ARENA and the off-grid 'path to parity'

As a result of Australian Renewable Energy Agency's recent announcements of support for projects in the off-grid electricity sector, a number of capital cost benchmarks are now available in the market. The off-grid benchmarks are high compared to those for utility-scale or residential solar, mostly due to higher construction, transport and labour costs and also because remote projects do not benefit from economies of scale.

This is one of the reasons ARENA was established in 2012 with a mandate to reduce the cost and increase the use of renewable energy in Australia. ARENA strategically provides funding support to renewable energy projects during the developmental stages. This will greatly reduce the time it would have otherwise taken for the renewables industry to flourish to the point where it no longer requires long-term government support.

The deployment of renewable energy solutions in remote communities and businesses has considerably less than that in urban and metro areas. This is due partly to the increased cost of constructing and operating projects in remote areas, but also due to the lack of experience in assessing, planning and developing off-grid projects in Australia.

It is ARENA’s role to find ways to overcome such barriers. In 2013 ARENA launched the Regional Australia’s Renewables program, which is developing local know-how and reducing the cost of renewable energy projects in the off-grid mining, fringe-of-grid and remote community sectors.

RAR also presents an opportunity to displace a significant amount of the comparatively expensive diesel generation that currently powers remote Australia, with the installation up to 1 GW of off-grid renewable energy capacity.

Each of ARENA’s RAR projects is different: some involve energy storage while others employ complex control systems to integrate the renewable energy into local mini-grids. Some projects benefit from existing infrastructure and construction capability while others need to import expertise from elsewhere.

Why is the cost of off-grid renewable energy so high?

Many of the factors that make off-grid solar projects different to large-scale, grid-connected solar projects also increase the cost of the electricity generated.

1) Higher construction, labour and transportation costs

Remote locations generally do not have an established construction capability, which needs to be established by early projects in the region. Very remote locations can also involve high mobilisation costs. Construction costs (including transport) are typically around twice as high in remote areas compared with utility-scale grid-connected projects. This is due to the cost premiums associated with construction in remote locations. Fly-in fly-out workers are an obvious cause, as is the transportation of equipment over long roads of variable quality.

Construction cost premiums observed by ARENA are supported by Rawlinson’s Construction Cost Guide, which for example indicates that construction costs at Weipa in remote northern Queensland can be expected to be 80 per cent higher than for a similar project in the city of Brisbane.

2) Higher cost of capital

In addition to higher capital costs, off-grid projects are subjected to further economic penalties due to lack of scale. This increases operating costs as a percentage of revenue. As a result, smaller projects typically struggle to attract low-cost finance and may need to be 100 per cent equity funded, which has a significant impact on their cost of finance. Over the longer term, however, ARENA expects lower cost financing options to emerge (for example, project aggregation models).

3) Inclusion of storage

The inclusion of battery storage in remote renewable energy projects can also increase capital costs significantly, depending on the amount of storage required. Storage technologies allow standby diesel to be turned off without reducing reliability in the event of a demand surge or sudden drop in renewable output. It also enables renewable energy to be kept for use when it is required. The cost of battery storage remains high but is expected to decline sharply (perhaps halve in cost) over the medium term.

4) Control systems

The design of control systems for renewable energy also involves significant one-off costs. Sophisticated control systems can double the level of penetration (even without significant battery storage), which justifies the additional capital cost of the system. The economics of off-grid projects and the barriers to industry adoption of renewable energy were discussed in a previous Climate Spectator article here.

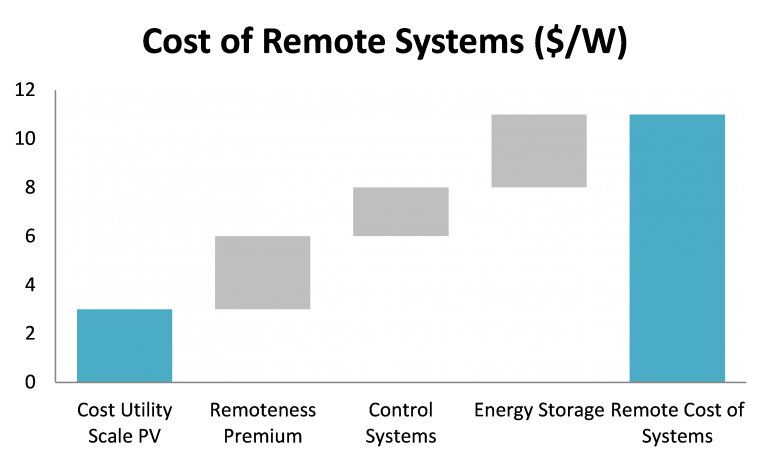

The following chart shows the cost premiums that would apply to a generic renewable energy project constructed off-grid with control systems and limited battery storage.

It’s all relative

It is important to note that energy is already more expensive in off-grid locations due to the high cost of diesel. The displacement of diesel by renewable energy provides remote communities and businesses with more affordable electricity as well as greater energy security.

ARENA’s off-grid projects have differing degrees of penetration. The Doomadgee project is expected to displace around 30 per cent of diesel usage with limited storage, whereas Lord Howe Island intends to incorporate significant battery storage to increase penetration to around 70 per cent. The Weipa project plans to achieve up to 100 per cent instantaneous penetration following Phase 2 but will only displace around 20 per cent of diesel on average due to the nature of the load at Weipa.

The higher capital and operating costs of high penetration off-grid renewable energy projects are offset by the high cost of diesel generation that they displace, which at diesel prices of around $1 a litre typically equates to $250-$300 a megawatt-hour.

In general terms, an off-grid renewable energy project might be around three times as expensive (once control systems and/or storage is included) than a grid-connected 5-10MW project. However, the cost of the energy being replaced is also around three times higher (that is, $300 a megawatt-hour for diesel offset compared to $90-$100 a megawatt-hour for grid-connected solar including $40-$50 a megawatt hour for LGCs).

ARENA funding closes the economic gap

Whether on-grid or off, ARENA provides grants to close the economic gap faced by renewable energy projects because of early-mover disadvantage and other cost penalties. This is done by:

– reducing perceptions of investment risk (including reduced contingency and lower return requirements) and demonstrating the reliability of renewable energy

– reducing the cost of finance by giving local investors and banks experience

– building greater capacity in the local renewable energy sector, particularly by creating supply chains and more standardised system components, and fostering competition

– promoting innovation that could lead to cost reductions

– spreading these benefits through targeted knowledge sharing.

ARENA expects all its projects to be viable without subsidy within five years due to cost reductions and efficiency improvements. For a ‘typical’ 1MW (high penetration) project with a capital cost of $10 million and a $4 million ARENA grant, the following analysis illustrates the potential ‘path to parity’. This path will of course be impacted by other factors, including diesel prices, the continuation of the diesel tax rebate and other government policies such as carbon pricing.

(Note on rate of return: ARENA negotiates extensively with recipients to ensure that rates of return are appropriate and competitive. However, it is reasonable for early mover projects to incorporate some level of risk premium given the lack of track record, which can result in a project incorporating a larger contingency or some 'buffer' in the rate of return required. Rates of return also vary significantly based on the risk profile of the project and other factors, such as whether the proponent is government owned, pricing to enter the market or required to make a commercial return.)

ARENA is confident that its current and future portfolio of investments will support the development of a local renewable energy industry that can be commercially viable without ARENA subsidies by 2020.

If this is achieved, significant benefits will flow to the Australian community through increased energy security, reduced risk and lower energy costs. This will also result in a reduction to community service obligation subsidies that are currently being borne by governments across Australia.

Ivor Frischknecht is ARENA chief executive and Dan Sturrock is investment director at ARENA.