A turning point in the bond market?

| Summary: With the US economic growth tipped to outpace the Australian economy, the local bond market may present a buying opportunity before yields stop following the US market higher, especially if the domestic economy does head into a recession. |

| Key take-out: There may be rewards for good timing. |

| Key beneficiaries: General investors. Category: Fixed Interest |

The recent volatility in financial markets closing out the 2013 financial year was largely precipitated by US Federal Reserve ( “Fed”) Chairman, Ben Bernanke announcing after the policy meeting on 19 June that the Fed could taper its $US85 billion a month bond/mortgage paper buying program later in 2013 and end purchases mid-2014. The Fed’s news that “quantitative easing” (QE) may be coming to an end caused a significant sell-off in the US treasury markets.

In other words we had falling bond prices and rising bond yields .

The Fed’s QE program has artificially caused yields to remain at very low levels with the intention of encouraging consumers and business to borrow. The extent of the program is evidenced by the percentage holdings of the Fed in the treasury market which over the last two years has risen from about 15% of total securities outstanding to over 35%.

If this buying program was removed then yields on treasuries would be driven to a much higher market equilibrium level. Even the hint that the Fed might taper its program caused the yield on the US 10-year bond to move from 2.14% before the announcement to 2.57% directly afterwards.

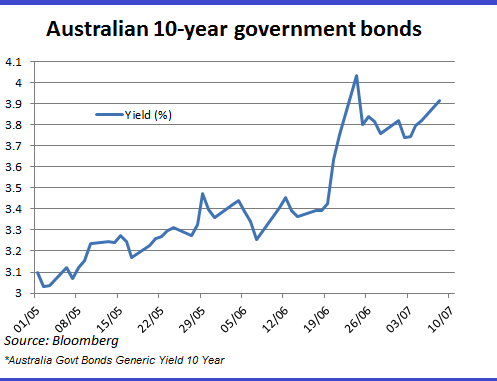

There has traditionally been a strong nexus between the Australian bond market and the US treasury market. Over the last five years the correlation between the two markets is around 90% which means that an increase in treasury yields in US treasuries is matched almost entirely by an increase in Australian government bond yields. And so when the yield on treasuries rose after the Fed announcement the yields on Australian bonds followed. Ten-year Australian bond yields moved from 3.40% before the Fed meeting to 4.01% after the announcement.

However, I expect that at some point the relationship between the Australian bond market and the US bond market must breakdown…and when that happens there will be opportunity in the local bond market.

The Australian economy appears to be in a different stage of its economic cycle than the US. American economic growth is aided by the Fed’s QE programs. While government sector employment has gone backwards, the employment statistics last Friday showed that the US private sector continues to be strong, supporting the move in the unemployment rate from 10% in 2009 to currently 7.6%.

In Australia, the unemployment rate has been moving in the opposite direction. It hit 5.9% soon after the Global Financial Crisis, fell to 4.9% at the end of 2010 but has since been rising. It currently sits at 5.5%. The Australian economy has not had the exceptionally easy monetary policy afforded to US consumers and businesses over the last couple of years. The Australian dollar has been extremely high, which has had a suffocating effect on a number of sectors like manufacturing and tourism. And the engine of domestic growth, the mining sector, is under pressure with falling commodity prices and a possible credit crunch in China. Some commentators have suggested that Australia may face a recession in the next year or two, which is the right time to be invested in bonds.

It appears to me that the yield on treasuries will continue to rise. Since Fed Chairman Bernanke’s announcement about potentially tapering QE, a number of members of the Fed have stated that the removal of QE will be very much data dependent and suggested that currently the data is still below expectation. However the treasury market has got a sniff of the Fed’s next move and will look to drive yields higher.

If the yields on Australian bonds initially follow suit it will ultimately represent an excellent buying opportunity: As yields rise on fixed rated bonds, the prices fall meaning that Australian bonds which have become cheaper over the last couple of months may become even more attractive. Australian investors who acquire government bonds or corporate fixed bonds at these levels may then be very well positioned for an upswing in local bond prices when our yields no longer follow US yields upwards.

Australian investors generally have an underweight allocation to fixed income product but I believe this should increase - especially if we do actually head into a recession.

Chris Black is executive director of Laminar Capital Markets.