Are the glory days over for Asian stocks?

Summary: Higher borrowing costs for US dollars are set to end the tyranny of “risk-on, risk-off” investing, where Asian markets move according to the appetite among global investors for risking cheap dollars in search of higher returns. The Asian region's era of rapid economic growth also appears to be behind it. |

Key take-out: Until Asia can embrace corporate governance, minority shareholder rights and the power of creative destruction, the most profitable destination for Asia's investments may remain on Wall Street. |

Key beneficiaries: International investors. Category: International investing. |

If you're like me, you're old enough to remember when Asia was where investors could count on relatively rapid growth and superior returns. It was a place where opportunities, while certainly not equal, were at least abundant enough that anyone willing to risk the time and money stood to do better than they might in the “old economies” of the West.

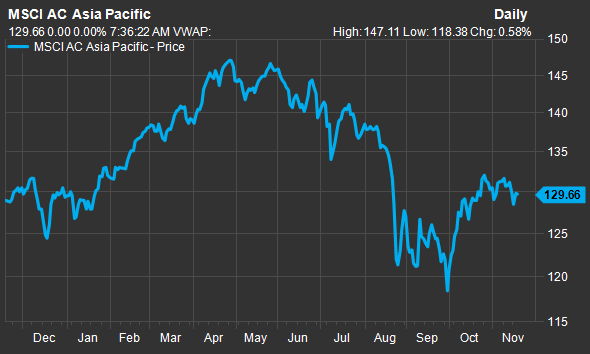

If Asia's stock markets today are any guide, however, it looks as though those days may be long gone. Understanding why will become increasingly important in the next few weeks as markets brace for the first US interest-rate increase in eight years. Markets now judge the odds of a Fed rate hike in December at slightly over two-thirds.

Higher borrowing costs for US dollars stands to end what this column has termed the tyranny of “risk-on, risk-off” investing, in which Asian and emerging markets rise and fall not with changes in their own economic or corporate fundamentals, but according to the appetite among global investors for risking cheap dollars in search of higher returns. And that appetite – like Pavlov's dog – is conditioned to respond almost exclusively to signals about how soon the Fed will or won't end the era of near-zero interest rates.

There was a time, before the global financial crisis, when that would have been good news for Asian markets. Stacked up against the US or Europe, who wouldn't have chosen to invest right here in Asia? Indeed, in the past 15 years, the MSCI Asia ex-Japan index has outperformed the S&P500, returning roughly 190 per cent in US dollar terms, compared with about 90 per cent for Wall Street.

But most of that outperformance came in the decade prior to the global financial crisis. In the past five years, Asia has lagged Wall Street, returning just 25 per cent against the S&P500's 110 per cent. The only major Asian markets that managed to beat the S&P in that period – in dollar-based returns – are two of its smallest, the Philippines and Thailand. And while Asian markets tend to outperform in boom years, they under-perform even more dramatically during busts.

What's changed? The region's era of rapid economic growth appears to be behind it. While emerging Asia is still growing at slightly more than 6 per cent a year, that's a far cry from the double-digit rates more common before the crisis.

In many ways, the region doesn't need to run so fast. Asia isn't as young and vibrant as it once was. The working-age population in China peaked in 2010, according to data from the United Nations, Thailand's peaked last year and Vietnam will reach its zenith next year. And while there are still three teeming Asian nations with growing populations – India, Indonesia and the Philippines – it looks as though East Asia's population overall peaked alongside China's. And like anyone who has reached middle age, Asia's economic future from now on will be largely about quality, not quantity.

Second, the export engine that powered Asian growth in the decades before the crisis has slammed into reverse. Asian exports, which once grew reliably at double-digits, sank into a single-digit pace in 2011 and have been shrinking all year. Theories abound for why this has happened: rising costs in Asia have pushed manufacturing to Eastern Europe and Mexico; manufacturers are “re-shoring” production to Europe and the United States; the US recovery isn't broad enough yet to boost demand for Asian manufactured exports and anyway, the US consumer's taste has shifted away from buying things like TVs or cars to buying services like streaming video and Uber taxi rides.

Third is China. After bursting onto the region's economic landscape in the late 1980s and then becoming the world's factory after joining the World Trade Organization in 2001, China has steadily gobbled up the lion's share of Asian exports, pulling its smaller neighbours into its slipstream in a way described as “flying geese” when Japan did it in the 1980s.

But China's ability to emulate Japan in getting US consumers to fund its development has run its course, long before China has managed to achieve Japan-style development or income levels. Yet China, like Japan in the early 1990s, now faces the dilemma of how to shift its export- and investment-led economy out from under a massive bubble of credit reckoned to be the equivalent to 250 per cent of its annual economic output. And rather than choose the short, but socially painful, solution of allowing the bubble to burst so the economy can restructure and move on, China appears to have chosen a Japan-style solution of trying to grow its way past the bubble, but at the same risk of slipping into a deflationary coma in the process.

Unfortunately, the rest of Asia isn't far behind. With real demand slowing across the region, Asia has also become ever more reliant on debt to fuel growth: according to HSBC, bank debt in Asia isn't very far behind China at roughly 110 per cent of GDP. Debt isn't at crisis proportions yet, but as global borrowing costs rise, it will grow more quickly and be much harder to pay down without going bust in the process.

Cheaper and cheaper

As debt grows and economies slow, Asia's corporate earnings have slipped into recession. According to Morgan Stanley, this downturn has been going on for the past four years, with earnings peaking this summer in Taiwan, but as far back as 2013 in Thailand and Malaysia, 2012 in Indonesia and 2011 in India.

So while Asia's markets may look cheap relative to what the global investment herd has been willing to pay for earnings since the global financial crisis, they may need to get a lot cheaper once the Fed raises rates and investors resume gauging markets based on their real earnings prospects. And on that score, the global companies available to investors on the S&P500 may represent better proxies for global growth than investing directly in companies in Asia or elsewhere.

Asian stocks, as represented by the MSCI Asia Pacific index, look cheap relative to earnings. But they're expensive if you add in how much companies have borrowed to generate those profits. Once you include that, only three markets in Asia appear to offer real bargains: Hong Kong, South Korea, Taiwan and mainland Chinese shares listed in Hong Kong, also known as H-shares or red chips. Shares in Thailand look cheap only if you believe that Thai companies will be able to boost earnings by almost 20 per cent in the next year. And, as this column detailed earlier, Indonesia is a bargain only if you buy analysts' projections that companies there will somehow see earnings jump by 60 per cent.

Perhaps most discouraging, however, is that some of the best potential values in Asia lie hidden away in markets like India, Malaysia, and the Philippines, where lots of shareholder value could be unlocked if investors could convince companies there to restructure, spin off non-core assets and trim debt. But all three markets also happen to be dominated by closely held companies controlled by powerful families or governments unlikely to cede control. There are no Apples, Amazons or Facebooks disrupting the status quo in these markets.

Until China and the rest of Asia can overcome vested interests to truly embrace corporate governance, minority shareholder rights and, most importantly, the equalising power of creative destruction, the most profitable destination for Asia's investments may remain half a world away on Wall Street.

This piece has been reproduced with permission from Barron's.