Active vs passive? The results for 2022 are in

How good would it be to pick the stock market winners year after year? It sounds easy enough, and if I could pull it off, I’d just live on a large boat in the Mediterranean. Probably surrounded by other large yachts captained by super-successful investors.

But after 40 years of managing money, for the life of me I just can’t consistently outperform the index.

Damn shame about that.

More Australians are realising that unless you’re Nostradamus or have an extremely reliable crystal ball, it’s not so easy to consistently beat investment markets.

This goes a long way to explaining why index-based exchange traded funds (ETFs) that match rather than beat market returns have become so popular.

If you’re not convinced, the latest SPIVA Australia Scorecard[1] shows how challenging it is to one-up investment markets. It looks at how well actively managed funds fared throughout calendar year 2022 relative to market indices.

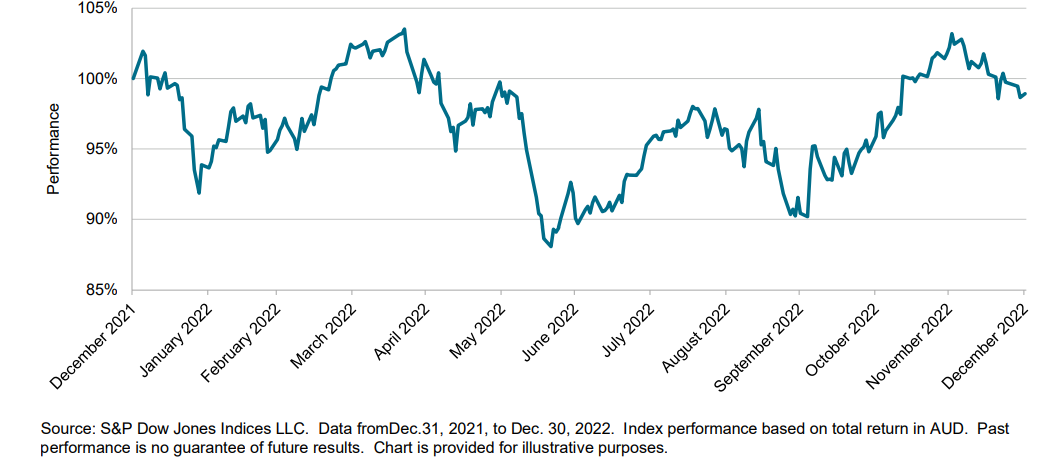

To put things in context, last year dished up a bumpy ride for shares. The market dropped 9.9% in the first six months, then climbed 9.8% in the second half, closing the year down by 1%.

|

Performance of the S&P/ASX 200 – calendar year 2022 |

|

|

As the SPIVA Scorecard notes, in the first six months of the year, active share managers would have been best off “avoiding villains, rather than searching for heroes.” It adds that the second half of 2022 offered plenty of “routes to glory”, for those with the skills to identify them.

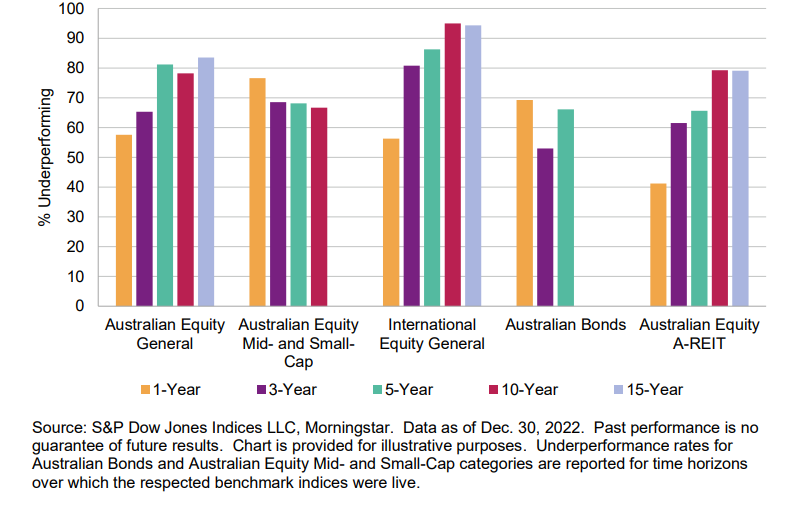

Of course, hindsight is always a wonderful thing, especially when it comes to investing. But it turns out that the majority of actively managed share funds – three out of five – failed to beat market returns last year.

It’d be easy to write this off as a rare result in a tough year. But that’s not the case. Outpacing investment markets is tough enough in one year. Pulling it off year after year is exceptionally difficult, and today’s rooster can easily become tomorrow’s feather duster, with most active managers falling behind their benchmark over the long run.

|

Percentage of underperforming active Australian funds – calendar year 2022 |

|

|

The sting in the tail is that actively managed funds typically charge higher fees than ETFs. After all, active management is labour intensive. It calls for extensive research and analysis to cherry pick stocks that will (hopefully) outperform. But once you tack on fees, an active manager has to deliver even better results for investors just to meet the market. And there’s no discount on fees if the fund dishes up below-market returns.

Look, when three out of five full-time investment professionals can't beat the market, it's even less likely the rest of us will achieve better results. For me, it’s a no-brainer that picking a portfolio of low-cost, diverse index funds should treat you well over time.

[1] https://www.spglobal.com/spdji/en/documents/spiva/spiva-australia-year-end-2022.pdf

Frequently Asked Questions about this Article…

The article highlights that consistently outperforming the market is extremely challenging, even for professional fund managers. Most active funds fail to beat market indices over the long run.

Index-based ETFs have gained popularity because they match market returns rather than trying to beat them, offering a more reliable and cost-effective investment option for everyday investors.

In 2022, three out of five actively managed share funds failed to outperform market indices, highlighting the difficulty of beating the market even in a single year.

The SPIVA Australia Scorecard shows that the majority of actively managed funds underperformed compared to market indices in 2022, reinforcing the challenges of active investing.

Actively managed funds typically charge higher fees due to the labor-intensive nature of stock selection, which means they need to deliver even better results just to match market returns.

Consistently outperforming the market is difficult because it requires accurately predicting market movements and selecting the right stocks, which is challenging even for experienced professionals.

The article suggests that everyday investors might benefit from choosing a portfolio of low-cost, diverse index funds, as they tend to perform well over time without the high fees of active management.

The stock market experienced a volatile year in 2022, with a 9.9% drop in the first half and a 9.8% rise in the second half, ultimately closing the year down by 1%.