A private equity comeback

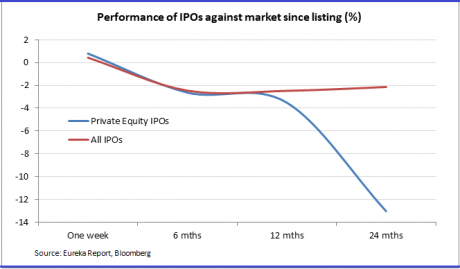

| Summary: Initial public offer activity is picking up once again, and private equity firms are in the thick of the action. There have been a few notable private equity IPO flops, but over the first two years they typically outperform other IPOs. But the devil is in the detail: By the time they are two years old, private equity IPOs would have underperformed the overall market by 13% on average. |

| Key take-out: As well as bringing more IPOs to the market, we are also likely to see private equity firms launching takeover bids for some of our listed players. |

| Key beneficiaries: General investors. Category: Shares. |

Private equity firms are on the move once again, and this will have a material impact on the market as the deal masters prepare to work their magic.

The early stirrings are in contrast to the past few years, which have been hallmarked by the conspicuous absence of activity from the private equity sector. This has largely been because of unfavourable funding conditions, the lack of available assets for acquisition, and the poor appetite for initial public offers (IPOs).

These headwinds are quickly abating, but the question is whether this development is good or bad news for retail investors.

Private equity investors typically use cash and debt to gain majority control of a company in order to expand or improve the business, and then sell the investment for a profit after three- to five-years.

Deals on the increase

“This is a good time for private equity; we have done one deal so far this year in Asia-Pacific, and by the end of this calendar year we would have done three or four,” says Simon Feiglin from The Riverside Company.

“Any private equity firm with money would share our sentiment. Anybody who has got capital will tell you they are anxious to deploy [the capital].”

Some private equity investors are actively looking to raise money from the market, such as industry doyens Mark Carnegie and Alex Waislitz; while others such as CHAMP Private Equity are eyeing the reawakened IPO market as a way to crystallise a profit on their investments through a share float.

“Conditions are probably as good as they have ever been since the GFC [global financial crisis],” says CHAMP director Darren Smorgon. “We are contemplating some exits and would also expect to be making some acquisitions in the next 12 months.”

For all their smarts, private equity firms suffer from a public image problem. A number of recent high-profile private equity-linked IPO flops, coupled with the general secrecy they operate under and the complex financial structures they sometimes use to bolster the performance of a business in their stable, are the key drivers behind the negative perception.

While some of the accusations levelled against the deal wizards are justified, a rebound in private equity activity is more positive than negative for everyday investors.

This may come as a surprise given how Myer’s IPO left a sour taste in the mouths of many investors, with private equity group TPG Capital seen to have overcharged subscribing shareholders to the IPO of the department store chain.

Myer isn’t the only float-flop that has been plaguing the reputation of private equity firms. In fact, more failures than successes come readily to mind – we are looking at you Collins Foods (CKF) and Norfolk Group (NFK)!

Before fertility services company Virtus Health’s listing in June this year, you would need to go back to drilling services company Boart Longyear’s debut in May 2007 to find another successful private equity-backed float, where the new stock outperformed the ASX All Ordinaries Index in the first week of public life.

However, looking at IPOs over the past decade, a private equity-backed float is more likely to generate stronger returns. As shown in the bar chart below, less than 40% of private equity IPOs have lagged the All Ords in the first week of listing, while the average for all IPOs is 56%. As an aside, the woeful performance of IPOs in general is why I recently suggested selling IPOs in the first few days of trade.

This trend continues right through to the two-year mark, and the average returns generated by private equity IPOs in the early days of their listing is better than other types of IPOs. As you can see in the chart below, private equity IPOs have rallied 0.8% ahead of the broader market in the first week of listing – which is twice the performance of all other IPOs over the past 10 years.

However, as your statistics lecturer would have pointed out on the first day of class – statistics can yield anything if tortured enough. If you look over the medium term, private equity-backed IPOs really start to look more like dogs. The difference in performance between the two IPO groups becomes shockingly stark once they pass their one-year anniversary as a publicly traded company.

By the time they are two years old, private equity IPOs would have underperformed the market by a whopping 13% on average, when other IPOs would be lagging by a modest 2.1% over the same time frame.

The worst-performing private equity floats at the two-year mark from listing are Boart Longyear (BLY), which underperformed the market by 60.4%; hosiery and linen manufacturer Pacific Brands (PBG), which lagged 57.5%; and automotive parts retailer Repco, which was under by 52.3% before it was bought back by a private equity firm in 2007.

Perhaps this shows how good private equity investors are at picking the right part of the business cycle to exit their investments. WilsonHTM Investment Group strategist, Damien Klassen, thinks there are other reasons why investors should be more critical when weighing up a private equity IPO.

“Often when you get a normal IPO, it is because the company needs some capital to grow the business and they are willing to give a bit of a discount [in selling equity] to shareholders in order to get the capital,” says Klassen.

“But when you get a private equity [float], they are often trying to get out of their investment. Their game is about maximising the price, and you’d think this predisposes you to getting lower returns from private equity.”

Smorgon doesn’t believe this is a fair criticism as institutional investors buying into the IPO do not always want to see private equity firms holding on to part of the listing company.

“Private equity firms are always happy to take money off the table, but we are not the one that’s necessarily pushing for it,” he says. “Every time we looked at floating companies, we always say we are happy to retain some equity.”

However, Smorgon notes that half of the institutional investors usually want CHAMP to exit completely to avoid a stock “overhang”. If the market knows there is a large investor looking to sell down their stake over the medium term, the overhang can constrain the share price performance.

Private equity players on the prowl

IPOs are not the only way private equity will leave their mark on the market over the next several months. We are also likely to see these firms making bids for some of our listed players.

Don’t be surprised if earthmoving equipment company Emeco Holdings (EHL) gets another look in after management recently confessed that it received an incomplete and highly conditional takeover offer from two private equity firms back in May before Emeco broke off talks.

Smorgon believes private equity companies will be “running their ruler” over companies like Emeco again given that its share price has nearly halved to around 26 cents since the offer was made.

Emeco’s peers, such as Boom Logistics (BOL), are also likely to be attracting attention given the track record of private equity interest in the equipment leasing business.

It is also worth noting that Emeco and Boom are both trading at around a 66% discount to the value of their tangible assets, although Boom has a lower debt profile. Private equity firms find such targets appealing as the price discount to what the equipment might be worth gives them some downside protection.

If private equity firms are keen on lobbing a bid, they are likely to be feeling some pressure from the rising equity market. If stocks keep on the uptrend, assets won’t stay cheap for long.

Boom is part of the Uncapped 100, and I placed an “underperform” recommendation on the stock on August 14 due to management’s propensity to disappoint. While Boom could run up on takeover hopes, you shouldn’t buy a stock just for this factor.

This is why I am keeping my recommendation on the stock and would urge investors to sell into any rally unless we get more concrete evidence that a bid is forthcoming.

The final reason why an increase in private equity activity on the market should be welcomed by investors is because this is a sign that things are looking up as the amount of deals being undertaken is a measure of confidence in our market.

The reopening of the IPO market and a rebound in deal activity could yet herald a very pleasing year-end “Santa Rally”.