April enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

2014’s largest quarterly surrender came and went with solid spot pricing and large trade volumes. With the final compliance date having passed, it appears a modest under surrender of STCs has taken place, although it is not clear whether this is owing to exemptions or the incorrect forecasting of electricity demand. Meanwhile, as the nation’s second RET Review in as many years rolls on and the Minister for the Environment Greg Hunt reaffirms his vague support for the RET, the small scale industry maintains grave concerns for it future.

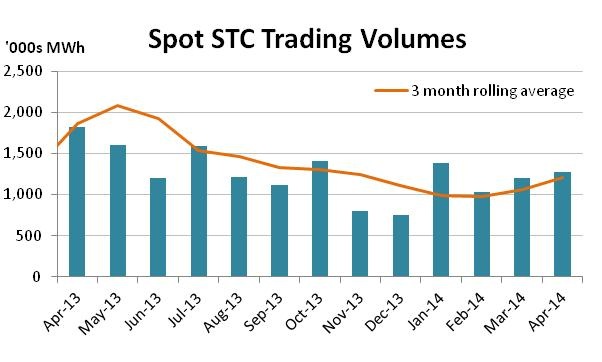

Q1, with its 35 per cent proportion of the annual obligation, is always an interesting quarter. Trade volumes are large and the forward market usually busy as participants aim to set themselves up for the year following the release of the Small-Scale Technology Percentage. Q114 was no different and for the second consecutive year it also yielded strong pricing outcomes.

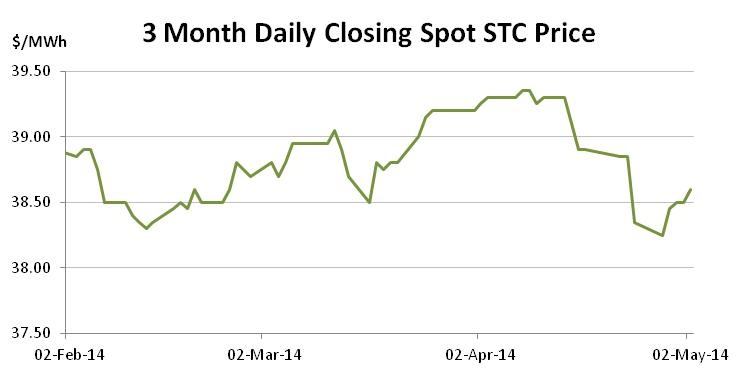

The market began the month of April in the low $39s reaching a mid-month high of $39.35 before gradually softening from that point onwards. Having reached a low of $38.15 the spot eventually recovered to end the month at $38.50.

The forward market was highly active across April with backwardation maintained on the curve out beyond Q1. July (Q2) spent most of the month 20-50 cents below the spot, although as the latter softened toward the end of the month this margin was reduced and the July forwards are now trading in a more ‘normalised’ fashion at a cost of carry premium to the spot. For Q3 (October) and Q4 (Jan 2015) the market remains more strongly backwardated with both sitting around the $38 mark.

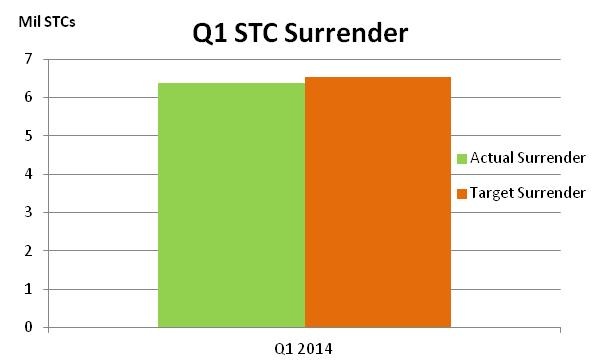

The passage of the final Q1 surrender date (April 28) has seen approximately 6.38m STCs surrendered against a nominal (35 per cent) target of 6.53m. The under surrender of 147,000 STCs (or 2.2 per cent of the nominal target) is either a reflection of exemptions that can apply under the Act or of actual electricity demand being less than the forecast used to calculate the Small-Scale Technology Percentage, or both. For the purposes of comparison, in Q1 2013 an under surrender equivalent to 2 per cent occurred.

Of particular note in the forwards have been the presence of a number of transactions for settlement in Q1 2015. A range of transactions have now taken place in what amount to healthy volumes revealing a growing number of participants who believe it unlikely that any scheme change which results from the the RET Review will have a major impact on the first quarter of 2015.

Within the solar industry there remains however, a significant concern that the Abbott Government’s handpicked panel will deliver the death blow for the STC scheme, despite the release of several studies which undermine the keystone arguments currently being used to justify the RET Review. A recent analysis by the REC Agents Association which charts PV system install data from the Clean Energy Regulator against incomes has once again undermined the argument that the SRES has been a form of middle class welfare. The study reveals that far from the wealthiest installing PV systems at the expense of the poor, instead it has been suburbs with below average incomes in cities and regional areas that have had the greatest uptake, with suburbs with higher incomes less likely to install PV.

The second major argument posited by those hoping to see the RET scrapped , namely that the RET is pushing up electricity costs, has also been dealt another blow by a study commissioned by the Clean Energy Council which reveals that eliminating the RET altogether would yield a tiny initial reduction in bills before causing a far larger and sustained increase in them.

Large-scale Generation Certificate (LGCs)

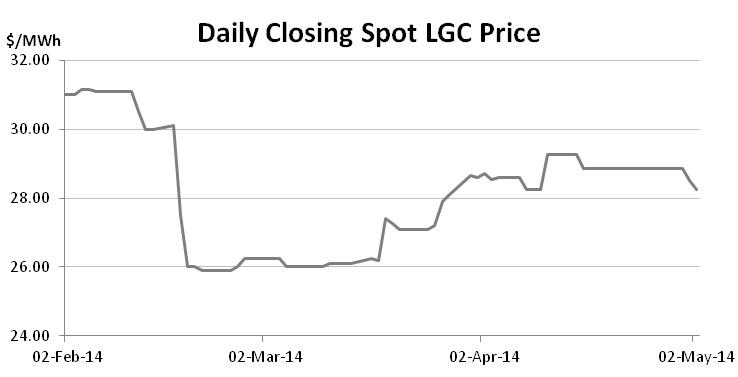

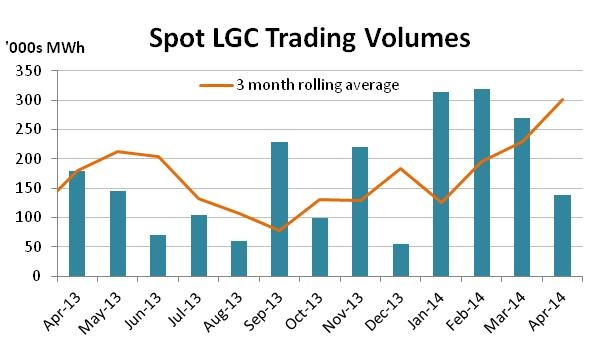

Comments from the RET Review’s head that all options were on the table (including the abolition of the RET without any compensation for existing projects) alongside repeated, yet deliberately vague statements from members of the Abbott Government that the RET would stay have capped a confusing period for the LGC market. Across April a drop in spot activity coincided with generally stable pricing while a healthy amount of activity in the Cal 15 vintage was seen for the first time this year.

From carbon pricing to the expansion and separation of the market from its small-scale sibling, as well as a major review undertaken across 2012, the nation’s large-scale renewable market has dealt with plenty of uncertainty in recent years. Rather than alleviating current concerns, that experience has simply rendered the duplication of the last RET Review all the more frustrating to many participants. As a result of it, spot prices remain low with the prospect of significant reductions to the target mooted as part of the Review.

Across April, a month interrupted by the Easter/ANZAC Day holidays and overshadowed by the conclusion of Q1 compliance in the STC market, the spot LGCs traded within a narrow $28.25-$29.20 band and closed the month at $28.85. In early May the market softened further to again reach the bottom end of this range.

Such pricing levels are well below that required to bridge the gap between the current wholesale price of electricity and the cost of the marginal technology (wind). Yet with the head of the Abbott Government’s RET Review panel saying ‘everything is on the table’ as part of the Review, including the potential reduction or complete abolition of the LRET, it doesn’t appear likely there will be any substantial improvement in prices in the short term.

Of note across April was the return of a healthy level of activity in the Cal 15 vintage which, for the most part had been overlooked so far this year with participants focusing on Cal 14 or using options to hedge Cal 15 instead. A run of activity both early and late in the month (around the $30.55-$30.65 range) seemed to come at the expense of the options market which failed to register any activity. Since these trades took place the spot price has since softened. In terms of Cal 16 occasional interest exists in the underlying yet pricing remains wide reflecting the considerable uncertainty which exists at that stage on the curve; many participants consider Cal 16 the likely start date for any changes that may arise from the Review.

On the Review, speculation remains rife as to its likely outcome, a kind of tiring past time that most are sick of undertaking but are unable to avoid, perhaps a bit like smoking. Most dismiss as too extreme the prospect of the LRET being abolished altogether. Yet that the outcome will be negative for the target (regardless of what evidence and argument is submitted) is universally accepted. It is for this reason that the release of a study which suggests that while the repeal of the RET would modestly reduce electricity prices in the short term, before then resulting in larger increases down the track, has been largely overlooked as likely to sway the outcome. The prevailing view in the market appears that only the threat of political pain, not the emergence of salient argument to the contrary, would stop the Abbott Government from significant changes to the RET.

For now the wait will continue among participants for the conclusion of the Review process which is set to happen ‘mid-year’ and then for the emergence of the Coalition’s response.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.