Are you earning what you're worth?

Plenty of Australians are doing it tough right now thanks to a string of rate hikes and inflation that’s sitting at 6.1%. That’s seeing a lot of belt tightening, but there is another solution to managing a money squeeze. It involves looking at the other side of the ledger – what you earn.

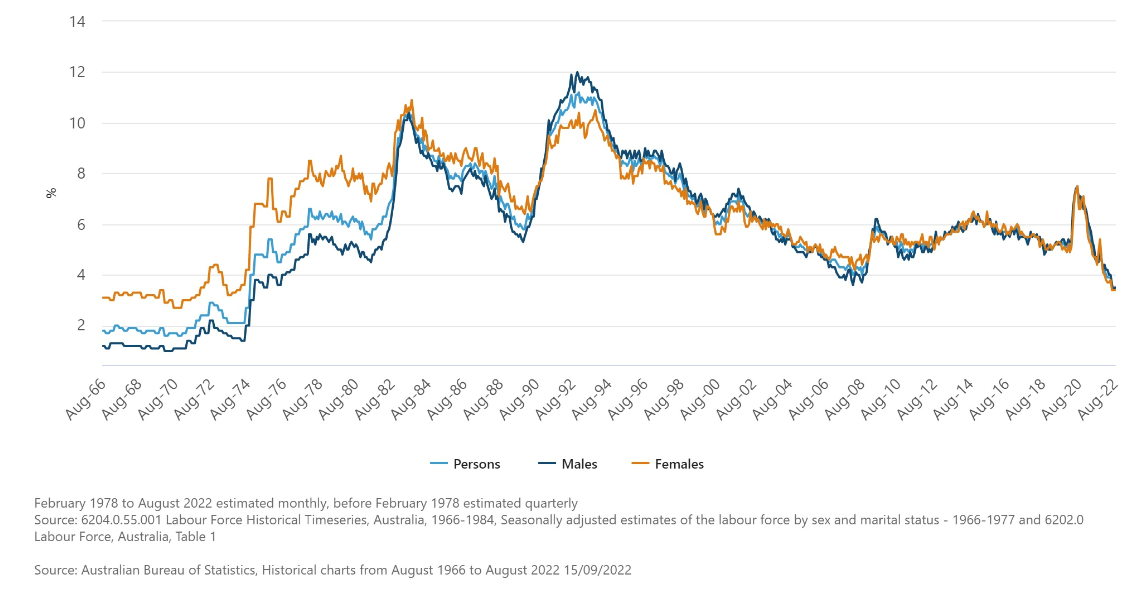

The good news, for workers at least, is that Australia has a very tight labour market right now. The unemployment rate is an exceptionally low 3.5%[1]. As the graph below shows, we haven’t seen unemployment rates at this level since the 1970s. Better still, all workers are benefitting – both male and female.

|

Unemployment rate Australia, August 1966 to August 2022 seasonally adjusted |

|

|

Such a tight labour market means employers can struggle to fill roles. And in the true spirit of supply and demand, this is seeing businesses offer higher wages to attract new recruits.

Wage growth for new jobs hits 3.8%

The latest data from employment marketplace SEEK shows advertised salaries are up 3.8% over the year to August[2]. That’s a lot more than the 2.6% increase in the Wage Price Index[3]. It goes to show that looking for a new job could mean pocketing a pay rise.

But it could pay to act sooner rather than later. As the chart below confirms, the wage premium offered to jobseekers is starting to dial down.

|

Annual growth of SEEK Advertised salary Index |

|

|

4 out of 5 bosses expect staff to ask for a pay rise

Of course, earning more doesn’t have to be as drastic as pulling stumps on your current role.

If you like your job and have a decent career path, it can make sense to have a chat with the boss about an uptick in pay, especially if you’ve made a strong contribution to the business throughout the year.

Making a request for a pay rise isn’t always easy. But chances are your employer won’t be surprised if you turn the conversation around to talk of higher pay. A survey by recruitment firm Robert Half found four out of five (81%) business leaders are expecting more employees to ask for a pay rise in 2022.

The same study found almost all (96%) employers are increasing their salary budgets this financial year – by an average of 20%.

That said, it pays to be realistic about your employer’s capacity to deliver higher pay. The lowest paid roles, which tend to be in retail and hospitality, have seen wages growth of 3.4% this year. Businesses in these sectors work off very tight margins, and some employers simply can’t afford to increase their staff’s pay.

Know your market value

What matters is that you know your worth – it’s a good starting point for pay negotiations no matter whether you are looking for a new job or staying in your current role.

SEEK has an online salary look-up tool, and many of the big recruiters like Robert Half and Hayes publish annual salary guides for various professional roles. Or check out the PayScale website for hourly pay rates across a variety of jobs.

The catch of working multiple jobs

For a growing number of Australians, navigating higher living costs has meant holding down two or more jobs. The Australian Bureau of Statistics recently reported that 900,000 Australians are working multiple jobs – the highest level since 1994.

However, there is a risk that some of these workers could face a tax debt when they lodge their next tax return. Let me explain. For Australian residents, the first $18,200 of income you earn is tax-free. This tax-free threshold is equivalent to earning:

- $350 a week

- $700 a fortnight

- $1,517 a month.

The drawback is that the tax-free threshold only applies once. If you have two jobs, both employers will likely deduct tax from your wage on the assumption that you’re entitled to the tax-free threshold – unless they’re advised otherwise. This could mean that by the end of the financial year you’ve paid considerably less tax than required.

That’s why the Tax Office advises letting a second (or third) employer know they should withhold tax from your income at the higher, 'no tax-free threshold' rate. Yes, this can cut into your take-home pay from a second job. You may even find it’s not financially worthwhile working two jobs. But that could be a whole lot better than being lumbered with an unwanted tax debt that you struggle to repay.

[1] https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release#:~:text=Unemployment-,In seasonally adjusted terms, in August 2022:,1.8 pts below March 2020.

[2] https://www.seek.com.au/about/news/seek-advertised-salary-index-advertised-salaries-grew-by-38-in-year-to-august-2022

[3] https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/wage-price-index-australia/latest-release

Frequently Asked Questions about this Article…

In a tight labour market, you can increase your earnings by exploring new job opportunities where employers are offering higher wages to attract talent. Alternatively, you can negotiate a pay rise with your current employer, especially if you've made significant contributions to the business.

The current unemployment rate in Australia is exceptionally low at 3.5%, which is the lowest since the 1970s. This tight labour market benefits workers as employers compete to fill roles.

Advertised salaries have increased by 3.8% over the year to August, according to data from SEEK. This is higher than the 2.6% increase in the Wage Price Index, indicating that job seekers could benefit from a pay rise by looking for new opportunities.

Before asking for a pay rise, it's important to know your market value and be realistic about your employer's capacity to increase pay. Consider using online salary tools and guides to understand your worth and prepare for the negotiation.

Working multiple jobs in Australia can lead to a tax debt if both employers apply the tax-free threshold to your income. It's advisable to inform your second employer to withhold tax at the 'no tax-free threshold' rate to avoid underpaying taxes.

You can find out your market value by using online salary look-up tools like SEEK's, or by consulting annual salary guides published by recruitment firms such as Robert Half and Hayes. These resources provide insights into pay rates for various professional roles.

Some employers, particularly in sectors like retail and hospitality, operate on tight margins and may struggle to offer higher wages. Despite a general trend of increasing salary budgets, these businesses may have limited capacity to raise pay.

The tax-free threshold in Australia is $18,200, meaning this amount of income is tax-free. However, it only applies once, so if you have multiple jobs, you need to ensure your second employer withholds tax at the higher rate to avoid a tax debt.