A strong jobs report won't alter the Fed's course

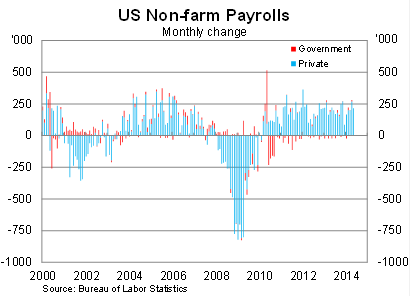

The US economy might have contracted in the first quarter but it has rebounded quickly, with non-farm payrolls posting its strongest four-month period in two years.

Non-farm payrolls rose by 217,000 in May, consistent with expectations, following solid gains since February. Job creation in April was revised down to 282,000 (from 288,000).

This was the first time in 14 years that non-farm payrolls rose by 200,000 in four consecutive months and it was the strongest four-month gain since April 2012. To put this in perspective there have been just three four-month periods with this level of job creation in the past eight years.

Private non-farm payrolls rose by 216,000 in May, while government payrolls were effectively unchanged. Jobs in service industries expanded by 199,000, while payrolls for the goods sector rose by 18,000. Over the past year the service industry has accounted for over 85 per cent of jobs growth.

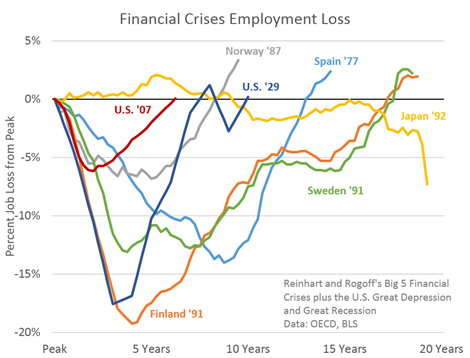

This month also marked a significant milestone for the economic recovery. Non-farm payrolls finally passed their pre-crisis peak -- it took around six-and-a-half years. This US recovery has been, by some margin, the longest since the Second World War.

However, when we consider recoveries resulting from financial crises the post-GFC recovery actually stacks up fairly well. I stumbled upon this graph, courtesy of Josh Lehner at the Oregon Office of Economic Analysis, which puts the current recovery in some perspective.

Nevertheless the current recovery could have been much quicker, particularly if the US Congress and the Obama Administration had not foolishly pursued an austerity agenda following the often hysterical debate -- of the irrational rather than hilarious variety -- on the debt ceiling.

This occurred at the same time as local and state governments were cutting jobs left and right, with many of them facing genuine budget problems that were not simply a figment of the Tea Party’s imagination.

Federal government payrolls are 7.4 per cent below their 2009 peak; state government payrolls are 2.9 per cent below their 2008 peak; and local government payrolls are 3.5 per cent below their peak in 2008.

Job losses for local governments accounted for well over half of all government job losses over the past six years.

The unemployment rate remained at 6.3 per cent in May, down from 7.5 per cent at this point last year. Around half of that decline is due to a fall in the participation rate, which partially reflects an ageing population but also some Americans giving up on finding work after a lengthy period of unemployment.

The participation rate is expected to trend lower over the next decade as the ‘baby boomers’ retire; however, I wouldn’t be surprised if it picked up temporarily as conditions in the US economy improve.

An improved outlook should provide the impetus necessary to encourage firms to take a chance on discouraged former workers -- although admittedly the literature on long-term unemployment suggests that discouraged workers tend to be the last cohort to benefit from better economic times.

With millions of discouraged workers waiting for an opportunity, there remains considerable spare capacity across the US economy. The labour market is certainly not as tight as an unemployment rate of 6.3 per cent suggests. It also explains also why wages and inflation remain so subdued.

The Federal Reserve is expected to cut its asset purchases by a further $US10 billion when it meets on June 17, but a normalisation of interest rates remains some way off. The Fed’s preferred measure of inflation, the core personal consumption expenditure (PCE) deflator, remains well below its upper target for annual inflation of 2 per cent and until that begins to change the Fed is unlikely to make a move.