A turning tide? What investors need to know about the Aussie economy…

| Summary: The consensus view of the Australian economy has been that the prospects were poor: rapid house price growth would prove short-lived as unemployment rose and incomes slumped and our stock market over-valued. After a string of better than expected economic data, the gloom is beginning to lift. |

| Key take-out: It is increasingly clear that there is nothing standing in the way of robust growth. |

| Key beneficiaries: General investors. Category: Economy and investment strategy. |

Data over the last couple of weeks has been critical and I suspect we’ve just passed through one of those defining moments for an investor. Mostly that’s due to the level of debate on the Australian economy. Recall the consensus view: That the economy would be weak over the next few years driven down by the end of the mining boom - the investment cliff even! Heavily leveraged consumers would be unable to pick-up the slack, and no reason was given as to why there would be no pick-up in non-mining investment. It just wouldn’t. Finally, the excessively high dollar was branded a millstone. That narrative has been dealt a severe body blow.

But it’s less about the actual growth number and more about the correct narrative

The implications of the weak economy narrative were far reaching. Rapid house price growth would prove short-lived as unemployment rose and incomes slumped. Similarly, our stock market was expensive, as there was little chance earnings could rise to justify already stretched valuations.

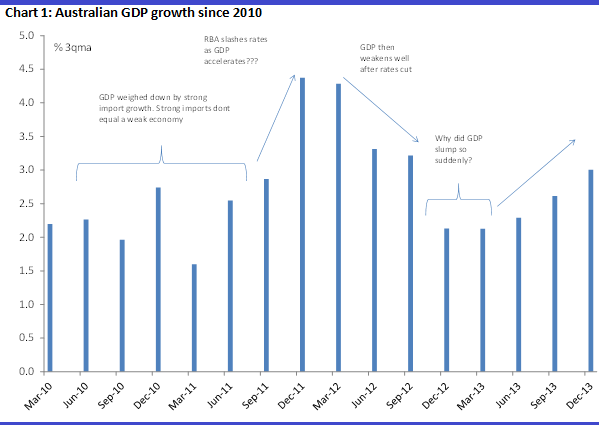

It’s becoming increasingly difficult to credit that story though. And that’s not so much because of what the economic growth numbers actually did, although the fact that GDP rose by a solid 0.8% in the quarter certainly does help. Annual growth of 2.8% is only a little below trend, but then again the average annualised growth rate of the last three quarters is pretty much at trend - around 3%. So there isn’t too much in it. It’s moot as they say.

Of much more importance for the investment outlook is that we are seeing evidence that my confidence narrative is the correct one. That is, that it was only a slump in confidence that saw weak growth in late 2012-early 2013 - that disrupted an otherwise robust growth trajectory. It certainly always struck me as odd that growth could go from a trend to above-trend pace in 2011 and early 2012 (excluding the Queensland floods) to a well below-trend pace of growth in the second half of 2012 and early 2013, for no apparent reason. Remember the slowdown came nearly 18 months - and 200bp - after the Reserve Bank started cutting rates. The reverse should have occurred. In particular, consumer spending should have lifted. Instead the growth rate halved and with it the GDP numbers weakened. It didn’t make sense.

The RBA Governor, Glenn Stevens only today alluded to the importance of confidence, noting that “a sense of stability (regards policy) should be of some help for businesses and households as they form their plans”. I have argued this myself for some years. That the RBA finally recognises it, is fantastic news for investors - it has significant implications.

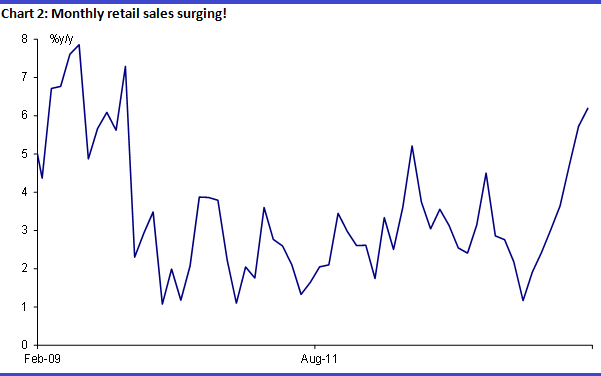

There is no impediment to consumer spending

This matters, because it is increasingly clear that there is nothing standing in the way of robust growth. The fact is, we now find that consumer spending has returned as a key driver of growth. In fact we first saw evidence of that nearly six months ago in the September quarter 2013. But given the volatility in the data it’s difficult, well pointless really, in trying to determine a trend from one quarter’s number. We’re now up to the second consecutive quarter that consumer spending has put in a solid result - 3% annualised in the second half of last year. That’s double the average over the preceding year, back to where it was before the RBA panicked everyone slashing rate; and it argues very strongly against the idea that consumers are too heavily geared to spend. If that were true, why would they be able to lift spending to quite a decent pace over the last two quarters? Not to forget the fact that consumer spending was robust through 2010 to mid-2012. No the truth is consumers are not being weighed down by high debt and they are not deleveraging. This means that there is no structural impediment to consumer spending growing at a trend, or even an above trend pace in 2014 and 2015. That’s why data out yesterday shows retail spending surging into 2014. As consumer spending accounts for around 60% of the economy this is an important fact.

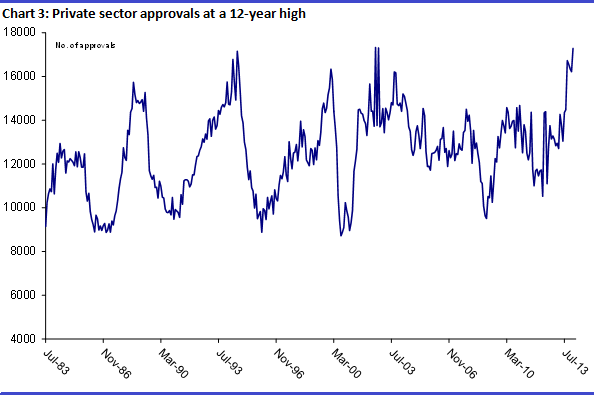

More broadly, we are seeing signs that growth elsewhere will be strong. You’ve no doubt already heard about the building approvals numbers this week - surging to a 12-year high. They’re up nearly 7% in January - 35% over the year. That is phenomenal growth.

To see how significant this is, consider that if housing starts do indeed rise 20% or 30% this year, then that could add on another 20% or so GDP growth this year. All of a sudden GDP could go from 2.8% to nearly 3.5% - and that’s with the end of the mining boom!

Of course, it’s got to be sustained and I don’t know if it will be. There is certainly no reason why growth in the residential and non-residential construction space wouldn’t be strong. We are coming off a very low base and there is ample scope for growth. With record low interest rates the question is, why wouldn’t it pick up?

Just how important is the end of the mining boom though?

That does leave the issue of the mining boom - or rather its end. Once again and as I have argued before, the story here is wrong. Firstly, recent data shows that mining boom still hasn’t finished. That’s a fact. True, mining investment fell 5.5% in at the end of 2013. But it’s still near record levels and expectations are that mining investment will remain exceptionally strong for the next couple of years. It’s fair to say however that mining investment is unlikely to add to GDP from here and in fact it looks like it may start detracting from sometime next year. That’s a little earlier than I had thought, but the fact is $150bn in projects that were committed to have been canned over the last year or so. Not, because of any fear over prices or a drop off in demand. No the mining boom lives - the problem is cost apparently. Meanwhile all the talk is of LNG shortages, and price spikes in Australia, Asian demand is surging and the US has announced they are going to ramp up exports of LNG to Asia.

Anyway the bottom line is that ‘the boom’ will start to unwind about 6-12 months earlier than I had initially anticipated - likely 2015. That’s still about three years after Martin Ferguson and other policy makers loudly and proudly proclaimed the end of the boom. Investors shouldn’t be alarmed by this though. I know policy makers are, but I think they have the wrong approach. If my economic narrative is the correct one, and it appears it is, then the end of the investment boom isn’t going to matter to much anyway. The mathematics is simple.

Mining investment is about 6% of the economy at the moment - with the boom. Household spending, government, dwellings and non-mining investment and net exports etc make up the rest of the 94%.

For illustrative purposes, let’s say mining investments slumps 30%. That would subtract about 1.8%pts from GDP. If the rest of the economy grows at 4%, that means headline GDP will be at 1.95% - notionally weak. Although is it reasonable to say the economy is weak if growth in 94% of the economy is strong? In that instance:

- Jobs growth will be strong - mining makes up only 2% of employment and not all that will disappear.

- Household incomes growth will consequently be strong

- Corporate earnings growth, outside of mining services will be solid

To borrow some meteorological terminology, the thermostat will say it’s cool, but the ‘apparent temperature’ will be warm. It’ll feel warm. Property will be booming, jobs growth robust, incomes solid etc - all of that will look great. Only GDP will be at 2% or less - meaningless for the majority. GDP will have ceased to give an accurate indication of economic conditions for the vast majority of Australians. This isn’t the first time that’s happened by the way.