A social turning point for media investors

Robert Gottliebsen

A social turning point for media investors

This weekend, let me share with you a story that has caused me to relook at just what is happening in our media and retail sectors. Also, I want to make sure you're up-to-date with the new apartment game that is taking place.

During the week I was yarning to an up-and-coming executive in her 30s and asked her what she thought of the Crown situation, where executives have been arrested in China.

She knew nothing about it because her age bracket (both males and females) don't read newspapers and don't watch television! They get their news from social media, and references to Crown would not have excited her. Now clearly, not all millennials – 18 to 32-year-olds – don't watch television or read newspapers; many do. But the latest surveys show that television watching by those aged between 18 and 32 has fallen 12 per cent, compared to a fall of 4 per cent overall.

We are looking at a social change of great magnitude which means that marketing to younger people, who will soon become middle aged, is going to involve totally new mechanisms than those currently used by traditional newspapers and television to reach audiences in middle and older-aged brackets. Increasingly the traditional media, unless it develops new techniques, is going to retreat to the older-aged brackets. It will have a far more restricted revenue base.

Those with shares in media companies need to understand this and realise that different styles of management are going to be required to adapt to the new audience situation.

But it goes further. In the online space the traditional way of placing advertisements, by selecting the areas you want to advertise in, is in decline. Let's say I access a Wall Street Journal site, the mass advertising digital analytical houses that have emerged know what sort of person I am. They conduct an automated online auction to place an advertisement before me on that WSJ page. The auction takes place in a fraction of a second. The more those bidding in the auction know about me, the more they will raise or lower their bid to catch my eyeballs. Remember, this is all taking place in a computer-driven space in a fraction of a second. Something like 50 per cent of online advertising is now being played in these instant auction games and that percentage is going to keep rising. Over time it will become more than 90 per cent.

So suddenly the value in media is 'knowledge of customer', and the ability to follow those customers going to different places on the web. Let me illustrate. The Fairfax print mastheads have very little value because they struggle to earn profits. But Fairfax joined with Nine and set up a business called Stan, which is basically an operation that distributes films online in opposition to Netflix. In the process they will have developed a great deal of knowledge about those who subscribe to Stan, in much the same way that Netflix has developed a huge database.

My guess is that the Stan database, and what movie choices reveal about the customer, is probably worth more than the long-standing print silos.

The transmission of video data by internet service providers to mobiles, devices and computer screens will become a even faster over time, which will only enhance the value of 'knowledge of customer'.

This will be the basis of the Amazon retail invasion into Australia. Amazon, which can market almost everything, is light years ahead of conventional retailers in techniques to extract value from this data and win the right eyeballs in online auctions. Too many of our retailers have not understood that they should have been assembling and deeply analysing their customer database over the last five years.

In the US we are seeing mass closures of retail stores and problems in the retail property space for those centres that haven't learned how to adapt to the new environment. That will come here too.

So look carefully at what the board and management of your investments in retail and media are saying and ask yourself: 'do these guys really understand the new environment they are heading into?' If they don't, the wise course in the longer term is to exit – but there will be many zigzags along the way.

Apartments' lucky turn

And now, returning to residential bricks and mortar, which is a much more conventional market. For a large portion of last year I was warning about the dangers created by the fact that the Chinese investors who bought apartments off-the-plan on 10 per cent deposits can't get funding from local banks and can't get the money out of China to settle when the apartments are completed. This is still the case. In Sydney the situation is well under control but in Melbourne there are 15,000 apartments that will require settlement by June 30.

However, several dramatic changes have taken place. In Sydney overseas Chinese have again begun buying off-the-plan with a vengeance in the belief that the current restrictions on money leaving China are short term. With Australians investing on a negative gearing basis, Sydney demand is exceeding supply and apartment prices are beginning to rise when they had been expected to fall. Those who have bought off-the-plan and have found the money to settle can sell at a profit and, alternatively, those that don't settle have given windfalls to the developer.

In Melbourne the 15,000 apartments to be settled between now and June 30 is a colossal amount. But massive exercises are being launched via non-bank institutions to mobilise money offshore and locally to lend to the Chinese off-the-plan purchases at 8 per cent. In most cases the Chinese can get about 30 per cent of the purchase price into Australia, so the lenders are happy to have that as a buffer given the high rate. But the Chinese off-the-plan buyers are also returning to Melbourne, so developers there are resuming selling off-the-plan, as is happening in Sydney.

Assisting the market is the enormous surge in students coming from overseas – enrollments in 2017 are some 20 per cent above last year because both the UK has shut the door and the US under Trump has become unpopular. That increases the demand for smaller apartments. The bottom line is that we may have some problems in Melbourne but the situation is looking a lot better than it did late last year. Meanwhile, Gold Coast prices are rising and Brisbane is looking better.

Commodity disruptions

Finally, I underestimated the short-term effect of US oil production. I expected it to lift next year but it came with a vengeance last month. In addition, commodity markets are nervous because China has imported large quantities of iron ore and other materials but steel and other exports are down, which indicates stocking. Finally, Indonesia is releasing much more nickel, which is hitting the nickel price.

Readings and Viewings

A key promise during Donald Trump's election campaign was that he would reinvest into US infrastructure, but the businessman may seems to have severely underestimated the challenge, according to this Washington Post article.

And, with their own Great Wall to reflect on, what are Chinese history scholars saying about Trump's Wall.

A hedge fund that has made its reputation on trading oil is predicting better than consensus for the commodity.

Speaking of hedge funds, an African firm has created a food-focused private equity unit, as food demand outstrips supply.

The Oxford degree that runs Britain.

Rents are falling quickly in 12 of the most expensive US cities.

Social media app SnapChat made headlines with a multi-billion dollar listing, followed by a 44 per cent share price surge. But why are brands attracted to the service?

However, the stock has since come under selling pressure on Wall Street after analysts had their say.

After years of environmental hurdles, the huge Keystone pipeline from the Canada through to the US has hit another hurdle; this time about whether it will use American steel. But the company at the centre of the project is optimistic about its future.

Another tweet about the pharmaceutical industry, and promoting “competition”, from the US President didn't impress investors this week:

It's been International Women's Week, and here's the best 12 places for women to work in the UK (if you're thinking of a move).

Meanwhile, it's also been Budget week in the UK, with high street pubs among the winners under the Chancellor of the Exchequer's plan.

Still in Britain, Toyota is delaying an investment decision there until the nature of Brexit becomes more clear.

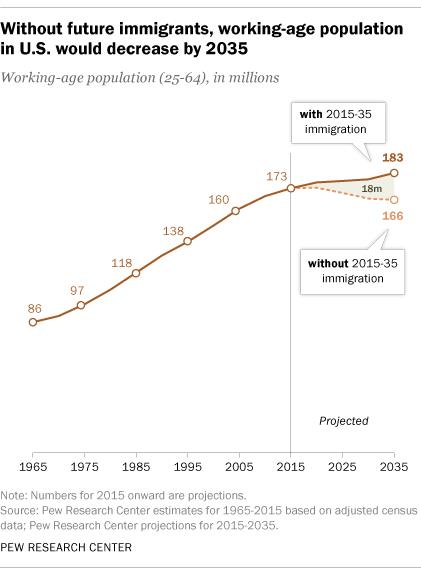

A Pew report has found the US labour force will shrink if not topped up by new immigrants, as baby boomers retire:

Lastly, with Volkswagen debuting its self-driving electric car this week, CBS considers how the outlook could change for the fledgling EV space under Trump.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

The past week saw rising bond yields and a rising US dollar in anticipation of the Fed raising interest rates in the week ahead and this weighed on commodity prices and yield sensitive shares. While US shares fell slightly, European, Japanese, Chinese and Australian shares managed to gain. Bond yields pushed up in most regions – with yields in the US and Australia rising above their highs in December last year indicating a resumption of the bond bear market. Apart from the impact of the rising US dollar, the oil price was also pushed down by rising US oil stockpiles with shale oil production looking like it's offsetting OPEC production cuts. The Australian dollar fell to around $US0.75 as the US dollar rose.

With short term investor sentiment towards shares remaining very bullish, nervousness around a third Fed rate hike (along with worries around Trump, eurozone elections or even North Korea) could help drive a correction in shares. However, with US monetary policy a long way from being tight, future rate hikes likely to be gradual and US economic data likely to be solid we don't see it derailing the bull market in shares.

While I am not so worried about a eurozone break up (the Dutch Freedom Party seems to be fading a bit and Le Pen may have peaked in France at levels that won't result in a victory in the second round), North Korea is worth watching. Tensions have clearly escalated with North Korea's latest missile test, South Korea employing the US THAAD missile defence system and China sanctioning both Koreas. This is likely to be just be another flare up in tensions to be followed by a cooling, but it's a bit less certain than in the past given North Korea's nuclear capability and the US looking at “all options”. At least one thing has been cleared up – despite pre-election rhetoric to the contrary the US under President Trump is standing behind South Korea and Japan.

RBA on hold at 1.5 per cent, for the seventh month in a row. As noted last week we now expect the RBA to leave rates on hold for the rest of the year. Another rate cut is still possible but it would require another leg down in underlying inflation. That said, talk of a rate hike this year is way too premature. Just because the US is hiking does not mean that the RBA will follow suit. The US is further into a growth recovery cycle than Australia and since the Global Financial Crisis RBA interest rate moves have diverged from those in the US – with the RBA hiking in 2009 and 2010 when the Fed was on hold and the RBA cutting rates last year when the Fed had increased rates.

More macro-prudential measures to slow housing may be on the way in Australia? While I may be jumping at shadows, the latest post meeting Statement from the RBA implied a bit of unease regarding lending to residential property investors and lending standards, probably on the back of the continuing surge in Sydney and Melbourne home prices. Most notably in the February Statement it said that “supervisory measures have strengthened lending standards” whereas it's now saying that “supervisory measures have contributed to some strengthening of lending standards” which suggests the RBA thinks a further tightening in lending standards in relation to lending for housing may be required. More macro-prudential measures to slow property investment may be on the way and this could take the form of lowering the threshold for growth in banks' total lending to investors to say 7 per cent year on year from 10 per cent currently.

The past week saw the 100 year anniversary of the first Russian revolution (what a fizzer and waste of life the second one later the same year turned out to be!) and International Women's Day. To help track the economic progress of Australian women, Financy (a women's money website) and Data Digger (a data company) have produced an index that brings together six key indicators. What is interesting is that our biggest listed corporates are driving change at the very top with more women on boards and this is the main driver of the Financy Women's Index since 2012. Hopefully the realisation of the benefits of gender diversity on boards will trickle down through our workforce in the years ahead.

Major global economic events and implication

US jobs data was strong with continuing very low jobless claims and a strong rise in the ADP private sector employment survey for February and a strong rise in imports driving a deterioration in the US trade deficit.

As expected the ECB left monetary policy on hold with President Draghi expressing a bit more confidence in the growth outlook but yet to be convinced the rise in headline inflation is sustainable and still sounding dovish, albeit a bit less so. We can't see the ECB announcing a tapering to its quantitative easing program for 2018 until after the French election is out of the way and assuming Le Pen does not win.

Chinese macro-economic targets for 2017 from the People's Congress contained few surprises – growth at 6.5 per cent, inflation at 3 per cent and the budget deficit as a percentage of GDP at 3 per cent – and confirmed that the focus is on stability.

Chinese economic data was a bit mixed. While imports surged 38 per cent year on year in February pointing to strong domestic demand, exports surprisingly fell 1 per cent yoy which is contrary to evidence of stronger global growth. Both look a bit exaggerated and may be reflect distortions due to the timing of the Chinese New Year holiday. Similarly while producer price inflation accelerated further in February to 7.8 per cent yoy, consumer price inflation fell suggesting little pass through of the rise in producer prices. Again holiday distortions may be playing a role. While it's clear that deflation has ended, producer price inflation is likely to slow going forward as the low base in commodity prices drops out of the annual calculation. Finally credit growth slowed sharply in February. PBOC tightening may have played a role but the slowing largely reflects a reaction to the surge in January. Given the month to month volatility it's best to take an average of the last two months and it remains solid. Chinese data is consistent with further modest PBOC tightening, but it's likely to remain gradual.

Australian economic events and implications

- Australian retail sales bounced back in January after a couple of soft months telling us that consumer spending has started 2017 on a solid note. While ANZ job ads fell in February this followed a strong January and the trend points to solid jobs growth going forward. Finally, housing finance was stronger than expected in January due to another surge in lending to property investors – which is up nearly 28 per cent from a year ago highlighting that the dampening impact of APRA's macro-prudential controls has worn off.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Lending, confidence and jobs data dominate

A good helping of Australian economic data awaits investors over the coming week with lending data, surveys of consumer and business confidence and job data dominating.

In Australia, the week kicks off on Monday with the Reserve Bank releasing the January estimates of credit and debit card lending.

On Tuesday most attention will be paid to the National Australia Bank business survey. In January business conditions hit the highest levels in 9 years while business confidence lifted to 3-year highs.

Also on Tuesday, Roy Morgan and ANZ release the weekly consumer confidence reading. Confidence levels remain healthy but volatile. Higher petrol prices, a lower Aussie dollar and softer sharemarkets are weighing on sentiment together with some disappointment that rate cuts are now off the agenda.

Also on Tuesday the Bureau of Statistics (ABS) issues the 'Overseas Arrivals & Departures' publication for January, containing migration and tourist flows data. Tourists from China and the US are growing at double-digit annual rates.

On Wednesday the monthly variant of consumer confidence – from Westpac and the Melbourne Institute – is released. The importance of the survey is that it will contain the survey results detailing the wisest places to put new savings.

On Wednesday, the ABS will also provide the seasonally adjusted and trend estimates of new vehicle sales for February. The interesting result from the industry data released on March 3 was that sales of sports utility vehicles overtook passenger car sales for the first time.

In addition on Wednesday the ABS releases data on lending finance – new housing, lease, personal and business commitments. Total new commitments fell by 5.8 per cent in December after rising 9 per cent in November.

The highlight of the week is probably the monthly job data to be released on Thursday. In January the unemployment rate fell from 5.8 per cent to 5.7 per cent despite the biggest lift in the employable population in eight years. We expect that employment rose by 18,500 in February while the jobless rate was probably steady at 5.7 per cent.

US Federal Reserve meeting. China activity data. Dutch election.

There are two highlights in the coming week. The first is the interest rate decision from the US Federal Reserve. And the second is the release of monthly Chinese activity data.

The week kicks off on Tuesday with Chinese data on production, retail sales and investment. The data covers January and February.

Also on Tuesday in the US is data on producer prices (business inflation) together with the NFIB business optimism index and the weekly data on chain store sales.

The US Federal Reserve kicks off a two-day meeting on Tuesday with the decision announced at 5am Sydney time on Thursday. With the economy in solid shape, another rate hike is on the cards.

On Wednesday in the US, data on retail sales and consumer prices are released. Economists tip a “normal” 0.2 per cent rise in core consumer prices (excludes food and energy) and a similar 0.2 per cent lift in retail sales. Traders will also watch for any potential surprises from the Netherlands election also on Wednesday.

On Thursday in the US the usual weekly data on jobless claims is released alongside housing starts, the influential Philadelphia Federal Reserve survey and JOLTS job openings survey. Starts may have lifted 2 per cent in February after a 2.6 per cent fall in January. The Philly Fed index may have eased from highs in March.

And on Friday in the US the industrial production data is released with the leading index and consumer sentiment survey. Economists tip a 0.3 per cent gain in production and 0.4 per cent rise in the leading index. Also G20 Finance Ministers meet in Germany on Friday.

Sharemarkets, interest rates, exchange rates and commodities

The widespread perception is that the Netherlands holds the record for the world's longest economic expansion. But according to OECD data, the record is already held by Australia. The claim that the Dutch held the record was based on data from private sector analysts, suggesting that the Netherlands expanded without a recession (defined as two consecutive quarters of contraction) from December quarter 1982 to September quarter 2008.

But the OECD data actually shows the Dutch economy contracted in the June and September quarters of 2003. The long expansion was actually December quarter 1981 to March quarter 2003 – 86 quarters. The quarterly OECD data goes back to 1960 and it is clearly an authoritative source of data.

Australia actually passed the Dutch record four years ago, in March quarter 2003. Australia has expanded for over 25 years without encountering a recession.

Craig James is chief economist at CommSec.