Are students revolting, or is it economics?

Last week I made my first overseas trip on which I ticked the box 'Australian resident departing permanently'. It’s given me cause to reflect on my career as an academic economist (and part-time journalist) in Australia.

Today I commence a new role as Head of the School of Economics, History and Politics at Kingston University, London, 41 years after my life as an economist began in 1973. That’s not when my PhD was approved, nor when I got my first academic job, but the date on which I participated in the student revolt over the teaching of economics in a dispute that led to the formation of the Department of Political Economy at Sydney University in 1975.

This dispute has always been tagged with a left-wing brush. Australia’s current Prime Minister Tony Abbott, when he was President of the Students Representative Council at Sydney University in 1979, supported cutbacks to University funding on the grounds that they would force Universities to stop running courses like political economy:

Abbott: “Quite frankly I think that these courses are not only trivial, but they are attempts by unscrupulous academics to impose simplistic ideological solutions upon students, as it were to make students the cannon fodder for their own private versions of the revolution. And I think that if there were further cuts to the education budget well then we would certainly see the Universities cracking down on that sort of course. The fact that they can offer that sort of course is to me proof that there is room for further cuts.”

Interviewer: “You also suggest cutting out political economy?”

Abbott: “That’s right”

(Tony Abbott, University of New England radio interview 1979)

There’s no doubt that the vast majority of the activists in Political Economy Movement were left-wing. But my core motivation for taking part in that dispute was that mainstream economic theory was simply wrong.

The next 40 years of reading economic literature confirmed that gut feeling. Mainstream ‘neoclassical’ economics had a multitude of flaws, all of which had been documented in the academic literature, yet almost none of them were discussed in economics textbooks.

Instead, textbook authors either ignored the problems, or did the mother of all Photoshop jobs on the frankly ludicrous assumptions that were made to paper over problems in the theory, so that the flawed models could sound halfway reasonable to someone who only read the textbooks.

I decided that the best way to reform economics was to explain the technical problems in economic theory in a way that a non-mathematical audience could understand, and to “read aloud the dirty bits” as well: to publish the unsanitised assumptions as they were made in the journals themselves. Statements like the following, for example:

The necessary and sufficient condition quoted above is intuitively reasonable. It says, in effect, that an extra unit of purchasing power should be spent in the same way no matter to whom it is given. (Gorman 1953 , p. 64)

“Intuitively reasonable”? Delusional is closer to it.

But explaining that the theory was unsound wasn't enough. There had to be an alternative way of thinking about the economy too that actually made sense, and there also had to be a reason for the public to actually worry about the state of economic theory in the first place.

I found the explanation that in Hyman Minsky’s John Maynard Keynes, which is not a biography. Most non-orthodox economics portrayed capitalism as having a tendency towards stagnation. In contrast, Minsky saw the fundamental instability in a capitalist system as upwards: “The tendency to transform doing well into a speculative investment boom is the basic instability in a capitalist economy.”

Banks, private debt, asset markets and money played essential roles in Minsky’s vision of capitalism, but they were completely ignored in mainstream economic models before the crisis. This is where Abbott was and is wrong: just because left-wing economists are ideological, it doesn’t follow that mainstream economics was logical. Crucially, its illogical decision to model capitalism as if banks, private debt and money didn’t exist led it massively astray when it came to perceive grave risks to the real economy.

Minsky’s realistic vision of capitalism instead indicated that a pure free market economy --one with no government sector at all -- could collapse into a terminal debt-deflation after a series of debt-driven booms and subsequent slumps. On the other hand, a mixed economy in which government was a substantial economic force whose net spending rose when the economy went into a slump would avoid a debt-deflation, but it would necessarily be cyclical, though with milder booms and slumps.

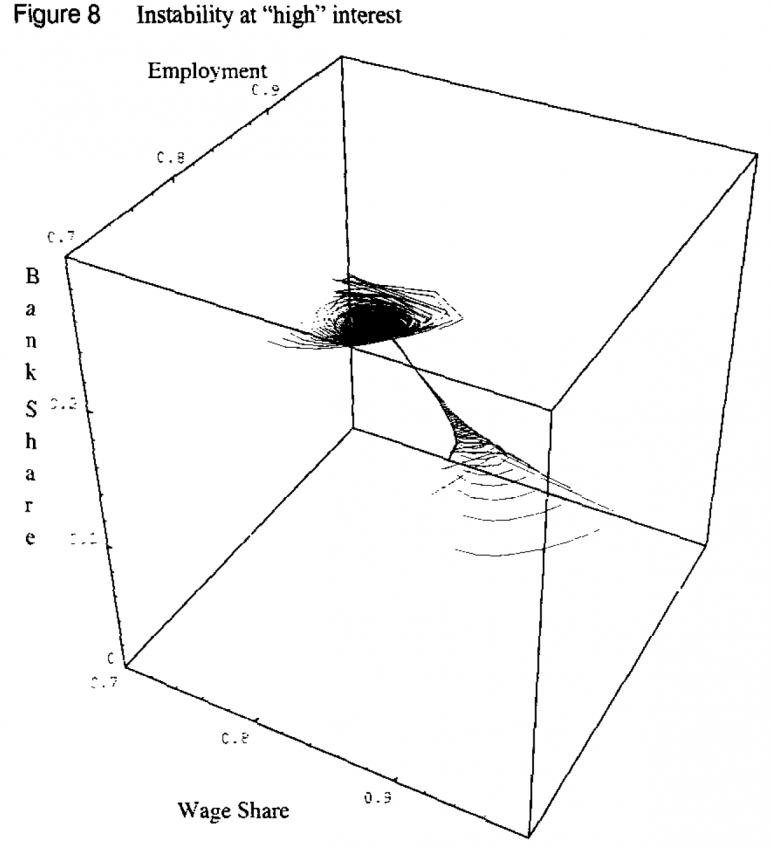

In 1992, I modelled Minsky by adding two elements of realism to Richard Goodwin’s highly stylised model of a cyclical economy. In Goodwin’s model, capitalists invested all their profits, while workers made wage demands depending on the level of employment. I added the reality that capitalists invest less than profits during a slump, but more than profits than a boom, with the extra finance being created by bank lending.

Figure 1: The "black hole of debt" in my 1992 model

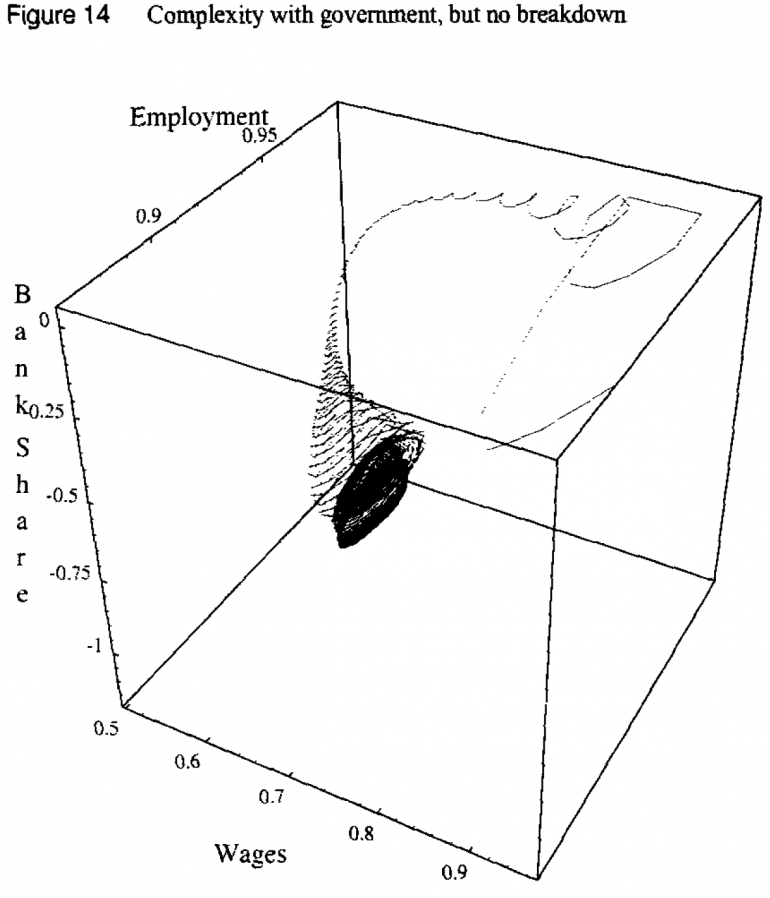

My mixed economy model included a government sector that defended a target level of employment spent more than taxes during slumps and less than taxes during booms, and financed this by its own money-creation capability.

The two models generated the outcomes Minsky anticipated, but the real world fitted neither of these models precisely. So I expected the real world to display a mixture of the results of the two models. As I put it in my 1995 paper: "Increased government spending during slumps would enable recovery in the aftermath to lesser booms; larger booms, however, could result in the rate of growth of accumulated private debt exceeding net profits for some time, thus leading to a prolonged slump."

Figure 2: The cyclically stable mixed economy 1992 model

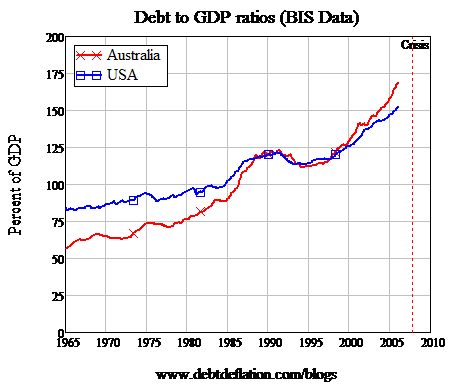

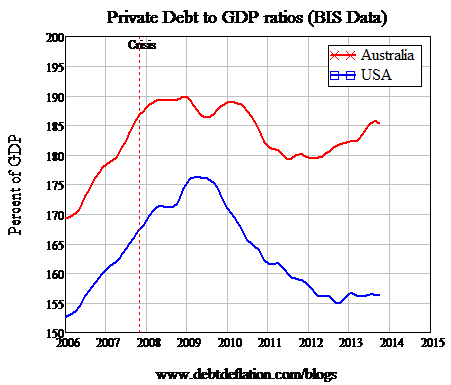

So I had an alternative way of thinking about the economy, which cautioned against the many radical ‘reforms’ of capitalism that the neoclassical school was gung-ho about: deregulating finance, reducing the size of the government sector, eliminating trade unions, driving inflation towards zero. From my “Minskian” perspective, what they were doing was making the real world less like the cyclical but stable system shown in Figure 2and more like the superficially stable but ultimately catastrophic system shown in Figure 1. I therefore felt that the economy could quite possibly fall into a serious economic crisis which would take the mainstream utterly by surprise. One look at the private debt data for Australia and the USA in 1995 (see Figure 3) convinced me that a crisis was certain in the near future -- and too soon to tolerate the lengthy publication delays that occur in the academic press. So I turned to the media and to the blogosphere.

Figure 3: Australian & US private debt ratios when I started to warn of an impending crisis

That crisis duly occurred about two years later, and took mainstream economics completely by surprise, because neoclassical economic models then completely ignored the role of banks, private debt, and money. They instead focused on the levels of employment and inflation, and saw the apparent stability of the ‘Great Moderation’ as indicators that they have finally tamed the business cycle:

"There is evidence for the view that improved control of inflation has contributed in important measure to this welcome change in the economy." (Bernanke 2004, “What Have We Learned Since October 1979?”)

Figure 4: The crisis began when the rate of growth of private debt slowed down

The crisis shook mainstream policy economists to the core, and led to the biggest government economic rescue operation since the Great Depression. It was a scale of engagement that took me by surprise, until I realised that the rescue policies were driven not by economic theory but by sheer, blind panic:

“We need to buy hundreds of billions of assets”, I said. I knew better than to utter the word trillion. That would have caused cardiac arrest. “We need an announcement tonight to calm the market, and legislation next week,” I said.

What would happen if we didn’t get the authorities we sought, I was asked.

“May God help us all,” I replied. (Paulson 2010, p. 261)

As it turned out, sheer blind panic was a better guide to what to do in a crisis than was economic theory. The immense injection of government money stopped the downward plunge into Depression—as Minsky had argued that it would.

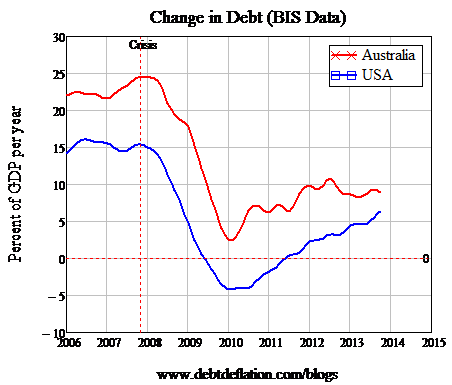

But then the human psyche came into play. Mainstream academic economists excused themselves from their failure to anticipate the crisis with the mantra that “no-one could have seen this coming”, politicians and policy economists went back to obsessing about the level of government debt, and ignoring the dynamics of private debt, and another private-debt-driven boom began in the Anglo countries (see Figure 5).

Figure 5: Today's recovery is driven by rising private debt from an unprecedented level after a slump

So business-as-usual has returned. But it won’t be business-as-usual at Kingston. I’ve been hired with the express mandate to take a University that is open to non-orthodox thought in economics and make it even stronger. We will teach neoclassical economics as well, warts and all. And we will teach the many non-orthodox streams of thought (post Keynesian, evolutionary economics, econophysics) too.

In doing so, we’ll be responding to the successors of those students who, 41 years ago, fought for a different approach to economics at Sydney University. There are now at least 65 student organizations around the world calling for a new approach to economics in what they have titled ISIPE: the "International Student Initiative for Pluralism in Economics”.

Today’s mainstream economists will surely regard them as hopelessly ill-informed about economic theory. They are not. They simply want a realistic approach to economics, as I did when I was in their shoes 41 years ago.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program. A longer version of this article will be published on Debtwatch later this week.