A neverending debt trap

In the introduction to last week’s post on my blog I appended the statement “Health warning: contains substantial portions of irony. May exceed your daily allowance”. Judging from the comments on Business Spectator, that was indeed the case for some readers. So I’ve eschewed irony in this week’s post.

Much of the irony last week was in this sentence – and the links gave the clue that my tongue was planted firmly in my cheek:

“Now, as any well trained economist knows, it’s a matter of simple logic that what happens to private debt is irrelevant to macroeconomics most of the time, because “debt is one person's liability, but another person's asset.”

The last two links led to earlier Krugman posts: no irony there. But the first two led respectively to the Wikipedia entry on irony and the wonderful scene in Monty Python and the Holy Grail where a logician proves that if a woman weighs the same as a duck, she’s made of wood and is therefore a witch:

“Bedevere: Exactly. So, logically...

Villager #1: If... she... weighs... the same as a duck,... she's made of wood.

Bedevere: And therefore?

Villager #2: A witch!”

Pure logic won the day here. But pure logic should be taken with a grain of empirical salt, because what logicians ignore can matter more than logical deductions made from what they consider. If the data contradicts the logic, then the logicians have ignored something crucial in their otherwise convincing argument.

The “if she weighs the same as a duck, she’s made of wood” Neoclassical logic that I was satirising last week is the proposition that private debt is normally irrelevant to macroeconomics because: “Debt is one person's liability, but another person's asset”. But for now I’ll unsatirically and unironically lay out their logic, before seeing how their reasoning fits the data.

If you total up everything you own – your worldly goods, your property, your savings account – then you have your gross assets. If you subtract from that sum everything you owe – your gross liabilities (outstanding credit card balance, your mortgage, and so on) – then the difference is your equity, or net worth.

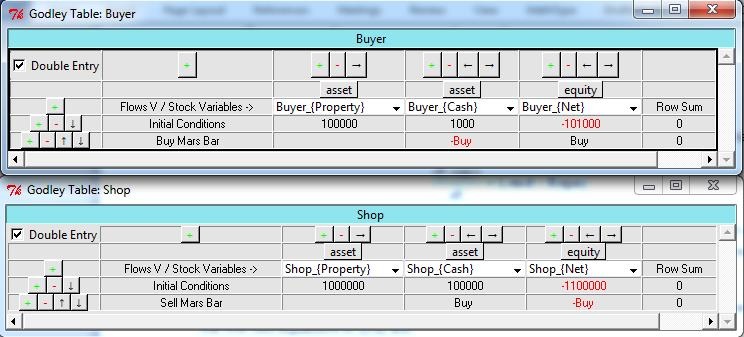

If you buy something (say a Mars Bar from a shop) you do so by transferring some of your most liquid asset – the cash in your wallet – to another entity. Your liquid assets, total assets and net worth all fall, and this is exactly matched by a rise in the shop’s liquid assets, total assets, and net worth (see Figure 1).

Figure 1: Buying something decreases your assets and net worth, and increases the seller's

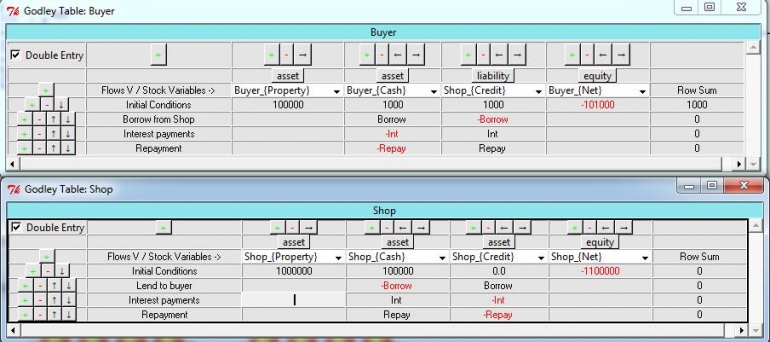

What happens if you borrow money from the shop instead? Then your assets and liabilities rise by the same amount: you have some extra cash, but you also owe the shop precisely the same amount. However your capacity to spend has risen because cash is liquid: the borrowing increased your liquidity. Of course, you also have to pay interest on the debt – which is why the shop was willing to lend to you – and ultimately repay the debt.

The shop has no change in its net worth: the fall in its cash assets is offset by the new asset of the loan to you. However the shop’s spending capacity falls, because it has swapped a liquid asset (cash) for an illiquid one (your debt to it) – see Figure 2. The return that enticed it to do so is the income stream the less liquid asset will earn from your interest payments.

Figure 2: Borrowing increases your liquid assets in return for an equivalent long term liability

So your increased spending power from the increase in liquidity is offset by the shop’s decreased liquidity. Any impact on aggregate spending is going to come down to whether you are more or less frugal than the shop. For this logical reason, Neoclassical economists ignore debt. As the quintessential “New Keynesian” Neoclassical economist Ben Bernanke once put it:

Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistributions should have no significant macro-economic effects… (see Essays on the Great Depression)

Given that logic, mainstream economists paid no attention to the rising level of private debt in the last two decades. But now they are paying attention because another part of their logic says that debt does matter when the economy hits “the zero lower bound”.

Here, the argument goes, some exogenous shock has hit the economy which makes lenders (like the shop) worry about the capacity of borrowers to repay debt. So they insist that some of the debt be repaid now. This forces the debtors to reduce spending.

In ordinary times, when the economy is in equilibrium (Warning Dr Smith! Irony! Irony!), interest rates will fall sufficiently that the fall in spending by the borrowers is matched by an increase in spending by the lenders. But in extraordinary times, the shock to the economy is so great that the interest rate that would entice lenders to spend enough to offset the decline in spending by borrowers is negative – and the nominal interest rate can’t be negative.

The real interest rate can be negative of course, if inflation exceeds the nominal rate, but in times of low inflation (like now) the economy can enter the dreaded zero lower bound – where the nominal rate of interest is stuck at zero and inflation is either low or negative too.

What Summers added to this conventional explanation of the current crisis is the proposition that this state of affairs may have existed for ages because the economy has been undergoing secular stagnation: the rate of technological progress and the rate of population growth may have been so low for some time that, given other factors in the economy, the “natural rate of interest” (cough, cough) has actually been negative.

So the economy may have been at the “zero lower bound” for three decades (as Krugman put it: “And this hasn’t just been true since the 2008 financial crisis; it has arguably been true, although perhaps with increasing severity, since the 1980s”), and the only reason we haven’t noticed is that a succession of bubbles have kept the economy floating above it. So bubbles may be necessary to avoid a permanent slump. Quoting Krugman again:

So how can you reconcile repeated bubbles with an economy showing no sign of inflationary pressures? Summers’ answer is that we may be an economy that needs bubbles just to achieve something near full employment – that in the absence of bubbles the economy has a negative natural rate of interest.

I’ll leave the policy issue of whether the economy needs bubbles to another post. What I want to do today is test an implication of this theory – which is that, if it is true, private debt has been economically significant not just since the crisis, but since as early as the 1980s.

But here comes the duck-woman comparison: this can’t have been true for all time, since no-one is arguing that the economy has always been suffering secular stagnation. There were obvious times – like the 1950s and 1960s (and to some extent the 1920s too), when the economy was going gangbusters. So there must be some time when private debt didn’t matter – when the “natural rate of interest” was above zero. From then on, debt mattered, but the phenomenon was hidden by bubbles.

Krugman leans in precisely this direction in his post:

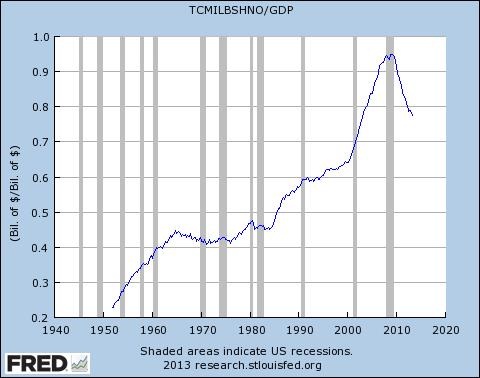

One way to quantify this is, I think, to look at household debt. Here’s the ratio of household debt to GDP since the 50s:

Figure 3: Ratio of household debt to GDP

There was a sharp increase in the ratio after World War II, but from a low base, as families moved to the suburbs and all that. Then there were about 25 years of rough stability, from 1960 to around 1985. After that, however, household debt rose rapidly and inexorably, until the crisis struck. (Krugman)

So let’s test this theory – let’s see whether the woman weighs the same as a duck – by looking at the relationship between private debt and the macroeconomy over time.

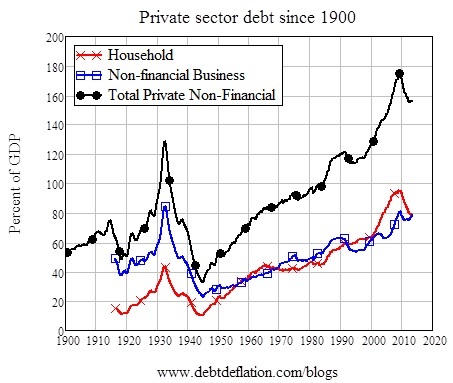

Figure 4 extends Krugman’s chart by including business sector debt as well (click here to see how this data was compiled – as well as a longer term estimate for US debt that extends back to 1834: the data is downloadable from here).

Figure 4: Total private sector debt to GDP ratio

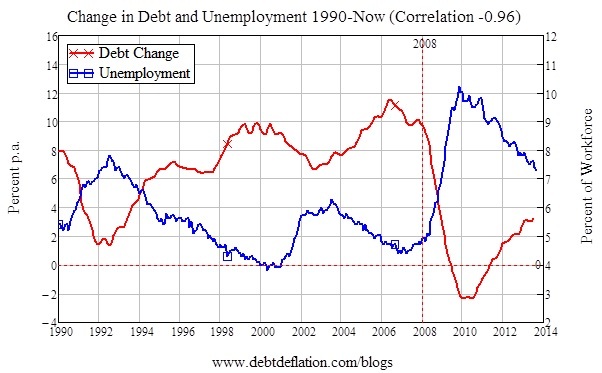

Now let’s look at the annual change in private sector debt (divided by GDP), and plot the unemployment rate against it in recent years – from 1990 till now (see Figure 5). Sure enough, there’s an incredibly high correlation: -0.96. Maybe the woman does weigh as much as a duck!

Figure 5: Debt matters since 1990

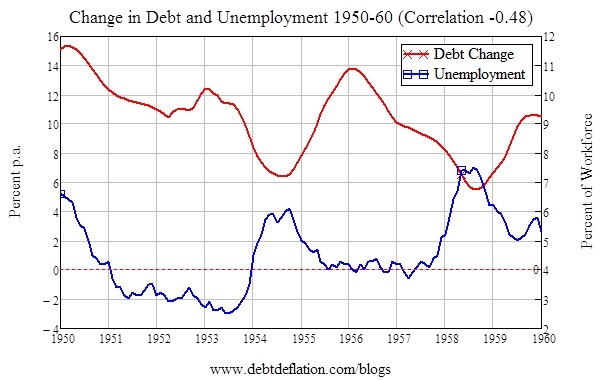

But let’s continue weighing. The “secular stagnation masked by a bubble” argument surely doesn’t apply to the 1950s, when technological capability and population were both growing rapidly. So according to the standard argument, there should be no correlation between change in debt and unemployment back then, right?

Figure 6: Debt matters in the 1950s too

Wrong. The correlation is a lot lower, but then so was the private debt level: between 50 and 70 per cent of GDP back then, versus 120-180 per cent from 1990 till now. Maybe the woman weighs more than a duck – and therefore isn’t a witch.

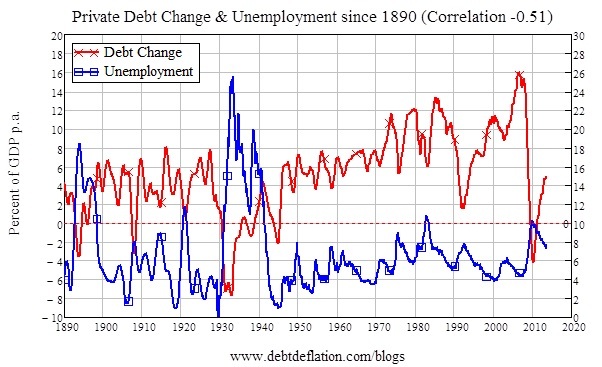

How about over the recorded history of unemployment in the USA – which begins in 1890?

Figure 7: Change in debt and unemployment correlate over the long term

Hmmm. Correlation coefficient of -0.51 over 130 years. It looks like the change in debt matters all the time.

That’s the case I’ve been making, as a proponent of Minsky’s Financial Instability Hypothesis, for about 30 years, but I’ve been ignored by Neoclassical logicians because of the “one person’s asset is another person’s liability” argument.

The Pythonesque aspect of this Neoclassical logic is that it ignores the fact that banks behave very differently to persons. Krugman calls people who think bank lending is significantly different to individual lending “banking mystics”, but the data indicates that people who ignore banks in their macroeconomics may in fact be “barter mystics”. The evidence contradicts Neoclassical logic, so the logic must be at fault – as it was in Monty Python and the Holy Grail.

Oh, and if you haven’t seen the movie, Bedevere’s logic didn’t do the woman any good: his scales were as wonky as his logic. Rather like economic theory.