Australia is paying the price for our reliance on exports

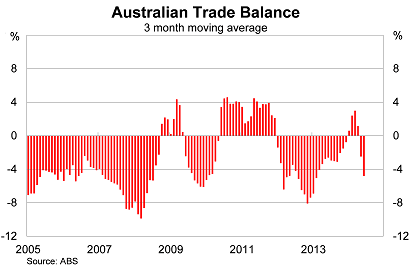

Net exports, the main driver of growth earlier this year, have deteriorated sharply during the June quarter. Despite export prices declining significantly in support of volumes, net exports are set to subtract at least 0.8 percentage points from growth in the June quarter.

Australia’s trade deficit narrowed to $1.7 billion in June -- from $2.0bn in May -- to complete a fairly ordinary quarter for trade. Nevertheless, the result exceeded market expectations for the deficit to remain at around $2bn.

The result follows a strong start to the year, which saw net exports contribute 1.4 percentage points to March quarter real GDP. The Reserve Bank of Australia noted a few months ago that they expected the trade sector to soften a little but the recent deterioration has been larger than widely anticipated.

The value of exports rose by 0.5 per cent in June, to be 0.9 per cent higher over the year. Exports declined in both April and May on the back of a sharp decline in prices. By comparison, imports fell by 0.8 per cent in June, to be 4.8 per cent higher over the year.

The Australian dollar has picked up in recent months, which combined with a sharp decline in commodity prices, has weighed on export income and margins throughout our mining sector and the broader economy.

Export values are likely to come under further pressure in July, with the RBA’s commodity price index falling a further 1.1 per cent in Australian dollar terms. This was the sixth consecutive decline in the series, with commodity prices falling by a total of almost 15 per cent over that period.

Adjusting for the change in prices, net exports are set to subtract from real GDP growth in the June quarter. According to a combination of ABS monthly data and a simple model, net exports will take between 0.8 and 1.4 percentage points from real GDP in the quarter. This largely offsets the gains from earlier this year.

It follows on from a string of fairly ordinary data. Yesterday I noted that retail trade volumes fell during the quarter and the outlook for mining investment points to sharp declines over the next couple of years (Households feel the pinch of a struggling economy, August 4). Building approvals remain elevated but are well past their peak.

Households are stretched by declining real wages and high indebtedness and the non-mining sector is cautious and waiting for conditions to improve before they commit to greater investment. Meanwhile, the federal budget indicates that public spending won’t contribute significantly to domestic demand for a number of years.

The Australian economy is relying on exports to do the heavy lifting and this hasn’t been the case for three months. Net exports are all but certain to improve over the remainder of the year but there is great deal of uncertainty surrounding that outlook, most of which comes from the Chinese economy.

Exports to China continue to rise and are 10.6 per cent higher over the year. But its real estate market appears increasingly shaky and seems set for at least a moderate correction over the next couple of years. This will weigh on iron ore demand at the same time that more production comes online from Australian suppliers. Export prices are set to fall further in the years ahead.

The trade data during the June quarter was fairly ordinary but export volumes are set to climb over the remainder of the year. The big question is whether the rise in volumes will offset the fall in export prices: if it does, then that provides some upside risk to income growth and the federal budget. If not, the benefits of the third stage of the mining boom may be a lot less than is commonly expected and may result in growth remaining below trend for longer than the RBA anticipates.