A long-life hit to dairy prices?

Just as happened in iron ore, the dairy industry and its investors are having trouble grasping the significance of the 40 per cent fall in dairy export prices.

Dairy had been hailed at the new boom as China's demand skyrocketed.

As a result, domestic production rose but the industry was totally unprepared for the combination of increasing European production and the ban on Russian dairy imports imposed by President Putin in retaliation for bans placed on Russia as a result of its Ukraine actions.

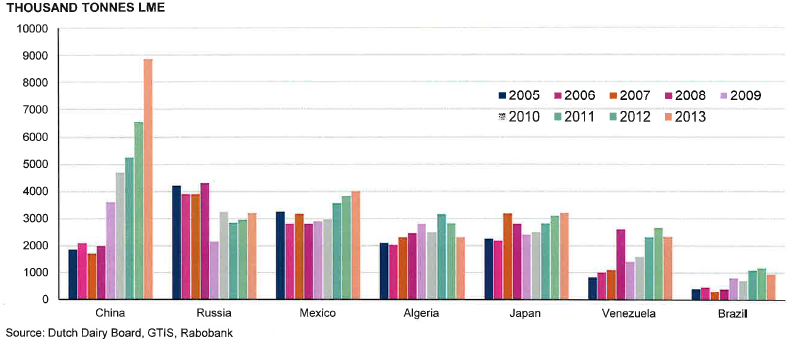

As the graph below shows, while Chinese imports have skyrocketed, Russian imports still equal one third of the inflated Chinese demand -- in 2005, Russian imports were higher than China.

With one third of China's demand being stockpiled thanks to the Russian ban, and the rate of stockpiling increasing due to the lift in production, the price fall is no surprise.

It is now clear that Saputo paid too much for Warrnambool Cheese and Butter -- at least in the short term. Saputo aimed Warrnambool at the depressed export market rather than in to the higher-priced local market and has thus been forced to pay farmers less than the standard Murray Goulburn is offering.

Saputo has also revised back overly optimistic predictions on milk prices. If a reduction in the Murray Goulburn price equalises the situation in coming months, then no long-term damage will be done, but, if the price difference were to continue, then farmers would leave Saputo for Murray Goulburn.

Bega had been expected to lift profits but now expects profits to be steady.

Fonterra in NZ is suffering and its Australian operations have been doing little better than break even.

The Japanese giant Kirin paid $3.7 billion for National Foods and Dairy Farmers in 2007 and 2008. It has already written down the investment by at least $1.3 billion, or one third, and there may be more write downs to come because many of its plants are old. The dairy business is tough on inexperienced players like brewers.

Murray Goulburn, for procedural reasons, has delayed its $500 million equity issue, but the issue also comes at a difficult time. Murray Goulburn plans to offer equity to non-farmers, where the dividend will be related not so much to the profit, but to the price of milk.

If the milk prices rise, so will the dividend. But the reverse also applies. Profits will be engineered to cover the payout, but they are not the force that drives the big farmer co-operative. It's relatively easy to issue equity based on the milk price when the price is soaring on the back of higher Chinese demand. It's much harder to do it when the price is falling.

Murray Goulburn may find it much easier to sell the equity to self-managed funds rather than to the short-term oriented Australian institutions.

Australian Dairy Farms yesterday had a successful listing. It plans to buy dairy farms and reap the benefit of higher milk prices that come from farm consolidation.

If Murray Goulburn can hold the milk price at current levels, then that strategy will work. If the Putin ban continues, then it is likely that the milk price will fall further, which will lower the value of existing farms, although this will make new acquisitions more attractive.

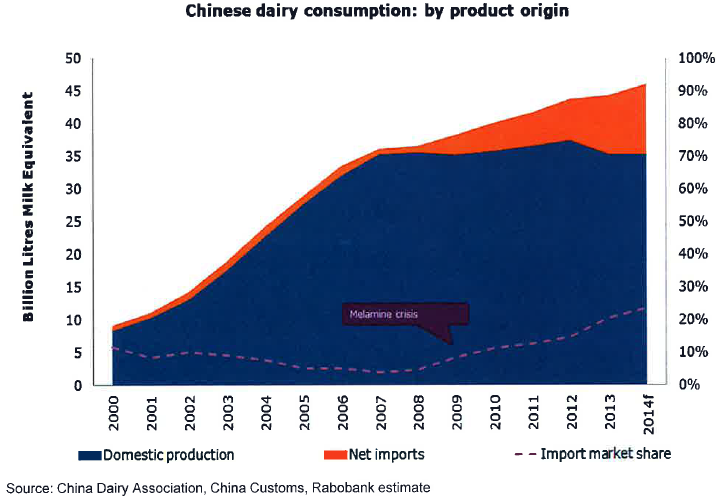

It is important to understand that the Chinese dairy market is dominated by local production.

The graph below shows that while Chinese imports have been rising sharply, imported dairy is a relatively small part of the Chinese demand. However, local production has not risen since 2007, so imports will need to continue to rise to match growing consumption as the Chinese come to understand the health benefits of dairy.

But the Chinese demand is different to Australia with regard to cheese. The Chinese buy cheeses similar to Australia's Kraft Cheddar rather than the more varied cheeses that dominate our local consumption.

While everyone believes that the current slump is temporary, if it goes on for too long and the stockpiles of European dairy get too high, the price will stay down much longer than anyone expected.

And if that happens there will be big falls in dairy company shares around the world.