Auction action is falling away

Summary: More and more Australian property sellers are looking to private sales, as the importance of auction clearance rates falls.

Key take-out: The number of houses sold at auction in Australia is falling.

When it comes to Australian residential property, clearance rates have long been one of the most closely watched market indicators. However, as they continue to fall in our auction cities, the measurement is becoming less prominent as a leading indicator.

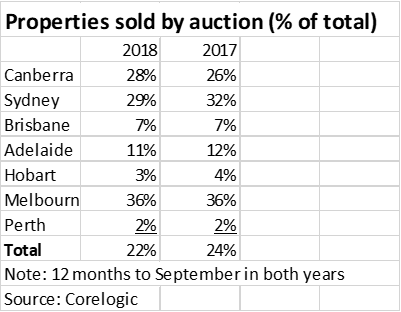

Outside of Sydney, Melbourne and Canberra, very few properties actually go to auction. Over the past 12 months, only 22 per cent of all properties in Australia were sold by auction, a reduction from the 24 per cent recorded in 2017. In the residential market, particularly in Sydney and Melbourne, two shifts have been occurring. Firstly, fewer properties are selling overall, whether by private sale and auction. There has also been a shift away from auctions to private sales.

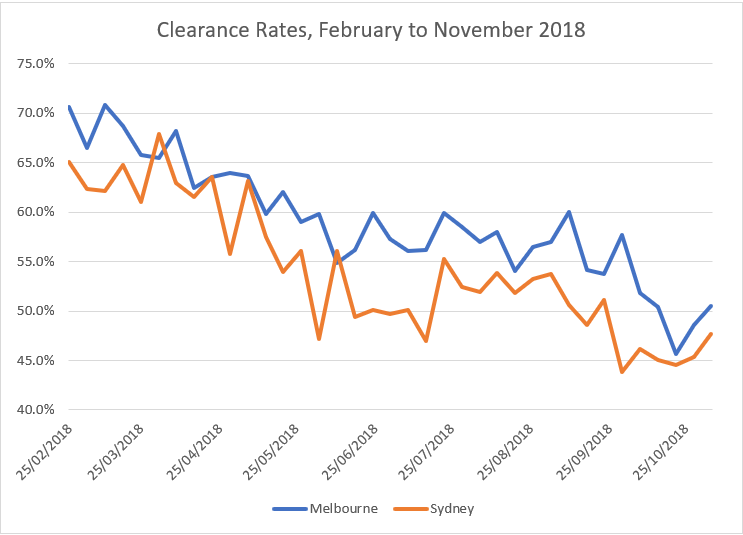

In terms of Sydney and Melbourne, the emphasis placed on clearance rate data does impact consumer sentiment, but it only tells part of the story. The data is certainly relevant in inner suburban markets, where the majority of auction activity takes place, but in both cities, it has been trending down for some time. In Melbourne, the clearance rate was consistently over 70 per cent until November 2017, at which point it started falling away. In Sydney, the decline started even earlier – in June 2017. The clearance rate in Sydney is now between 45 per cent and 50 per cent, while Melbourne’s is only marginally better.

Source: Corelogic

Could clearance rates keep declining? There has been only one occasion in either Sydney or Melbourne in which the clearance rate dipped below 40 per cent on a normal auction weekend. That was in Sydney in July, 2008, at the peak of the Global Financial Crisis. At this time, the clearance rate fell to 36.5 per cent, but jumped straight back up to 50 per cent the following week.

Auction clearance rates rarely get to very low levels because an auction with no bidders is a bad outcome for a vendor. If there are far fewer people looking to buy and only a small number of potential buyers, a private sale makes much more sense. For that reason, as clearance rates decrease, far fewer people go to auction.

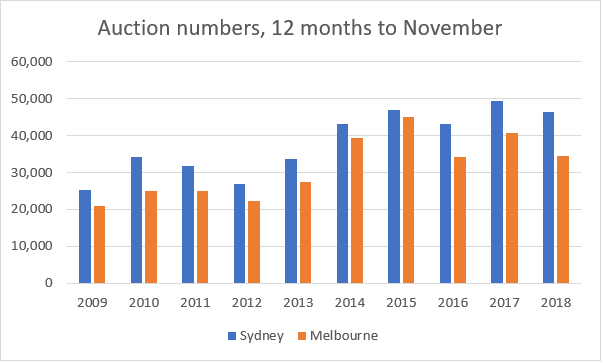

In Melbourne, overall listing volumes are up on last year, but the number of auctions taking place over the past 12 months is almost 3,000 fewer than the previous year. In Sydney, the decline is in excess of 6,000. It’s important to understand that these declines have been largest in places which were never traditional auction hot spots – generally the outer suburban areas. As the heat has come out of the market, the move back to private sales in these areas has been the biggest factor driving the decline in auction numbers.

Source: Corelogic

With clearance rates low and fewer vendors going to auction, could this also spell the end of Super Saturdays? The biggest Super Saturday ever recorded was March 25, 2018, when 2,071 properties went to auction in Melbourne. This was when pricing was really starting to turn, which shows that many vendors were quite clever in picking the end of the growth cycle.

Lower clearance rates and declining auction numbers don’t necessarily mean that people aren’t selling, but we can be confident that Super Saturdays will be more subdued over the next couple of years. It’s likely that we will need to wait for the end of the next cycle to see auction weekends return to peak levels, and at this stage it’s too early to say when this may occur.

While we wait, the market will need to look for other leading indicators – such as demand – to properly gauge the future health and performance of Australian residential property.

Nerida Conisbee is the chief economist at REA Group.