An inflation dampener on US rate expectations

The US labour market continues to go from strength-to-strength -- posting its ninth consecutive month where employment rose by 200,000. As a result, the unemployment rate dipped to 5.8 per cent and the US economy remains on track for a rate rise next year.

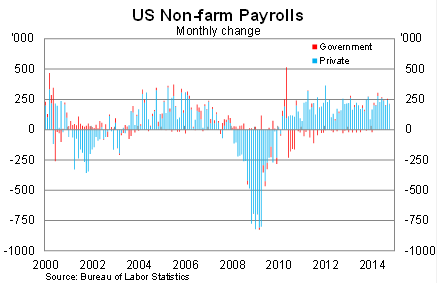

Non-farm payrolls rose by 214,000 in October, following a strong result in September, and the labour market remains on track for its strongest calendar year since 1999. Payrolls were revised up in both September (up 256,000 compared with an earlier estimate of 248,000) and August (up 203,000 compared with 180,000).

The solid result ensures that annual job creation remains at around its highest level in eight years. Over the past 12 months, the US economy has created a net increase of 2.64 million jobs. Non-farm payrolls are now 1.32 million above their pre-crisis peak.

Private non-farm payrolls rose by 209,000 in October, while government payrolls were up by 5,000. Local governments drove public sector employment growth in October and the federal government cut jobs modestly.

Government payrolls -- at all levels -- remain well below their peaks. In fact, federal government employment has declined to its lowest level since 1966.

The services sector continues to drive the recovery, gaining a further 180,000 jobs in October. Over the past year, the services industry has accounted for almost 85 per cent of job growth.

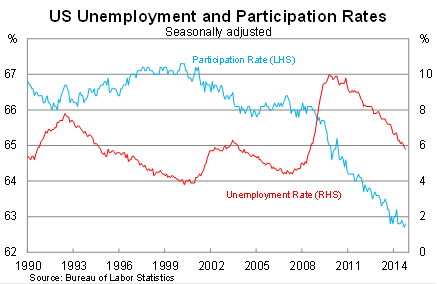

The unemployment rate dropped to 5.8 per cent in October -- its lowest level since July 2008 -- to be 1.4 percentage points lower over the year. The participation rate remains near 35-year lows but more importantly hasn't deteriorated any further over the past year.

Nevertheless, it is widely anticipated that the participation rate will decline over the next decade. That's the reality of unfavourable demographics but, in the short-term, the participation rate may edge a little higher, particularly if employment growth maintains its current pace throughout next year.

The level of the participation rate does, however, highlight why the Federal Reserve has not yet raised rates. Fed chair Janet Yellen has frequently noted that there remains considerable spare capacity across the US economy, which partly explains why wage growth remains subdued.

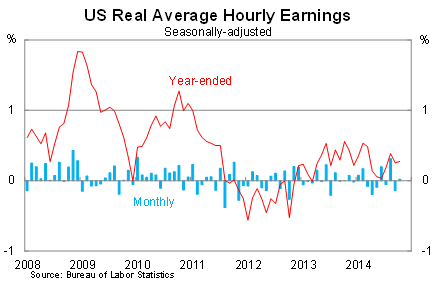

Real average hourly wages have increased by just 0.3 per cent over the year to October. Real household consumption, by comparison, has increased by 2.3 per cent over the year to the September quarter.

Consumption can exceed wage growth in the short-term due to population and employment growth, wealth effects and households dipping into their savings. But for household consumption to maintain its current momentum, wage demands will need to rise.

There's good reason to be optimistic going forward -- spare capacity continues to be absorbed -- but there is also a structural shift towards lower paying service sector jobs that threatens to keep wage demands more muted than during previous upturns.

That in turn may result in softer household spending moving forward; though this could be offset by a stronger US dollar. The US dollar is now at a five-year high -- albeit still at a very low level -- and this will directly increase the purchasing power of US consumers.

Now that the Fed has ended its asset purchasing program, attention has naturally shifted to raising interest rates. The timing will be data dependent; the unemployment rate by itself is now low enough to justify raising rates but the inflation rate remains well below the Fed's annual target and therefore there is scope to maintain rates around zero per cent.

Financial market volatility may be one reason why the Fed delays a rate move; the flattening of the yield curve is another. But if the unemployment rate drops to 5.5 per cent by March next year, it is difficult to see wages remaining weak or the Fed ignoring those figures.

That said, when the Fed does raise rates, it will do so at a slow and steady pace. It is hard to see a Fed chaired by the notoriously dovish Yellen moving too soon or too quickly. That's why I cannot discount the possibility that a rate rise might be delayed until the second half of next year, even if the fundamentals might justify an earlier move.