Are non-miners turning the investment corner?

Summary: With the mining boom well behind us, capital investment by businesses has been on the wane. But new data showing a pick-up in commercial lending activity suggests the non-mining sector is keen to invest. |

Key take-out: Increased capital investment by businesses should translate into a rise in jobs numbers. But the billion-dollar question is whether the latest lending numbers point to an ongoing rise in investment activity. |

Key beneficiaries: General investors. Category: Economy. |

The missing ingredient in Australia's economic transition – the ongoing shift away from mining investment – has been a lack of investment by the non-mining sector.

Australian businesses struggled in the aftermath of the global financial crisis and eight years on we continue to see its influence on our business leaders.

The lack of investment from the non-mining sector is most readily apparent in the employment figures we see each and every month. But it's also apparent in the productivity figures that continue to disappoint year after year.

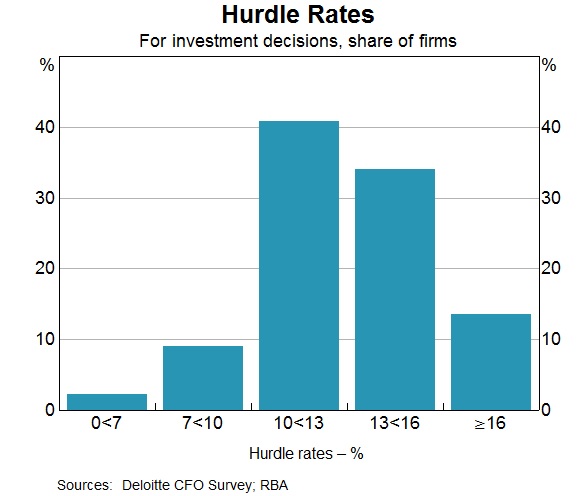

At the heart of the problem is a disconnect between interest rates and the returns that businesses seek from new investment. Evidence suggests that the ‘hurdle rates' for new investment tend to be excessively high for many companies. Australian business leaders are often seeking returns that simply aren't reasonable or likely in a low interest rate environment.

In an ideal world, business leaders would look at available investment opportunities and put their money towards the project or projects that offers the highest estimated return. But if that return isn't particularly high, as is often the case in a low interest rate environment, then business leaders may instead decide that it is better to simply hold off rather than lock funds into a long-term and potentially risky project.

Undeniably there is a logic to it and business leaders aren't stupid. But the process of delaying investment and holding out for greater returns isn't without its cost. It's bad for long-term growth and productivity and it's also bad for employment growth, which underpins domestic demand and expenditure.

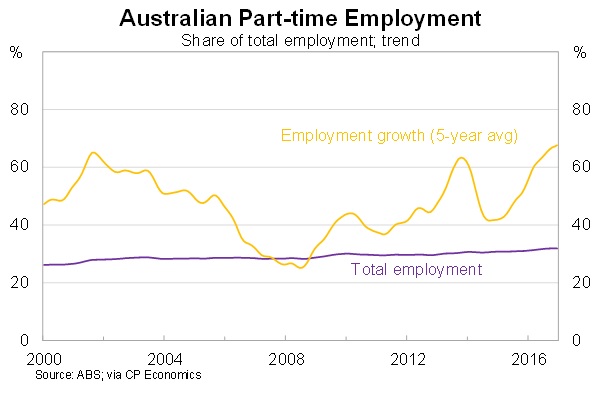

Full-time employment fell throughout most of last year and employment growth has generally underperformed compared with history since 2011. Part-time employment has accounted for two-thirds of employment growth over the past five years, which indicates that employment growth hasn't been centred in high-wage, high-productivity roles.

Another symptom of a lack of investment across the non-mining sector is the high dividend payouts across Australia's largest companies. Over the period from 2005 to 2015, Australia averaged a dividend payout ratio of 67 per cent. This compares to 60 per cent in the United Kingdom; 55 per cent in Europe and 48 per cent in the United States. It jumped to over 80 per cent in 2015.

A lack of investment has, to some extent, been a positive for investors. At least in the short term. Money that isn't being invested has often ended up in the pockets of investors, which has supported spending and removed pressure on household budgets.

Nevertheless, it will be impossible to maintain existing dividends in the long term unless businesses begin to invest in the productive capacity of the Australian economy. An economy with insufficient investment rarely sees sufficient productivity growth and productivity is ultimately the only source of long-term sustainable growth.

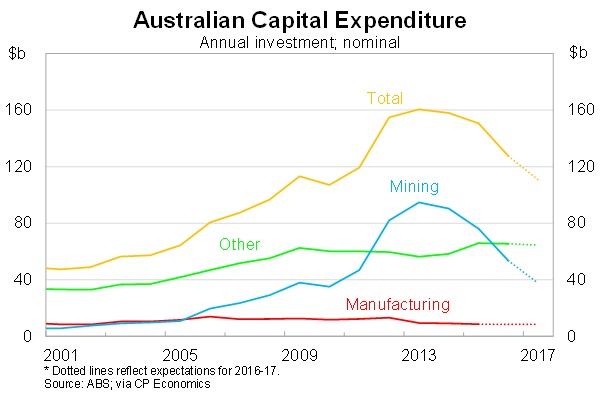

Recent developments on the investment front are pretty mixed and warrant further discussion. We know that mining investment has been falling – it's a natural result of a once-in-a-lifetime investment boom – so we shouldn't focus too much on further investment in that sector.

On a quarterly basis the Australian Bureau of Statistics (ABS) releases a survey that estimates capital expenditure expectations across Australian corporates. It provides some insight into how investment will develop over the next 12 to 18 months.

The graph below shows expectations for capital expenditure for the 2016-17 financial year. Current expectations is that investment spending in the non-mining sector will be broadly unchanged from 2015-16.

Thankfully other areas of the economy have helped to mitigate this lack of investment. Residential construction has been a key source of growth and household spending has held up a lot better than might be expected given the ongoing weakness in wage growth.

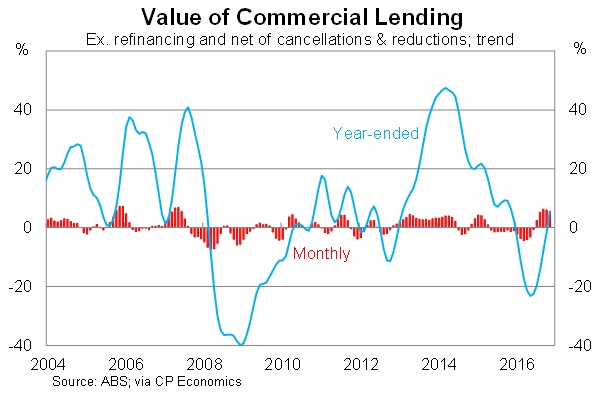

The good news though is that there is mounting evidence that the non-mining sector may be ready to turn the corner. On Monday the ABS released new data on commercial lending activity, which suggests that businesses are beginning to borrow again.

Commercial lending isn't entirely used on investment – around a quarter of commercial lending is devoted to revolving credit facilities – but most of the recent growth has been concentrated in fixed facilities, which are largely related to investment and supporting investment.

Also, by virtue of the fact that the mining sector looks to foreign markets for financing, we can conclude that the growth in commercial lending is concentrated within the non-mining sector.

Whether this persists is obviously the billion-dollar question. If it does then we will begin to see a turnaround in employment and stronger investment and productivity growth. That scenario is an exciting one for investors.

If I was to play devil's advocate for a moment I'd note that the earlier ramp-up in commercial lending throughout 2014 didn't exactly lead to a boom in non-mining investment. Though it is also worth noting that there can be some lag between receiving approval for a commercial loan and actually making an investment.

The first real evidence we will receive on this front will come on February 23 when the ABS releases its update on capital expenditure expectations. A sizable upgrade for non-mining investment in February will put the economy and transition on a much surer footing.

I will be paying close attention to the investment and lending data in the months to come, and investors would benefit from focusing on investment as a useful proxy for further performance.