AGL is wrong on demand response

One of the great outcomes for consumers of the AEMC’s Power of Choice Review is a proposed Demand Response Mechanism, which will allow a reduction in demand to be traded directly into the wholesale market as an alternative to extra supply, and thereby compete with generators to receive the spot price for electricity.

Currently, while it can be used by energy networks to avoid or defer costly network upgrades, demand response cannot compete directly in the wholesale spot market. The result is that generators face less competition from more efficient ways to balance supply and demand during peak times.

All consumers in the NEM currently pay heavily for the lack of demand response in the market through the high prices paid to generators to meet peak demand, which can reach $13,100/MWh. These high prices will be reduced, and sometimes eliminated altogether, when under the DRM large energy users are paid a fraction of that to curtail loads at peak times

In yesterday’s Climate Spectator, Simon Camroux from AGL shared with us his concerns about the new Demand Response Mechanism (Flirting with a dicey NEM fix, December 12).

Simon says ...

Camroux starts with some really good points about why demand response is an effective part of an energy market. But he misses some key ones – notably, the fact that demand response reduces the price of energy for consumers.

He then promises to explain to us why the DRM proposed by AEMO won’t be effective. But the reasons offered don’t seem to amount to much of a case for his argument. All are debatable, and some are simply false. Let’s look at a few of his claims.

- It’s complicated – or is it? The mysterious diagrams explained.

The first resort of any energy policy reform naysayer is usually to point out the perceived complexities, either of the reform in question or the energy market that it fits into.

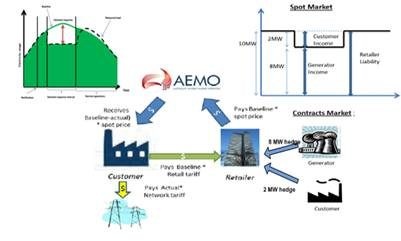

Camroux offers us ‘an amalgamation of two diagrams contained in the final AEMC Power of Choice Report’, shown again here, as evidence that the DRM is bad because it’s ... complex.

Firstly, if complexity was a valid reason to not do important things in the National Energy Market, we wouldn’t actually have a National Energy Market. Having poked around the NEM for a while now I’m yet to discover the ‘simple’ thing in the energy market that we are meant to use as a benchmark to measure ‘too complex’.

Secondly, in spite of the artist’s valiant creative efforts to illustrate the complexity of the interrelatedness of everything with this collage, what these diagrams are telling us is not even that complicated.

Let me summarise the diagrams in bullet points:

First, how does the DRM work in a practical sense?

– The spot price in the NEM goes up on a peak day, so..

– A large energy user switches something off, so...

– Demand is reduced, so...

– Less generation is required.

Hardly rocket science. Even the financial arrangements, though new, aren’t that complicated by energy market standards:

– The large energy user gets paid the wholesale price (that money would otherwise have gone to the generator, so other consumers are not out of pocket);

– The large energy user pays the retailer based on what they would have consumed anyway (so the retailers aren’t out of pocket either, and the large energy user is prevented from gaming); and

– The distributor is paid for the use of the network (just like normal, so the distribution business is not out of pocket).

Importantly, under this model, if the participating consumer gets it wrong and dispatches when prices are low, they alone will lose out and other consumers still benefit through reduced wholesale costs.

- Playing the gaming game

Camroux claims that DR participants have ‘a strong incentive to inflate the baseline energy consumption’, to be paid for demand based events.

Putting aside the astounding irony that AGL would be concerned about gaming in the energy market (see this story for an example), let’s consider what would be required for a DR participant to do what has been suggested.

Baseline consumption is used as a reference for the energy that a participating consumer would have used had they not curtailed their load. His concern about gaming demonstrates a lack of understanding of not only the proposed DRM, but of how consumers use energy. The baseline approach proposed by AEMO is similar to that used effectively in other energy markets around the world, with some appropriate customisation for the Australian context.

Consumption is calculated on the basis of energy consumed on site over a matter of weeks. Given the intermittent nature of high price events and difficulty projecting them more than hours in advance, to inflate one’s long term baseline energy consumption would require energy users to pay much higher bills over weeks and months on the off-chance of the occasional smaller windfall.

As a strategy for managing risk and making long term profit, gaming the DRM is up there with playing poker machines.

- It cost HOW MUCH?

The crux of Simon’s claims about the cost impacts of the DRM are the supposed implementation costs, ‘estimated by retailers to be approximately $110 million dollars’ for upgrading their IT and other systems to accommodate consumers participating in the DRM

In recent weeks, retailers have been pressed to substantiate these claims, yet have offered no evidence. Alternate views put forward by independent IT and systems specialists put the real cost at less than to 10 per cent of the $110 million claimed by retailers.

Regardless, if the cost of automated systems upgrades was even a fraction of $110 million claimed, retailers would instead take the much cheaper option of manual processes for their customers with DR, rather than overhauling their billing and settlements systems.

In the absence of any evidence being provided, it’s hard to see this $110 million claim as anything other than a number that has been dreamt up and then doubled. And doubled again for good measure ... and again, because – I don’t know, Christmas is around the corner, or something.

But why would retailers make up stories?

It would be unfair to target AGL here, they are far from alone – their concern reflects that of all vertically integrated retailers across the NEM. They see an imminent threat to their bottom lines of their generation businesses. Totally understandably, as businesses trying to protect the interests of their shareholders in times of falling demand, they are squealing. Any incumbent would, just like the junk food industry would oppose an anti-obesity campaign.

But when their public case made against the DRM comprises a host of specious claims, hopefully the AEMC will be guided by the National Electricity Objective, which prioritised the ‘long term interests of consumers’ over the ‘short term whining of incumbent businesses’.

DR isn’t some exotic, novel or poorly understood tool – it’s a sensible part of any effective energy market and is notably absent in the NEM. It’s no coincidence that we have some of the highest peak energy prices in the world. Let’s introduce the Demand Response Mechanism and stop paying such astronomical prices to generators for energy when we don’t need it.

Craig Memery is the Energy Consumer Advocate with the Alternative Technology Association.