A power price reality check

On Friday the Australian Energy Market Commission released its updated estimates of expected trends in household electricity prices out to 2014/15. As outlined in our news story, the AEMC expects that the large price hikes, which began in 2007 with the new regulatory regime governing electricity networks, are now almost behind us.

On a nationally averaged basis, the AEMC expects prices to rise from 25.9 cents per kilowatt-hour (c/kWh) in 2011/12 to 31.3c/kWh by 2014/15.

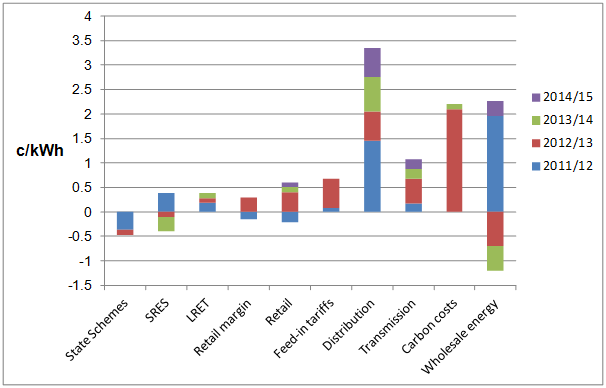

Using the data from this report as well as the AEMC’s prior report on retail price trends, I’ve assembled a break-down on the individual components of price rises we’ve experienced since 2010/11, detailed below for each year.

Individual components driving changes in household electricity prices (2011/12 to 2014)

(negative values mean component reduced prices in that year)

Source: AEMC (2011) Possible Future Retail Electricity Price Movements: 1 July 2011 to 30 June 2014; and AEMC (2013) Possible future retail electricity price movements: 1 July 2012 to 30 June 2015

What stands out like a sore thumb is distribution network charges, supported by transmission networks, as the biggest cause of price rises, even though peak demand growth has tailed off well below the projections used to justify this huge expenditure. Of course network costs would stand out even more as the primary culprit of price rises if we extended the time period back to 2007.

Wholesale energy strangely also had a significant impact in increasing prices in 2011/12, even though the wholesale energy market in the eastern states was subdued. It’s likely this was due largely to state regulators badly overestimating retailers’ costs of acquiring energy in setting regulated retail prices. This should hopefully correct itself in years 2012/13 and 2013/14 with the low wholesale energy market costs acting to bring retail prices downward (but not enough to offset large increases in charges from distribution and transmission networks).

Carbon pricing did have a big impact in 2012/13 (although offset with tax cuts and pension increases), but that is now behind us, and its impact in 2013/14 will be minimal.

In terms of the clean energy support schemes, the failure to automatically and rapidly adjust feed-in tariffs to changes in solar uptake has had the biggest impact. Yet, for some reason, inflation of retailer’s own costs combined with rises in their margins have had an even greater impact in raising prices in 2012/13 (but partly offset by declines in 2011/12).

The state-based schemes – which are mainly focussed on encouraging greater energy efficiency will have a negligible impact. Please note that the reduction in costs for 2011/12 indicated in the chart may be an overestimate, due possibly to differences in approach by the AEMC between their 2011 and their 2013 report.

Interestingly the Small Scale Renewable Energy Scheme – which supports solar PV and solar hot water – is expected to experience reductions in costs in 2012/13 and 2013/14 that will completely offset the rise they imposed in 2011/12.

And for all the huff and puff from Origin Energy about their supposed concern for consumers associated with the Large Scale Renewable Energy Target, its impact is little more than 0.1c per annum.

Such a simple chart, yet the full context it provides seems to have been lost in the political drama that has been electricity prices over the last few years.