A rubbish index you may want to follow

Summary: There are plenty of economic indicators out there, some more worthy of attention than others, even if they are a little alternative.

Key take-out: Investors might like to keep in touch with these lesser known indicators to help them make better financial decisions. The garbage indicator and men's underwear index may sound like jokes but historically have been reliable at times.

There's a running joke that if you ask three economists a question, you're bound to wind up with at least five different answers. Economics just isn't a science.

When the reliability of ‘real' economic indicators is in clear contention, maybe we should put some trust in Big Macs, iPhones, rubbish and underwear as well.

CommSec updated its iPhone Index this week, which simplifies purchasing power theory for retail investors, and released data on ‘peak' luxury vehicle sales as a potential harbinger for house prices.

But there's a whole range of alternative metrics that strategists and pundits may use to gauge where the economy is heading.

Eureka Report rounded up the best of breed alternative indices that retail investors might want to keep an eye on.

The Garbage Index

Coined by Bloomberg economists Michael McDonough and Carl Riccadonna, this index thinks the health of a nation is determined by the amount of garbage its society produces.

The thesis goes, when the US economy is in good shape, its people can afford to throw out more items and more frequently.

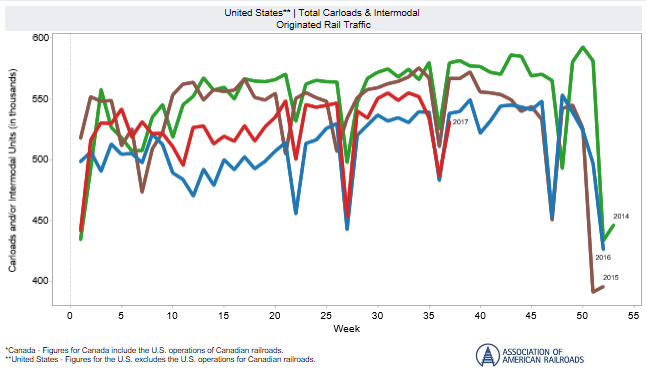

The Garbage Index is the weekly data coming out of the American Association of Railroads (AAR), and because of frequency, is thought to have a lead on more mainstream data like GDP.

For the week that ended on September 16, total US weekly rail traffic was 530,774 carloads and intermodal units. Only statistically significant in context, that figure is down 1.4 per cent compared to the same week last year.

What's interesting is the turning point happened just a fortnight ago, when the 2017 figures dipped below the corresponding 2016 figures for the first time.

From the data set, the cautious consumer isn't a new phenomenon, and holding onto items is seemingly the new normal. Investors may however use sudden and steep drop-offs from these historically low levels as a proxy for GDP and potentially view these as signs of weakening consumer confidence.

The iPhone Index

The Economist came up with the Big Mac Index in 1986 “to make exchange-rate theory a bit more digestible”. The Big Mac Index measures the theory of purchasing-power parity based on the relative cost of one of McDonald's ubiquitous burgers in 46 countries, measured against the US dollar.

Perhaps in light of the Australian dollar's recent wild ride, CommSec this week updated its iPhone index to the same effect.

CommSec's report questions whether the Aussie dollar is too strong considering Australia is now the 25th cheapest country in the world, of 57 countries, to buy an iPhone 7 in US dollar terms.

This time last year, Australia was the 17th cheapest place to buy an iPhone (US76c) and a year before the fifth cheapest (US69c). This also speaks to local retailers and suppliers not adjusting prices for currency impact, which retail investors could note as another threat to the broader retail sector.

Countries are however difficult to compare on a like-for-like basis. As a coincident indicator, the iPhone Index confirms the state of play and might help investors better understand purchasing power theory, but there are complications in practice.

Countries are however difficult to compare on a like-for-like basis. As a coincident indicator, the iPhone Index confirms the state of play and might help investors better understand purchasing power theory, but there are complications in practice.

The exclusion of sales tax rates is a major complication. Freight or shipping costs can also weigh on the equation, where buyers might purchase goods offshore if they are significantly cheaper, presenting arbitrage opportunities, which presumably forces local retailers to reassess pricing.

Guns-to-Caviar Index

An omen of things to come, as believed by some, the Guns-to-Caviar index is a metric that compares private business jet spending (caviar) to fighter jet spending (guns).

Where the CBOE volatility index, or the VIX, is a coincident indicator believed to be a ‘fear gauge' that can reflect tension on a geopolitical level, defense spending could be perceived as a leading indicator pre-empting future turmoil. Meanwhile, elation among the global economic elite – or the 1 per cent – is said to be reflected in private business jet spending.

Guns-to-Caviar was coined by Richard Aboulafia, the Vice President of Analysis at Teal Group.

“Going back three decades ago, the fighter jet market was 80 times bigger and then we got to a point where the markets were exactly the same, until they then switched,” Aboulafia told Eureka Report from Washington DC.

“The top-end of the business travel market has come under a lot of pressure in the last 12-18 months, and that's not to say we should cry for people who can't have their caviar, but these are difficult times because of some depressed emerging markets, like the oil rich economies of the Middle East and Russia.

“All of a sudden it just doesn't seem prudent to buy a jet. That little holiday we took from history is over and the fighter market is back in a big way.”

For investors, Aboulafia said the most comprehensive military expenditure data comes out of the Stockholm International Peace Research Institute (SIPRI) and the General Aviation Manufacturers Association (GAMA) has quarter-on-quarter data on business jets. He also looks at the stock prices of defense corporations.

Last year was the first since 2011 where the aggregate top-line for defense budgets went up, and noticeably, including in Australia. Some investors may see this as a buying opportunity for safe haven assets like gold and the Japanese yen.

Luxury Vehicle Index

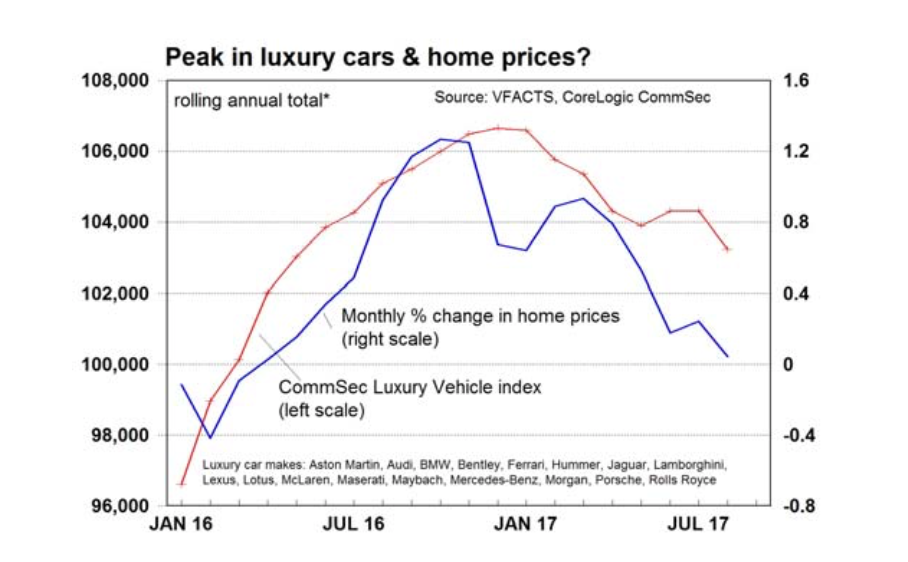

Closer to home, luxury vehicle sales are thought to be a leading indicator of Australian house prices.

CommSec's luxury vehicle index this week showed that sales totalled 103,231 units in the year to August, down 1.8 per cent on a year ago. That's the biggest annual decline in more than five years.

“In the past, when the ‘top-end' of the new vehicle market has peaked it has signalled slowdowns – not just in the car market – but also in other asset markets such as the housing market. Those trends are lining up at present with the monthly growth rate in home prices slowing since late last year,” said chief economist Craig James.

“Rather than a leading or lagging indicator, luxury vehicle sales have been shown to be a coincident or confirmation indicator of home prices. Home prices are slowing and this has consequence for a range of other consumer spending and asset markets.

“Not only are Australian home prices showing signs of slowdown, but the same trend is underway in China. Clearly when prices ease, analysts and investors alike watch the situation closely in the hope that it is a soft-landing rather than a crash-landing.”

Underwear and pizza

Men's underwear becomes a stretched asset when times are tough, quite literally, where men stop buying new briefs altogether.

That's the theory of former US Federal Reserve chairman Alan Greenspan. He even turned the Men's Underwear Index into an acronym – the MUI – and it last bottomed in 2009.

“The MUI can certainly be powerful, but is also subject to fashion and other currents that drive behaviour – even the introduction of Tinder could be a driver,” CMC Markets Australia chief market strategist, Michael McCarthy, told Eureka Report.

The team at CMC Markets Australia developed a Pizza Index a few years back to gauge consumer spending and household stress. Pizza sales were going up, potentially because consumers reach for pizza as a pick-me-up when they can no longer afford big-ticket items. But it ended up just reflecting one major Australian company rapidly increasing its market share.

Still McCarthy lends credibility to these secondary measures, of the view the more information an investor has, the better their decisions.

“The bottom line is, these metrics all make investors more informed, which increases the likelihood of guaranteeing success. Basing choices on extensive information rather than gut feel or a tip from a neighbour in the long run is more likely to lead to success.”