ordinaries Index loss of 4.0 per cent. The Australian CleanTech 20 had a slightly better performance with a 2.3 per cent drop.

Over the this quarter of the 2013 fiscal year, the ACT Australian CleanTech Index also outperformed its benchmarks and recorded a gain of 7.3 per cent, ahead of the S&P ASX200's gain of 6.3 per cent and well ahead of the S&P ASX Small Ordinaries' 0.3 per cent gain. The Australian CleanTech 20 outperformed the wider index over the quarter with a gain of 8.5 per cent.

The market capitalisation of the 70 stocks in the ACT Australian CleanTech Index is $9.5 billion, after its rebalance, well off its peak of $16.3 billion in July 2007.

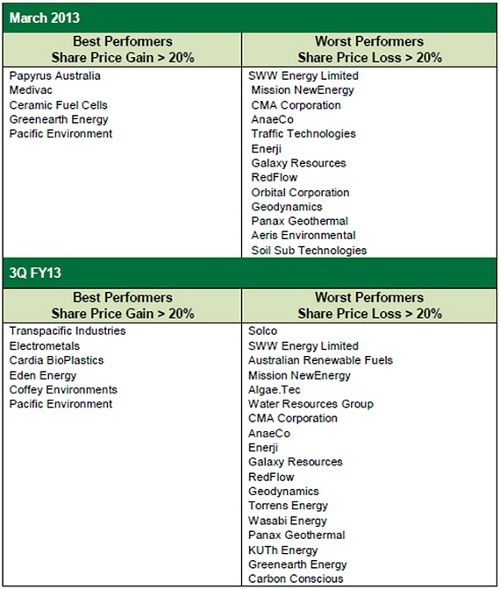

Best and worst stocks

The best and worst performers in terms of share price performance over the month, and the third quarter of the 2013 fiscal year are shown in the table below.

Index Rebalance

The ACT Australian CleanTech Index underwent its quarterly rebalancing at the end of December, which took account of recent share issues and other corporate activity.

The changes that were made were:

Additions

-- EcoSave Ltd (ASX:ECV) was established in 2002, and has expanded to become the fastest growing energy and water conservation company in the country. It is active in metropolitan and rural areas of every state in Australia and New Zealand. It has already provided energy and water saving solutions to over 250 organisations in commercial, retail and industrial arenas, as well as to departments in all levels of government. It researches energy and water conservation products from around the world and chooses those with the best payback to combine into bespoke energy and water savings solutions. EcoSave raised $5 million in an IPO in January 2013.

-- K2 Energy Limited (ASX:KTE) is engaged in solar technology development, as well as holding a significant investment in Mears Technologies Inc. K2 Energy holds the exclusive worldwide rights to the Mears Silicon Technology for all solar energy applications from Mears Technologies Inc. Mears Technologies Inc. is a US-based engineered material company focused on the developments and commercialisation of products based on its proprietary electronic material platform and has 80 granted patents and 200 patents pending. Mears Technologies has now entered its commercialisation phase. K2 Energy also owns 30 per cent of Trey Resources 1 LLC which has oil and gas acreage and production in Oklahoma that has exploration potential.

-- Actinogen (ASX:ACW) is developing medical and cleantech products with a focus on bio-remediation and bioethanol. Actinogen is dedicated to the discovery and isolation of a group of environmental bacteria known as the actinomycetes. These bacteria are a unique group that can exist as free bacteria, in fungal-like mycelial forms, and as ‘resting spores’. They also consist of genera that are either aerobic and grow best at ambient temperatures or are anaerobic and can grow at high temperatures. Some Actinomycetes can degrade industrial waste such as oils, tars, domestic and industrial waste, and the rehabilitation of oil spills. During 2011, Actinogen began a bio-ethanol research program, which has had very encouraging results. Actinogen is focused on commercialising its bio-ethanol research by constructing a pilot plant and plans to eventually become a bio-ethanol producer.

-- Reece Australia Holdings (ASX:REH) is a supplier of water appliances to the wholesale and residential market. The Reece business began in 1919 when Harold Joseph Reece commenced selling hardware products from the back of his truck. Today, Reece is a major public company and Australia's most successful supplier of plumbing and bathroom products. It has over 400 stores across Australia with over 3500 staff and thousands of products. As the plumbing industry has become more specialised, Reece has expanded into the allied areas of HVAC-R, Irrigation and Civil as well as Onsite, which services commercial plumbers and volume home builders.

Removals

-- Advanced Energy Systems Ltd (ASX:AES), which is refocussing away from sustainable development into more general property development.

-- Earth Heat Resources Ltd (ASX:EHR) – following its proposed divestment of its current assets and plan to seek alternative businesses.

A watching brief is being maintained on the following companies that may qualify for inclusion in the Index in the future:

-- AFT Corporation (ASX:AFT), which operates a solar installation business.

-- Energy Action (ASX:EAX), which is primarily a black energy trader with some operations in green energy trading and energy efficiency financing.

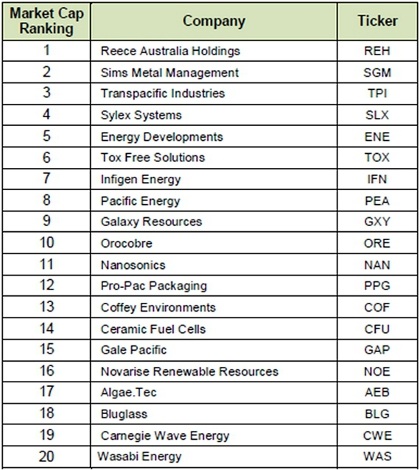

The top 20 table is shown below: