A US rebound won't budge the Fed's rate expectations

With a cold winter behind it, most indicators suggest that the US economy has rebounded and will grow strongly over 2014. But with significant slack in the labour market and low inflation, the Federal Reserve will leave rates unchanged until 2015.

In a testimony before Congress, Fed chair Janet Yellen said that “the overall economy [is] on track for solid growth in the current quarter” but she noted that there was considerable slack remaining in the labour market and that housing activity had been disappointing so far this year.

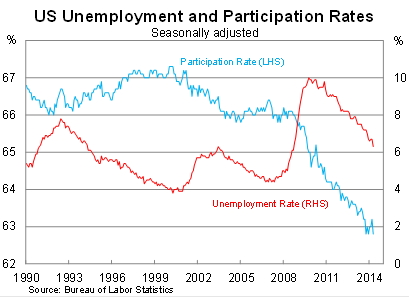

The labour market has improved significantly over the past year, with the unemployment rate falling much faster than the Fed expected, but there remains a long way to go. The unemployment rate has dropped to 6.3 per cent from 7.5 per cent a year ago, but around half that decline reflects a fall in the participation rate of people in the labour force.

In part this reflects a high number of retirements, with some baby boomers leaving the workforce, but also discouraged workers -- often the long-term unemployed -- giving up on finding a job. Yellen noted that “both the share of the labour force that has been unemployed for more than six months and the number of individuals who work part-time but would prefer a full-time job are at historically high levels”.

An important indicator of the remaining slack in the labour market is wage growth, which remains subdued despite stronger employment figures. So far there is little reason for employers to compete for the best available talent, with no shortage of applicants for most jobs.

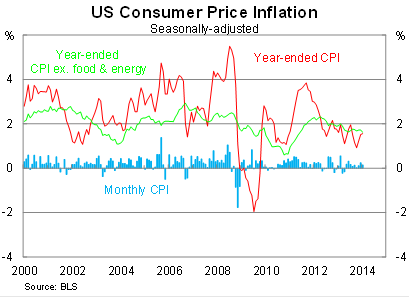

As a consequence, inflation remains subdued with most measures -- including the Fed’s preferred measure the core personal consumption expenditure deflator -- tracking well below the upper target of 2 per cent annual inflation.

With the trade sector relatively small in the US compared to countries such as Australia, the major driver of inflation is domestic wages. Until wages pick-up, inflation should remain fairly modest.

Yellen envisions a ‘Goldilocks’ scenario for the US this year, with activity picking up, the unemployment rate continuing to decline and inflation moving towards 2 per cent. This would be supported by less fiscal drag, gains in household wealth from housing and equities and improving conditions among trade partners.

But Yellen noted that “heightened geopolitical tensions or an intensification of financial stresses in emerging market economies could undermine confidence in the global economic recovery”. Another important risk for the US is that recent weakness in housing activity might persist longer than initially expected.

With considerable slack remaining in labour markets and inflation running well below 2 per cent, Yellen believes that “a high degree of monetary accommodation remains warranted”. In short, that’s just a complicated way of saying that rates won’t be rising any time soon. Nevertheless, the Fed’s asset purchasing program is set to wind back at its next meeting and I fully expect another US$10 billion cut in monthly purchases.

It was more of the same from Yellen, who has been upbeat about the outlook but realistic about the US labour market in recent public statements. But it is hard to fault her position, particularly since it is similar to my assessment of the US economy.

Despite a soft first quarter for growth, most indicators suggest that it was just a temporary setback. With non-farm payrolls expanding strongly over the past three months, the US recovery looks to be back on track and growth over the remainder of 2014 should be stronger than last year.

Whether that will be enough to create wage pressures, boost inflation and encourage the Fed to raise rates is an entirely different story. At least the timing of the next taper is much easier to estimate -- that will happen at the Fed’s next meeting in June.