A potential clean slate for coal mining

Today I want to introduce you to where private equity investors expect to make their next big killing – coal mining.

And if they achieve their goals, it will show how coal mining can prosper using different management techniques plus independent contracting. It will go a long way to reshaping large segments of the Australian economy. No change in industrial relations laws are required but a change of government would also help.

Although they do not plan to engage in this area, some of the backers of coal proposal believe similar techniques would transform the operation of General Motors and what’s left of the old food processors.

Queensland has some of the richest and best coal reserves in the world but its mines are shutting and a great many are losing money. The private equity investors have closely examined many big Queensland mines and are staggered at how the coal boom generated bad management practices by the major mining companies and even some of the smaller ones.

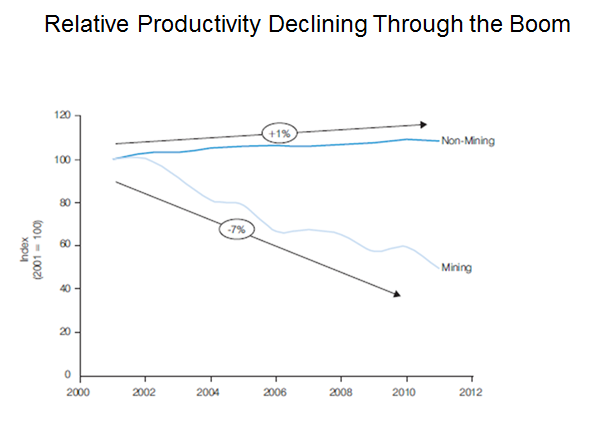

They believe that the operating costs of most mines can be reduced by between 35 and 40 per cent without too much difficulty. That totally transforms the economics of many operations. The scope to slash costs is illustrated by the graph below, which shows how badly Australian mine management has performed.

Source: Booz & Company

The private equity investors are particularly anxious to get hold of mines that have shut on the grounds that their costs are too great. The investors believe that in most instances mine closure was simply caused by mines not being rich enough to handle the bad management practices, given the depressed coal prices. Fix the management and you have a very profitable mine.

Accordingly, step one for restoring closed mines is not to rehire most past managers. When buying operating mines step one is to retrench almost all the managers, which is a harder task.

The new managers must understand modern mine management.

Part of that is better labour management but the private equity investors also believe that there are many other areas where the existing majors fall down including a lack of technical/engineering capability because mining, engineering and planning skills have been eroded in the drive for output during the boom. In too many mines there is a lack of operational discipline, wastage, double handling, and poor blasting management.

It is also possible to improve marketing.

On the labour front; hours, rosters, and supervision can be improved but there is no doubt that there are enormous efficiencies to be gained by using independent contracting in significant areas of a mine.

Under the private equity plans, base remuneration will be linked to coal mining awards but there will be opportunity to earn 100 per cent bonus payments. Labour overheads are slashed and there are no, demarcations or clock-watching.

This sort of management overturns decades of tradition. It might upset many but it’s a lot better than mine closures and offers high rewards for those who work this way.

And if it succeeds in the mines it will be the blueprint for saving many Australian industries.