At last a rally… but it's hardly world class

Summary: The Australian equity market is dominated by macro themes and sentiment at the moment and our market hasn't made any reasonable gains for nearly three years. Not all stocks are being belted, with industrials outperforming and some individual stocks enjoying a stellar run. The market is a punter's market, driven by narratives, and the herd is strong. |

Key take-out: If the Aussie market is going to join the global equity rally, then we're going to have to see some sense return and some of the pessimism subside. |

Key beneficiaries: General investors. Category: Shares. |

Global stock markets are rallying into the end of the year: The issue for Australian retail investors is whether our ASX is going to surf this wave or not?

Certainly, macro themes and sentiment very clearly dominate the Australian equity market at the moment. Unfortunately though, from a global perspective, Australia is just at the wrong end of some key themes such as beaten-up commodity prices.

Not that our market didn't have a good month in October. The S&P/ASX200 rose in accordance with a pick-up in global stocks and the normal seasonal upswing (stocks generally do rise in October and they did).

So the 4.3 per cent rise is a little more than what we've typically seen for an October lift (the five-year average is about 4.1 per cent). It has to be said though, that this underperforms, by a significant margin, gains in some of the larger global markets. So the S&P 500, DAX and the Nikkei rose between 8.3 and 12.3 per cent. Gains well above what the normal seasonal patterns would suggest.

It doesn't look much better over a longer time horizon either, with our market well down on its peaks and still down a bit for the year. In fact our market hasn't really made any reasonable gains for nearly three years.

In contrast, larger markets overseas are all up for the year and not far off record highs, or in the case of Japanese equities, at post-GFC highs.

Now the reasons for that are clear. Our miners have been hammered as commodities have dropped, and regulators are suffocating the banks. With energy stocks in tow, that's nearly two-thirds of the Aussie market – unloved.

Overlayed with that is the succession of incompetent political regimes which has destroyed confidence (under Turnbull this may be changing), and this is all coupled to a drive to get the Australian dollar down.

Indeed, the Australian dollar and the All Ords have a very strong positive correlation and they generally rise and fall together. In times when the Aussie dollar falls, global investors tend to keep away from Aussie assets as they don't want to wear the currency losses. Note that these are all macro themes which often have nothing to do with the fundamentals of individual stocks or “stock picking”.

Bearing all this in mind it's easy to make the case that the current rally is at risk. Mainly that's because none of these thematics have really changed

Separately, there is another key issue: The background is that while the Aussie market continues to underperform not all stocks and sectors are being belted. Industrials have outperformed for a variety of reasons including the weaker dollar, takeover activity and the pick-up in economic activity in NSW and Victoria. In addition there are of course individual stocks which have had a stellar run. Check out the recent price action in AMA, Blackmores or Bellamy's.

In many ways this was to be expected. I've often been alone in the market arguing that the non-mining economy is doing well and growing at an above trend pace. It is, and we are seeing that play out in some of these stocks. Sure, some are just bouncing back from a beaten-up state given the worst has not occurred.

That's all good and well, but a lot of these darling stocks are extremely expensive. Not just a little rich, we are talking crazy prices.

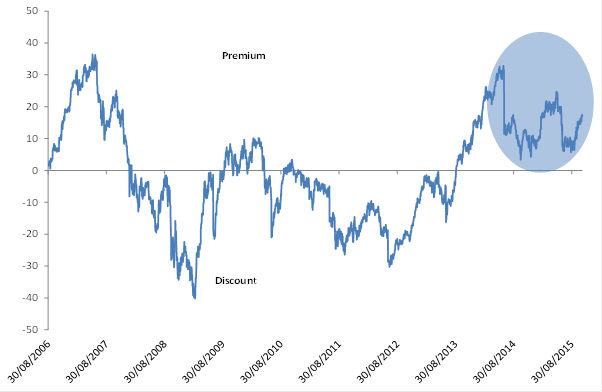

The industrials sector as a whole is trading at a 70 per cent premium on a trailing basis and 20 per cent on forward multiples. (That is, against their average performance since 2000 excluding the GFC period.) Some stocks are trading at record premiums (trailing) – over 200 per cent in some cases. That's not to say these aren't good stocks or haven't made money. They have. But investors are paying through the nose for that and have been for some time.

Chart 1: Industrials 1-year forward premium (%)

The question is why are investors seemingly prepared to do that: Yes they are good stocks, but record premiums?

In theory, premiums should be much higher than average given the new ultra-low rate world we live in. At records even. But in a well-functioning market, relative value should come into play at some point. Especially for stocks that pay no yield. So for instance, there are plenty of good stocks in our market with good fundamentals – earnings momentum, yield and decent value – that are simply being overlooked. For no real reason, other than they've got the wrong narrative. Sentiment is bearish in other words.

With that in mind, I suspect that the success of many other stocks isn't driven entirely by fundamentals. Indeed it seems logical to me, given the magnitude of some of the premiums being paid, that the sheer weight of negative sentiment on the bulk of our market, is helping these more fashionable stocks and sectors push higher.

To my mind then, this makes the Aussie market a punter's market. People are piling in, blindly in some cases, because risk aversion elsewhere is high and the herd is strong. On that view, many investors probably feel that they've got nowhere else to go given that two thirds of the market is unloved. In my opinion, this is simply punting, it's not investing or skilfully picking stocks. It's going with the flow. So I'm not as convinced as Alan Kohler is, that it's entirely a stock picker's market (see Kohler's Week, October 31).

Instead I think it's very much a market that is driven by narratives, getting the right story and one that the herd will respond to – and then seeing which stocks within that are the best, or the least worst.

On current thematics, and given the extremely hard run of the stocks and sectors currently in fashion, our market is probably a little more unstable than meets the eye.

These very rich stocks could correct on a whim and that would eliminate any support for our market and shatter the reputation of the stock pickers. I certainly don't think we can rely on already expensive stocks to continue to push higher. They might, but again, that's a punt.

The key saving grace for our market is that even if these higher PE stocks should correct, then we are only talking a small segment of the overall market. Industrials for instance are only about 7-8 per cent of the overall market (as defined by the industrial GICS category on the ASX).

Which brings us back to these macro themes I talked about earlier. The reality is, if the Aussie market is going to join the global equity rally, then we're going to have to see some sense return to the market. Some of the pessimism, on banks, miners, energy stocks, telcos, some consumer discretionary stocks and the A-REITs will have to subside.

Don't judge that on November's performance. November is seasonally weak for the All Ords – although the performance to date isn't bad.

Ironically it might be the RBA's recent decision to hold rates that helps spark that turn in sentiment. Firstly, it will help boost confidence in some of those sectors as well as assuage the concerns of foreign buyers that the Aussie dollar is set for continued large falls.