Apple's iTunes profit agenda

Apple's iTunes store will be 10 years old next month. From its inception Apple has stated that it aims to run the store “at break-even”. The business has grown so rapidly however that its profit-free nature has come under severe pressure.

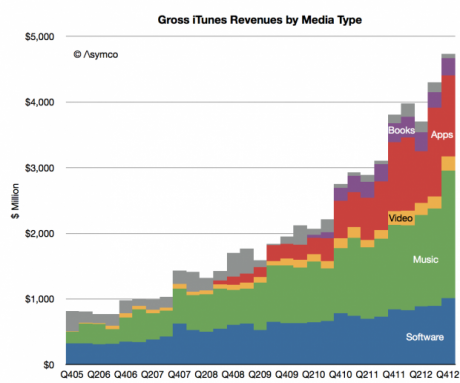

The reasoning goes that as more media types have been added costs have increased but revenues have increased even faster. Consider the estimated gross revenue base as shown below:

What is known as iTunes today has quintupled in seven years. Although cost of content sales are likely to have been preserved as a ratio (about 30 per cent) the vastness of transaction volume (estimated at 23 billion item transactions in 2012 alone) implies that there are some significant economies of scale.

This implies that the operating costs are spread more evenly and that therefore the possibility exists for some operating margin.

Put another way, at break-even the cost of operating iTunes stores would be about $US3.75 billion. It’s hard to imagine this level of operational expense for digital content.

For this reason, management has begun since 2010 to suggest that at least the App Store is run “a little over break-even”. How little is a good question? A one per cent operating margin (from gross revenues) would imply as much as $US45 million margin. I estimate 2 per cent is possible on Apps and 1 per cent on music.

That’s $150 million in margin content. Heady stuff.

However, since folding its software group into iTunes (the blue area in the graph above) the margin picture changes dramatically.

The Software group is one of the forgotten heroes of Apple.

Apple’s software division “Apple Software” is responsible for the following products:

- iWork which includes Pages, Numbers and Keynote. These are available through the Mac App store at about $US20 per product and the iOS App Store for $US10.

- iLife which includes iMovie, iTunes, iPhoto, GarageBand. The OS X versions are available free with new computers but they are also available as paid downloads for OS X through the Mac App Store at $US15 each and for iOS devices through the App store at $US4.99 per app.

- OS products including downloads of iOS and OS X. These are mostly free but some OS X updates are not free (typically $US19.99 for new version including the server version of OS X.)

- Professional tools which include the following products: Final Cut Pro(Video editor $US299.99), Logic Pro (Music editor $US199.99), Aperture(Professional Photo workflow $US79.99), Compressor (additional features for Final Cut Pro $US49.99), Motion (video transition editing for Final Cut Pro $US49.99

- Administration and development tools which include: Xcode integrated development environment which is free Apple Remote Desktop which is priced at $US79.99.

All these products are now sold through either iTunes App Store or Mac App Store. They used to be sold as traditional boxed software for many years but Apple has transitioned them all to be download-only and folded them into the catalogue of third party apps while lowering prices.

My estimate is that Apple’s own software generated $US3.6 billion in revenues in 2012. As you can imagine, this is a high margin business which grows at nearly 20 per cent per year. Although I estimate that the software business has been overtaken by the Apps and Music businesses in gross revenues, it keeps an operating margin similar to that of Microsoft or about 50 per cent.

This means that iTunes inclusive of Apple’s own software generates as much as 15 per cent operating margin on gross revenues. That’s over $US2 billion a year.

This post is excerpt from a report titled “iTunes Business Review” which will soon be available for purchase through the Asymco Store. Horace Dediu is founder and managing director of Asymco, a Helsinki-based app developer/industry analysis advisory firm. You can find his blog here.